zkEVM offers us entry to a brand new ecosystem constructed on prime of the cutting-edge zk execution layer. Nevertheless, extra crucially, we now want to pay attention to rising high-quality DeFi dApps on this layer as a way to keep one step forward.

A number of the new native zkEVM protocols haven’t issued tokens but, they usually have each probability of getting in early to grasp the sport. Let’s go together with Coincu to study them.

MantisSwap

MantisSwap is a single-sided AMM for buying and selling pegged property, with the objective of maximizing capital effectivity and minimizing precept losses for liquidity suppliers. MantisSwap’s novel design will push the bounds of current AMMs by offering improved capital effectivity, cheaper buying and selling prices, precept safety for liquidity suppliers, and a extremely intuitive person interface to drive DeFi development and acceptance.

MantisSwap would allow easy swaps of assorted stablecoins and pegged property whereas offering decreased slippage, decrease gasoline prices, and safer transactions. The ecosystem-centric DEX is predicted to grow to be the liquidity heart on Polygon, and the popular location for buying and selling pegged property, with the majority of liquidity inside a DeFi ecosystem flowing through its native DEX.

The protocol helps three sorts of stablecoin property: USDT, USDC, and DAI.

Mantis proposes the notion of Asset Legal responsibility Administration (ALM), which information property and obligations by sustaining the standing of every token, an idea influenced by typical finance. This structure is what permits for one-sided liquidity.

Along with ALM, MantisSwap employs the notion of a liquidity ratio to worth an asset relatively than plenty of tokens like a typical AMM. The liquidity ratio is outlined because the ratio of property within the pool to liabilities that the protocol should repay to its LPs (Liquidity Ratio = Property in Swimming pools / Deposits Made by LPs in Swimming pools).

The protocol employs the veToken structure for the venture’s governance token as a way to encourage customers to maintain the Token as a way to improve earnings. Make battle in the identical method that Curve Finance did and succeeded.

QuickSwap

QuickSwap, a Polygon-based automated market maker (AMM), is a fork of Uniswap and employs the identical liquidity pool methodology. Since it’s based mostly on Polygon, the DEX has faster transaction speeds and decrease prices.

Nicholas Mudge and Sameep Singhania created QuickSwap. The community employs an AMM paradigm to offer customers with a decentralized alternate expertise whereas exchanging tokens. Surprisingly, the Polygon-based DEX doesn’t have an order e-book. This is because of the truth that customers commerce from liquidity swimming pools.

Customers might also switch ERC-20 tokens from Ethereum to Polygon. Customers might also make the most of QuickSwap to commerce any pair so long as it has a liquidity pool. It’s fascinating to notice that establishing a brand new liquidity pool is relatively easy. To learn from different customers’ transaction charges, a person merely has to provide a token pair.

As a result of continually increasing demand for decentralized transactions, DeFi has hit a tipping level. As a result of overburden on the Ethereum most important chain attributable to the implementation of the DeFi protocol, transaction charges and affirmation occasions have skyrocketed.

Distinguished decentralized exchanges reminiscent of Uniswap and SushiSwap rely totally on the Ethereum most important chain’s capability. As a consequence, they not solely contribute to growing community congestion but in addition undergo from DeFi’s success.

To beat these technological constraints and allow DeFi to flourish, we’d like low-cost, high-performance infrastructure. The Layer-2 resolution is the reply, and QuickSwap is on the forefront of the Layer-2 DEX array, offering an answer to the current Layer-1 DEXs’ excessive transaction prices and congestion points.

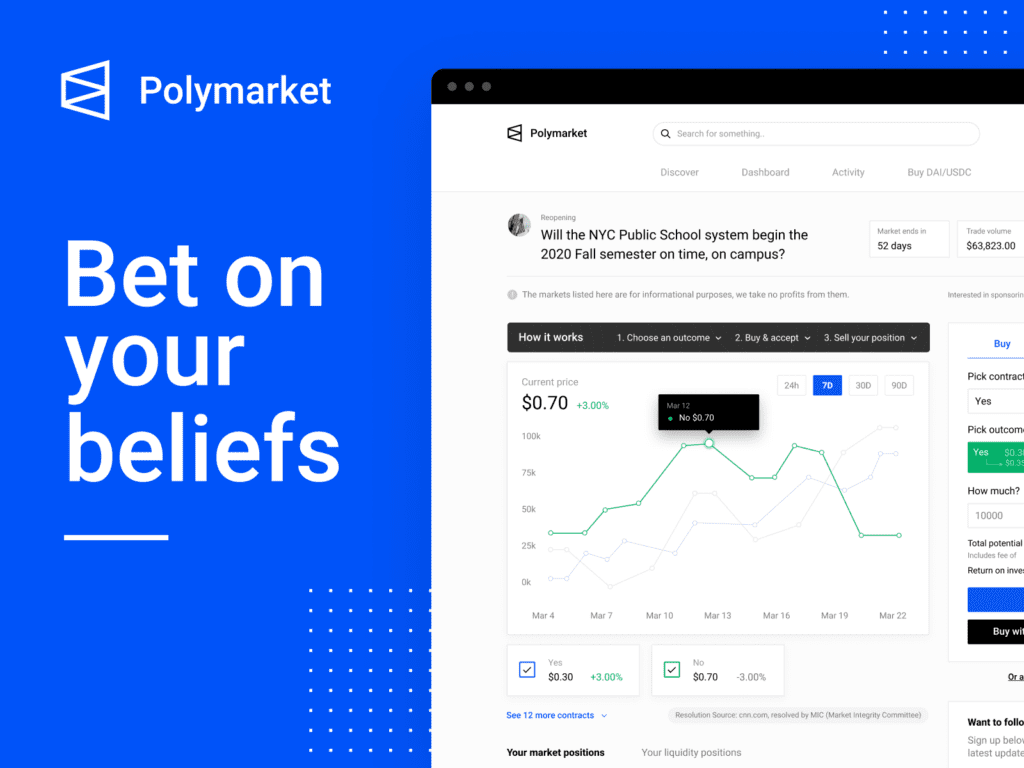

Polymarket

Polymarket is a decentralized buying and selling protocol on Polygon that makes use of the Uma oracle to offer knowledge infrastructure. Customers could deposit into Polymarket through managed exchanges like Binance or decentralized wallets reminiscent of Metamask. They’ll then forecast future market patterns and place trades appropriately. They might additionally exit the deal if issues go improper or take good points if all else is equal.

Polymarket has lately made an excellent title for itself locally. It attracts everybody’s consideration to present occasions reminiscent of Arbitrum airdrops, Balaji prophecies, and others. Polymarket, for my part, has the potential to grow to be one of the crucial necessary dApps within the subject within the subsequent months.

SynFutures

SynFutures is a decentralized and open derivatives platform that guarantees to democratize the derivatives market by permitting anyone to commerce something at any time. It permits merchants to create and commerce a various vary of property, together with Ethereum-native, cross-chain, and off-chain property.

Artificial property, or synths, are blockchain tokens that mirror an underlying asset, like equities, bonds, currencies, cryptocurrencies, choices, futures, NFTs, rates of interest, and extra. Synths not solely inject DeFi liquidity into the underlying asset, however in addition they present merchants with publicity to a wide range of devices, together with real-world property, with out the hassles of possession.

SynFutures permits customers to construct and commerce artificial property in a permissionless method. They might take lengthy or quick positions on a wide range of property, together with real-world property, NFTs, gold, hash charges, cryptocurrencies, BTC, and others. SynFutures could also be bought on a wide range of blockchains, together with Ethereum, Binance Good Chain (BSC), Polygon, and Arbitrum.

Satori Finance

TimeSwap is the world’s first fully decentralized AMM-based cash market protocol that’s self-sufficient, non-custodial, gasoline environment friendly and doesn’t want oracles or liquidators to operate.

TimeSwap’s patented three variables The fixed product AMM utilized by Uniswap motivates AMM. It offers the end-user freedom by letting them select their threat profile and set up the rates of interest and collateral for every lending:borrowing transaction. It’s ruthlessly easy, gas-efficient, and permission-free, enabling anyone to launch a cash marketplace for any ERC-20 token.

Conclusion

A lot of the above zkEVM tasks are nonetheless within the means of being accomplished, and there will likely be enhancements within the close to future. However given what they’re doing and aiming for, these are all tasks to stay up for. Hopefully, by way of this text, you will have discovered extra about potential zkEVM tasks, in addition to discovered funding alternatives with distinguished ZK tasks.

DISCLAIMER: The Data on this web site is supplied as normal market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.