Historic knowledge of an on-chain indicator could counsel that the $24,400 stage may very well be a significant stage of assist for Bitcoin proper now.

Bitcoin STH MVRV Would Hit 1.0 If Worth Declines To $24,400

In keeping with this week’s version of the Glassnode report, the 1.0 stage of the Bitcoin STH MVRV has been some extent of assist for the market throughout uptrends prior to now. The “STH” right here refers back to the “short-term holder group,” which is a Bitcoin cohort that features all traders who’ve been holding onto their cash since lower than 155 days in the past.

The “market worth to realized worth” (MVRV) is an indicator that measures the ratio between the Bitcoin market cap and its realized cap. The “realized cap” here’s a BTC capitalization mannequin that goals to seek out the “actual” worth of the asset by assuming that the worth of every coin in circulation is just not the present worth, however the worth at which it was final moved on the blockchain.

For the reason that realized cap accounts for the worth at which the traders purchased (which is the worth at which their cash final moved), its comparability with the market cap (that’s, the present worth) can inform us in regards to the diploma of profitability or loss among the many total market.

When the MVRV is larger than 1, it means the common investor is holding an unrealized revenue with their BTC proper now. However, values beneath this threshold suggest the market as a complete is holding some quantity of unrealized loss at the moment.

Now, the “STH MVRV,” the precise indicator of curiosity within the present dialogue, naturally measures the worth of the ratio particularly for the cash owned by the Bitcoin short-term holders.

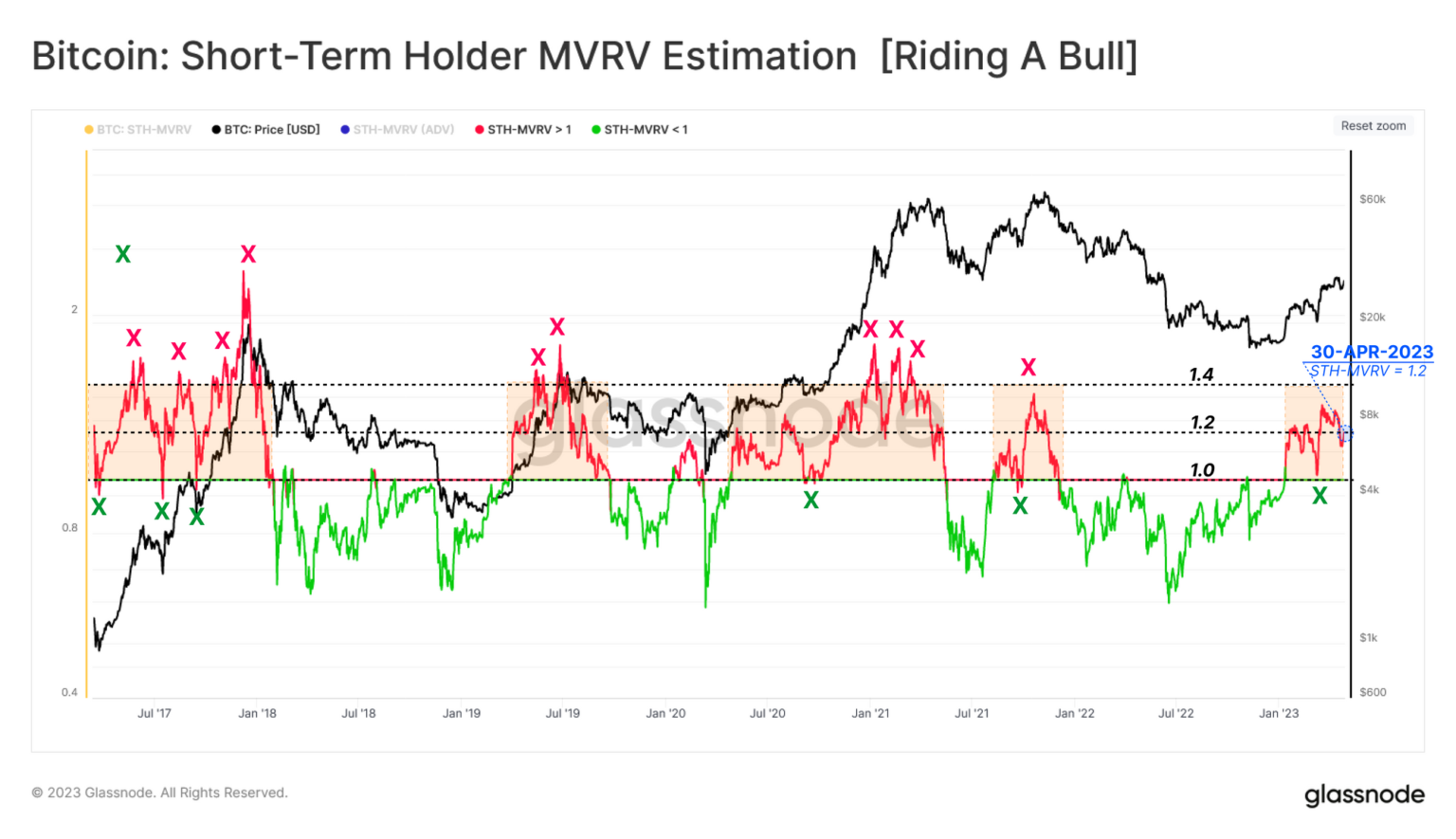

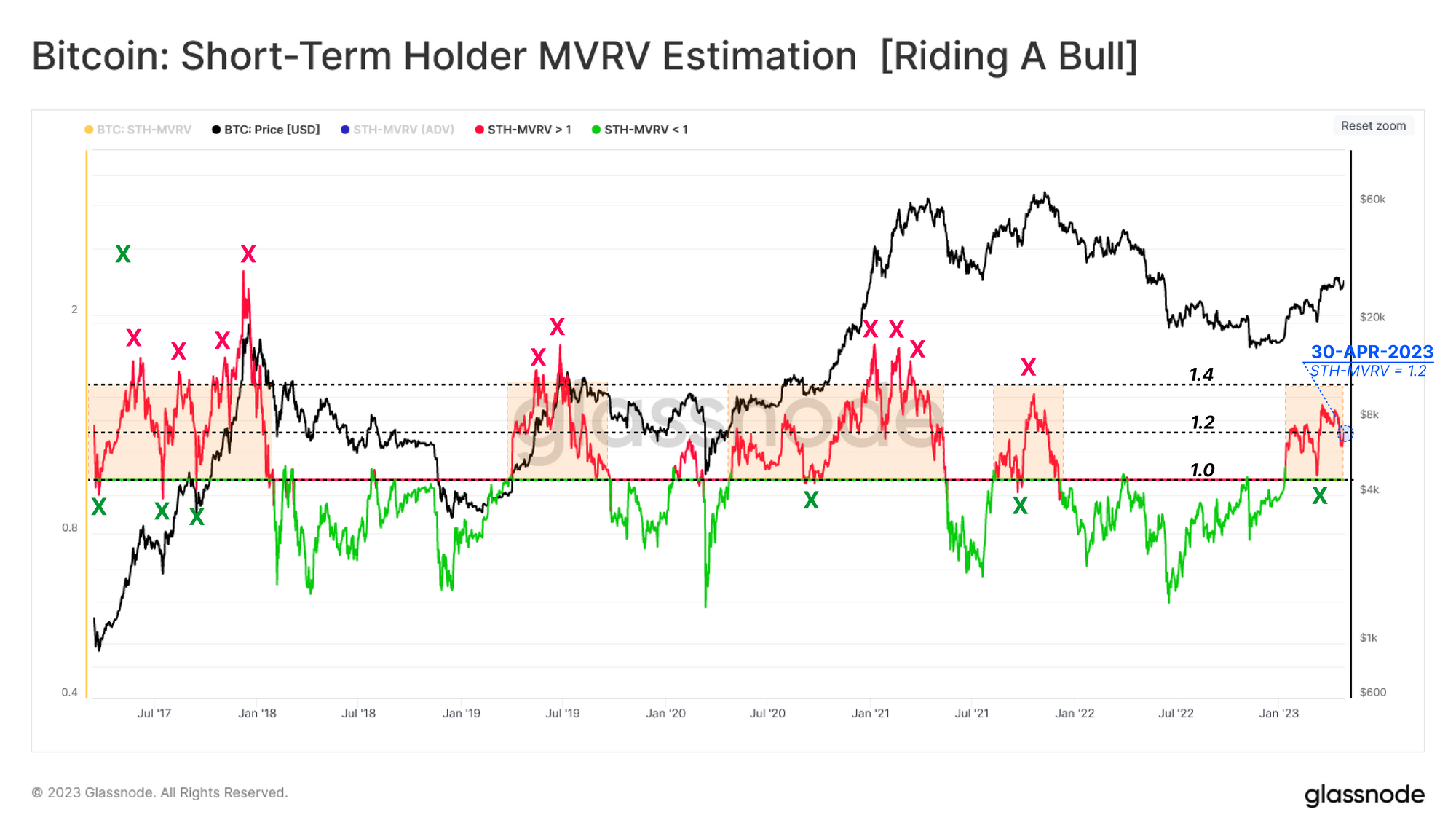

The beneath chart exhibits the development within the 7-day common worth of this metric over the previous couple of years:

The 7-day common worth of the metric appears to have been above the 1.0 stage in current months | Supply: Glassnode's The Week Onchain - Week 18, 2023

Within the graph, Glassnode has marked the traces of the 7-day common Bitcoin STH MVRV which were related to the worth of the cryptocurrency throughout the previous couple of years.

It seems like short-term corrections for the asset have typically develop into extra possible when this indicator has crossed a price of 1.2. At this stage, the STHs maintain unrealized earnings of 20%.

The current drawdown within the cryptocurrency’s worth from the $30,000 mark additionally passed off when the metric was above this stage. To be extra particular, the indicator had a price of 1.33 when the asset was rejected, implying that the STHs had 33% earnings.

The explanation that top MVRV values of this cohort have normally made a decline extra possible for the worth is that the upper the quantity of earnings that the STHs maintain, the extra doubtless they develop into to promote and harvest their positive factors.

From the chart, it’s seen that the on-chain analytics agency has additionally marked the relevance of the 1.0 stage (that’s, the edge line between revenue and loss) to the cryptocurrency. Curiously, this stage has typically offered assist to the worth in periods of uptrend.

The doubtless clarification behind this development is that the 1.0 stage serves as the fee foundation of the vast majority of the STHs out there, so when the worth hits this mark, these traders take a look at this level as a worthwhile zone to build up extra of the asset. Clearly, this conduct is just seen throughout rallies, as holders would solely discover it worthful to purchase extra in the event that they suppose the worth has the potential to develop.

Because the market is correct now, the worth would wish to say no to $24,400 with a purpose to hit this 1.0 stage. This suggests that if Bitcoin observes a deep decline within the close to future, $24,400 may very well be the extent that may present assist to it, contemplating the sample that has held throughout the previous couple of years.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $28,500, down 1% within the final week.

Seems like BTC has seen some volatility lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com