DeFi

Actual Yield is without doubt one of the actions that has these days emerged and been broadly mentioned, significantly in tasks within the space of derivatives and choices in DeFi, and significantly within the whitepaper of tasks on the Arbitrum’s ecosystem.

Because the high-risk, high-return interval of decentralized financing involves an finish, a brand new pattern of extra profitable however sustainable initiatives has began to take its place.

Actual Yield is at present predicted to assist DeFi recuperate and perhaps change into the pattern of the cryptocurrency business in 2023. It refers to initiatives that accomplish precise issues, make actual income, and reward customers with real tokens.

DeFi background in 2021

Seasoned crypto traders have famous that the market strikes in cycles. These so-called “bullish” phases usually observe Bitcoin’s halving occurrences and often end in sky-high costs as new contributors are Enticed by hype and guarantees. The dramatic worth rises that outline a bull market are sometimes adopted by even faster and sharper drops, and the “bearish” part is so in depth that solely ventures with good fundamentals can survive.

Moreover, every cycle is usually linked by a number of tales – well-liked tales that search to characterize the current market construction or speculate on the long run one. Though DeFi started in 2018 with the appearance of tasks like Dharma, MakerDAO, and Compound, it actually took off in the course of the “DeFi summer season” of 2020 when Compound launched COMP tokens for incentives.

The DeFi summer season ushered in a time of yield farming mania, with quite a few ventures imitating Compound by issuing tokens to pay earnings to customers. In essentially the most extreme circumstances, liquidity suppliers have supplied unrealistically giant 5, six, and even seven-figure sums for temporary durations of time. This liquidity supply mechanism helped launch the fledgling sector however in the end proved unsustainable. Liquidity on DeFi dried up as folks started to go away, and most DeFi currencies fared a lot worse than ETH in the course of the 2021 bull run.

This preliminary liquidity mining method is defective as a result of it generates an extreme variety of protocol native tokens relatively than sharing the rewards from the underlying protocol. Sourcing liquidity is essential for protocols. However, adopting this method is extremely expensive, with some estimates suggesting a value of roughly $1.25 for each $1 of assured liquidity. Nonetheless, for stakeholders and liquidity suppliers, the big nominal returns promised by liquidity suppliers are deceptive since actual rewards, as assessed by nominal returns minus inflation, don’t exist.

Following the DeFi summer season, the crypto business is now convergent on a brand new area of interest. Like most earlier parts, it’s lined by a brand new idea: “Actual Yield.” The phrase describes schemes that incentivize token possession and liquidity mining by sharing payment earnings. Actual Yield protocols usually restore precise worth to stakeholders by distributing charges in USDC, ETH, tokens produced by them and dropped at market by repurchase or different tokens that haven’t been self-published.

What’s Actual Yield?

Actual Yield is simply the revenue after eradicating inflation, and it’s fairly akin to the dividend of an organization. You make investments cash in a DeFi protocol, and the protocol generates revenue from which they pay you a tiny proportion.

The important thing distinction between Actual Yield and plenty of different occasions within the DeFi business to date is within the “Actual” element.

As everyone knows, the money earned by tasks may typically be inadequate to steadiness the challenge’s token inflation since they reward customers with unimaginable portions. Due to this, we typically consider that the challenge is worthwhile whereas, in actuality, it’s shedding cash. Because of this, we’ve the next system to compute Actual Yield:

Actual Yield = Income – Token Emissions

The place Income represents the challenge’s revenue and Token Emissions is the variety of tokens distributed as incentives to customers.’

The position of Actual Yield

Should you engaged in DeFi protocols within the years 2020-2021 to generate cash, similar to Yield Farming, Staking Pool, and so forth, it’s totally affordable that these protocols give an rate of interest. How “terrible” for the contributors.

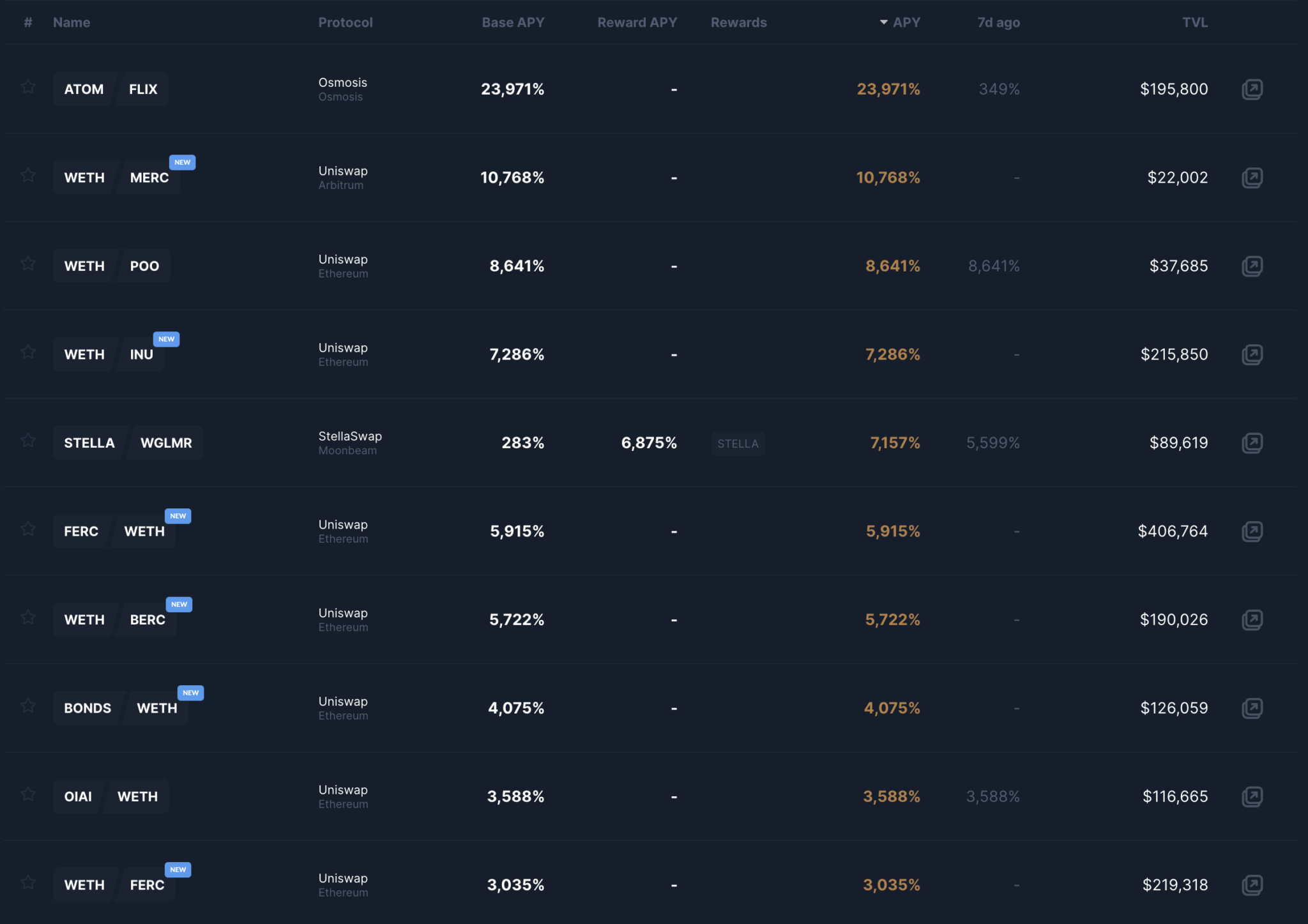

Supply: nanoly.com

Wanting on the picture above, you’ll be able to readily decide how a lot fund traders will get after a time period by utilizing easy arithmetic. Particularly, as extra people take part farming, the APR and APY ranges will fall, with the final contributors bearing the brunt of the “loss.”

But for Actual Yield, the enterprises will focus on the way to earn from their items relatively than simply producing and distributing tokens. Producing long-term revenues will allow the challenge to flourish steadily and never get inflated like Hovering excessive after which plummet into nothingness.

What does a sustainable Actual Yield want?

Hacking assaults, rug pull, token inflation, worth drops, and objects with restricted utility come to thoughts when most individuals take into consideration DeFi.

But, the Actual Yield motion supplies traders with a singular viewpoint on the decentralized monetary market, which differs from the standard monetary market – TradFi (Conventional Finance). Tasks should particularly meet the necessities listed beneath:

- There are apparent outcomes.

- There are clear makes use of.

- The initiative should create revenue (an important issue).

Why the three components talked about above?

Standard DeFi protocols would largely entice customers with extraordinarily excessive APR, and APY ranges, however the inclination of customers to acquire incentives will immediately promote stablecoins or different property, thus creating a major promoting pressure on the challenge’s token.

To “compensate” for market inflation, the challenge should produce extra various revenue streams from protocol actions.

Because of this, the challenge should develop a extra various revenue stream from protocol operations to “compensate” for the market’s diploma of inflation. Actual Yield differs from commonplace Yield in that it’s “Actual,” which is why any challenge that produces numerous precise cash from their protocol is Actual Yield. Following are a number of the commonest ways in which protocols profit from their operations:

- Uniswap, SushiSwap, Curve, 1inch, Balancer, PancakeSwap, Dealer Joe, Osmosis, QuickSwap, and SpookySwap are DEX manufacturers. The true yield on this state of affairs is the cost the consumer should pay for every transaction.

- NFT market: NFT Buying and selling Price, License Price on OpenSea, and LooksRare is real yield.

- Derivatives: dYdX, GMX, and Synthetix: closure, opening, holding, and liquidation prices are precise yield.

- Lending/Borrowing: Aave, Compound, MakerDAO, and TrueFi: Unfold between lending and borrowing charges

- Infrastructure: Filecoin, Helium, Arweave, and The Graph: Renting information storage sources, giving information, and information search prices.

Primary components of a worthwhile challenge

Transaction payment

Actually, transaction charges are a major supply of revenue for DeFi-active tasks. Each time a consumer buys/sells a coin/token/nft, they need to pay a transaction payment to the platform.

Lending payment

Debtors who use lending platforms like Aave, Compound, and others should pay an rate of interest/payment to each the platform and the lenders.

Not each challenge with robust revenue has a Actual Yield; the important thing to Actual Yield is revenue earlier than inflation. If the revenue is 5% and the challenge’s token inflation is 5%, the Yield right here is 0%.

Methods to discover “Actual” tasks?

To evaluate the true revenue in DeFi, chances are you’ll mix two instruments: Token Terminal and Messari.

- Step 1: See the challenge’s whole revenue and protocol income within the Token Terminal. Select “Metrics” from the web site’s homepage, then “Protocol Income,” after which seek for the protocol you want to examine.

- Step 2: Decide the challenge’s token distribution utilizing Messari. Navigation will lead you to the profile for a selected token, the place chances are you’ll choose “Token Economics” after which “Provide Schedule.” If Messari doesn’t give this data, make the most of CoinGecko or Dune Analytics instead.

- Step 3: Test the Income discovered on Terminal with its Emissions discovered on Messari. Keep in mind to multiply the Emissions worth by the token’s worth to get the whole value of its Emissions for staking.

After that, you compute utilizing the next system:

Income – Token Emissions = Actual Yield

Do not forget that this strategy is just not completely correct because it doesn’t disclose the overhead of a selected challenge. It would, nonetheless, give you an thought of how reliant a challenge is on releasing tokens for revenue.

After you’re feeling that you’ve got recognized a protocol that exhibits promising numbers, make it possible for the protocol has the next:

- Product/Market: Everybody will need to have a elementary want to make use of the protocol, no matter market circumstances or Token Incentives.

- Should-Have Onchain Income: If the protocol doesn’t generate income, it’s not actual revenue. Ensure this income surpasses Token Emissions + working prices. Provided that income is generated, the challenge can develop sustainably.

- Revenue ought to be paid in bluechip cash: A Defi challenge that meets Actual Yield requirements is when it pays income to customers in invaluable tokens/cash like BTC, ETH, or in stablecoins like USDC or BUSC. Not paying utterly with the token that the challenge issued.

Having a transparent roadmap: A challenge with Actual Yield is just not essentially good, and vice versa – a challenge with out Actual Yield is just not essentially a poor high quality challenge, it can be crucial {that a} challenge has a roadmap to make use of Yield from clear emissions. clear.

As well as, you additionally have to do not forget that income, revenue, and worth for customers are 2 separate points. Since many tasks generate income, income are excessive however don’t share that portion of income with token holders.

Conclusion

Though the phrase Actual Yield could have struck a chord, you will need to stress that this liquidity supply technique is much from flawless. Secondly, protocols have to be profitable with a view to present worth to stakeholders, therefore it’s ineffective for brand new tasks with few customers. To compete and appeal to enough liquidity and commerce quantity, protocols within the preliminary part should nonetheless resort to inflationary liquidity mining. Moreover, if protocols should flip over their earnings to liquidity suppliers or token holders, they may have much less cash for R&D. In the long run, this may increasingly have an effect on sure tasks.

We would all be “overshadowed” by the keenness within the uptrend market, however after we go searching, all of us see potentialities.

But, till the market enters the downtrend season, all hopes are dashed by “ghost” tasks that don’t create precise revenue or serve simply to confuse traders.

Actual Yield comes as a brand new criterion that permits us to shortly decide whether or not DeFi initiatives are wonderful. Because the market expands, new and tighter guidelines will probably be applied to make sure that the crypto business’s shared future turns into increasingly dazzling.

Actual returns or not, historical past has repeatedly proved that when markets are down and liquidity is scarce, solely the protocols with the strongest fundamentals and applicable for productive markets survive. Solely the best objects make it.

DISCLAIMER: The Info on this web site is supplied as common market commentary and doesn’t represent funding recommendation. We encourage you to do your individual analysis earlier than investing.