- Market members locked in a non-trivial $537 million in revenue following BTC worth rise.

- BTC’s RSI was in an overbought place, which might trigger bother.

Bitcoin’s [BTC] worth gained upward momentum final week, permitting it to as soon as once more cross the $30,000 mark. The uptrend gave traders hope for higher days as BTC’s worth had remained comparatively dormant for weeks. Although the value motion appeared optimistic, issues also can flip the opposite means spherical if historical past is to be believed.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Bitcoin lastly reclaims the $30,000 spot

After a number of weeks of ready, BTC lastly managed to place smiles on traders’ faces by registering a promising uptick. In keeping with CoinMarketCap, BTC’s worth went up by greater than 18% within the final seven days.

On the time of writing, it was buying and selling at $30,150.42 with a market capitalization of over $587 billion.

A tweet from Glassnode identified that the current Bitcoin breakout above the $30,000 worth stage has impressed an uptick in revenue despatched to exchanges, recording a worthwhile influx of $62.8 million. Nevertheless, BTC’s positive factors have halted, as evident from the marginal increment in its worth during the last 24 hours.

This will trigger bother

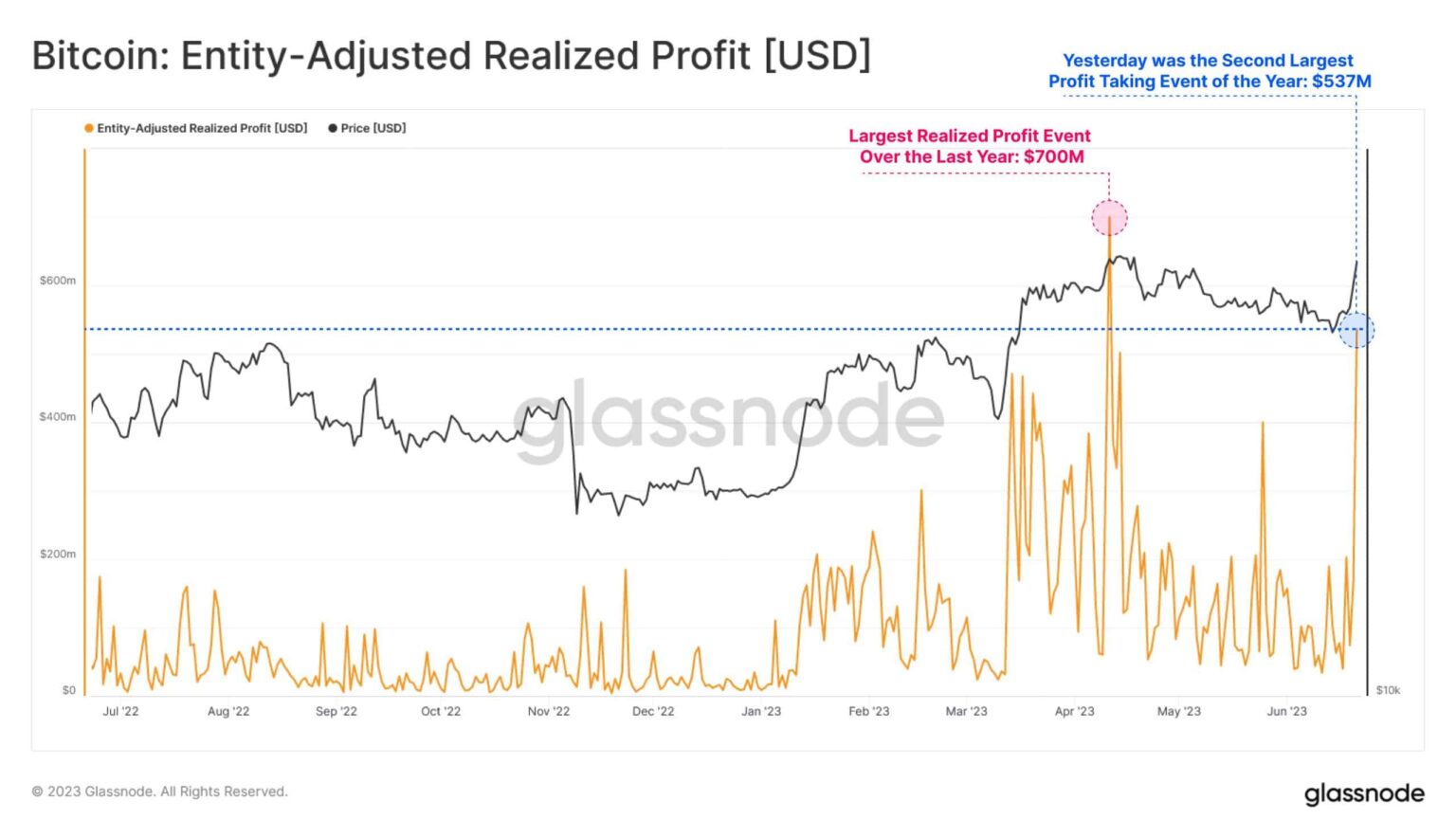

Glassnode, in one other tweet, identified a noteworthy improvement. As per the tweet, following the current uptick in Bitcoin worth motion, market members locked in a non-trivial $537 million in revenue, the second largest revenue taking occasion during the last 12 months.

As is obvious from the chart, the final time such an occasion occurred, it was adopted by a decline in BTC’s worth.

A have a look at BTC’s day by day chart didn’t present a cause to be bearish on the coin. As an illustration, the Exponential Transferring Common (EMA) Ribbon displayed a bullish crossover because the 20-day EMA flipped the 55-day EMA.

The MACD’s findings additionally complemented these of the EMA Ribbon, because it did reveal a transparent bullish benefit available in the market. Moreover, BTC’s Chaikin Cash Movement (CMF) registered an uptick after a decline, which additionally appeared bullish.

Supply: TradingView

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

That is why warning is suggested

Although the market indicators had been bullish, Bitcoin’s on-chain metrics instructed a special story. As per CryptoQuant, BTC’s Relative Energy Index (RSI) was in an overbought place. This will enhance promoting strain, leading to a worth correction within the coming days.

BTC’s web deposits on exchanges had been excessive in comparison with the final seven days, suggesting that promoting strain has already elevated. On high of that, BTC’s worry and greed index had a rating of 65 at press time, which was additionally a bearish sign.