Liquid staking is a decentralized finance (DeFi) subsector that lets customers earn yield by staking their tokens with out shedding their liquidity. It has grow to be the largest DeFi sector when it comes to complete worth locked (TVL), in keeping with crypto trade Binance’s Half-Yr Report 2023.

Inside the report, the crypto trade highlighted that liquid staking had dethroned decentralized exchanges (DEXs) because the top-ranking DeFi class by TVL as of April 2023.

The staking mechanism was a vital a part of staking Ether (ETH) earlier than the Ethereum Shanghai improve when customers had been unable to freely unstake their ETH. By then, liquid staking tokens (LSTs) supplied customers with liquidity whereas they earned yield with their ETH.

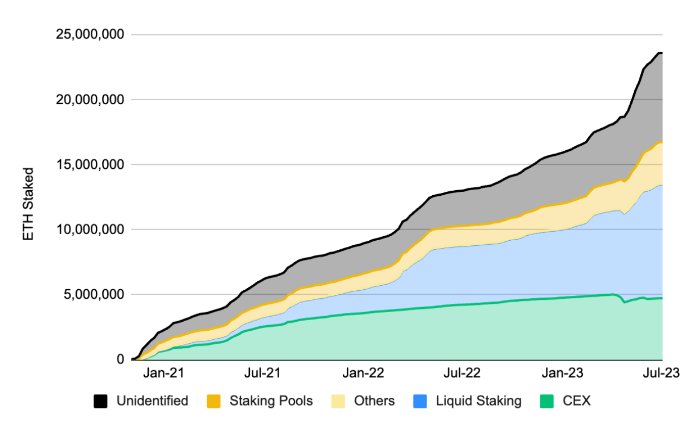

Liquid staking instructions 37.1% of the ETH staking market. Supply: Binance

On April 13, the Shanghai replace went dwell on the Ethereum mainnet, permitting customers to withdraw their staked ETH. Regardless of this, the report stated that liquid staking nonetheless continued to develop. “Apparently, development continues to be extraordinarily sturdy post-Shanghai, with liquid staking being the most typical manner for customers to stake ETH,” Binance wrote.

Associated: Speedy development in DeFi-focused Ethereum liquid staking derivatives platforms raises eyebrows

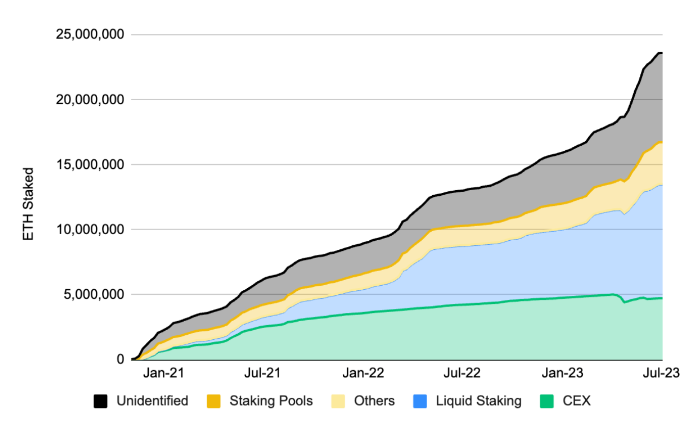

As well as, the Binance report additionally famous the emergence of the time period “LSTfi,” which can also be typically referred to as “LSDfi.“ The time period combines liquid staking and DeFi, with initiatives like yield-trading protocols, indexing providers, and initiatives permitting customers to mint stablecoins utilizing LSTs as collateral categorized as LSTfi protocols.

LSTfi protocols’ TVL has grown by 67% all through June 2023. Supply: Binance

In accordance with the report, the market is comparatively targeting the highest protocols throughout its early phases. Nonetheless, Binance predicted this can change as extra new initiatives emerge beneath this class within the close to future.

Whereas liquid staking has grow to be well-liked of late, customers nonetheless have to be aware of some elements. In an announcement, a Binance spokesperson instructed Cointelegraph that customers have to be cautious of some dangers related to liquid staking. This contains publicity to sensible contract vulnerabilities, slashing dangers and worth dangers. They defined:

“Liquid staking includes customers interacting with an extra layer of sensible contract, which could expose them to the potential of bugs within the sensible contracts utilized by liquid staking protocols. Subsequently, it is necessary that customers do their very own analysis.”

As well as, the Binance spokesperson stated that validators who fail to carry out their duties get penalized by having a few of their staked belongings “slashed.” Because of this customers have to be cautious and be sure that they don’t stake by way of a penalized validator. This can assist them keep away from losses. “It’s vital for customers to decide on protocols that diversify staked belongings throughout a spread of respected node operators,” they stated.

Lastly, customers have to be cautious of worth dangers. In accordance with Binance, customers can probably get a mismatch between the LST and the underlying token because of market worth fluctuation. This might additionally occur because of numerous causes, together with sensible contract points.

Regardless of the optimistic development of the liquid staking subsector, the DeFi sector typically carried out worse than the worldwide crypto market. In accordance with the report, although DeFi unlocked new use instances, the area’s dominance noticed a 0.5% decline towards the broader crypto area.

Acquire this text as an NFT to protect this second in historical past and present your help for impartial journalism within the crypto area.

Journal: How sensible individuals put money into dumb memecoins: 3-point plan for achievement