On-chain information exhibits the Bitcoin Community Worth To Transactions (NVT) ratio has shaped a bearish crossover, an indication {that a} decline could also be imminent.

Bitcoin NVT Ratio Has Shaped A Historic Bearish Crossover

The “NVT ratio” is an indicator that measures the ratio between the Bitcoin market cap and transaction quantity. In easy phrases, what this metric tells us is whether or not the asset’s value (the market cap) is pretty valued in comparison with the community’s capacity to transact cash (the transaction quantity).

When the ratio has a price above 1, it implies that the value could also be overinflated proper now, because the blockchain isn’t observing the shift of any important quantity of capital. The danger of a correction happening usually goes up the upper the metric tendencies above this mark.

Alternatively, the indicator being beneath the brink can suggest that the market cap could also be undervalued at the moment, and thus, a value surge could also be due for the asset.

Within the context of the present dialogue, the NVT ratio itself isn’t of curiosity, however relatively a modified type known as the “NVT golden cross” is. This metric compares the short-term transferring common (MA) of the NVT ratio (10-day) to its long-term MA (30-day).

As identified by an analyst in a CryptoQuant put up, this NVT golden cross could also be forming a sample at the moment that would result in a correction within the asset’s value.

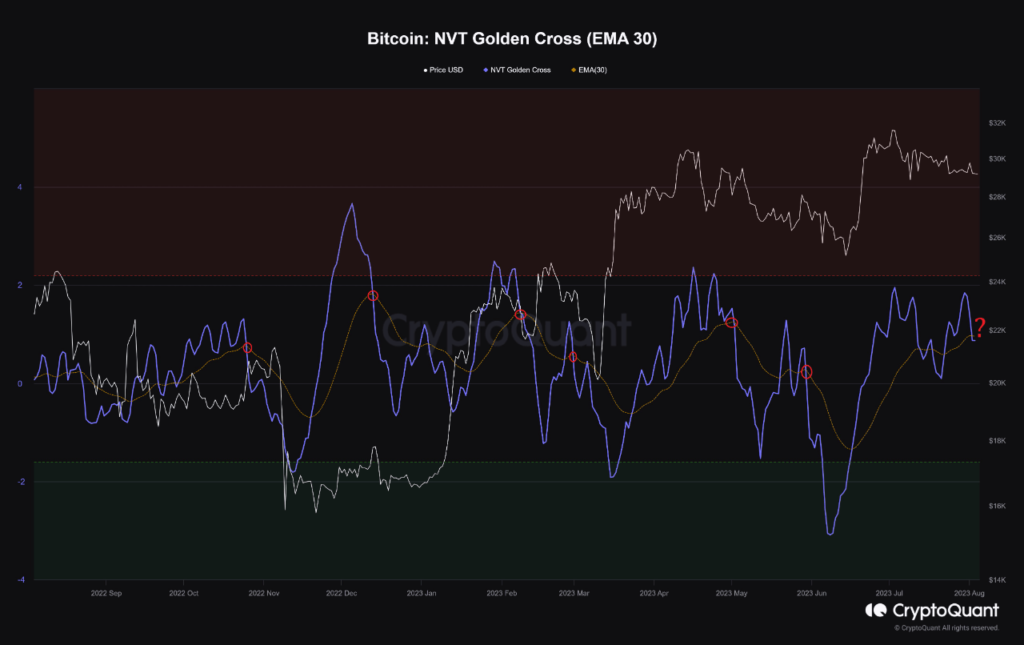

The beneath chart exhibits the development within the Bitcoin NVT golden cross and the 30-day exponential transferring common (EMA) of the identical over the previous 12 months:

The 2 metrics appear to have crossed one another in latest days | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin NVT golden cross has been happening not too long ago and has simply crossed underneath its 30-day EMA. This line seems to have traditionally been important for the asset, because the situations marked by the analyst exhibits.

Usually, at any time when the indicator has crossed beneath this EMA line, the cryptocurrency’s worth has taken successful. From the chart, it’s seen that this sample has already held up just a few occasions throughout this rally thus far.

Naturally, if this historic priority is something to go by, then the present bearish crossover may also result in Bitcoin registering a drawdown within the close to future.

It needs to be famous, although, that the crossover will not be totally confirmed but, because the NVT golden cross has solely barely gone beneath the 30-day EMA thus far. So it’s doable that the indicator may flip itself round within the coming days and cancel out the cross.

It now stays to be seen, whether or not the Bitcoin NVT golden cross and the 30-day EMA would preserve moving into the identical trajectories and solidify the cross, or if the sample would retrace.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,200, down 1% within the final week.

BTC has continued to point out stagnation not too long ago | Supply: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com