- Through the bear market, each retail and institutional buyers elevated their accumulation.

- Issues can get bullish within the quick time period as a couple of indicators had been in patrons’ favor.

After reaching an all-time excessive of over $67,00o in late November 2021, Bitcoin’s [BTC] value has remained underneath bears’ affect. In truth, that is the longest bear market in Bitcoin’s historical past, because it has lasted for greater than 490 days.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Although there have been a number of causes at play inflicting this, it needs to be famous that the bear market may not finish anytime quickly. It would require a set off for BTC to exit the bear market and register huge progress.

A endless bear marketplace for Bitcoin

Bitcoin goes by cycles. These cycles have a interval of growth, huge correction, accumulation, and renewed growth. Nonetheless, not each cycle is identical size. Michaël van de Popp, founder and CEO of MN Buying and selling, pointed this out in his latest tweet.

The longest bear market in historical past for #Bitcoin

It would really feel like a ghost city in crypto. It would really feel like there’s not even going to be a bull cycle anymore and I perceive why these ideas are there.

However why?

Effectively, folks base their choices on historical past. 👇… pic.twitter.com/Ljtv9wmw12

— Michaël van de Poppe (@CryptoMichNL) August 27, 2023

The current bear market is corresponding to what was seen in 2015 in sure respects. A interval of sideways motion usually decreases curiosity in property. This was evident from a have a look at Bitcoin’s on-chain information.

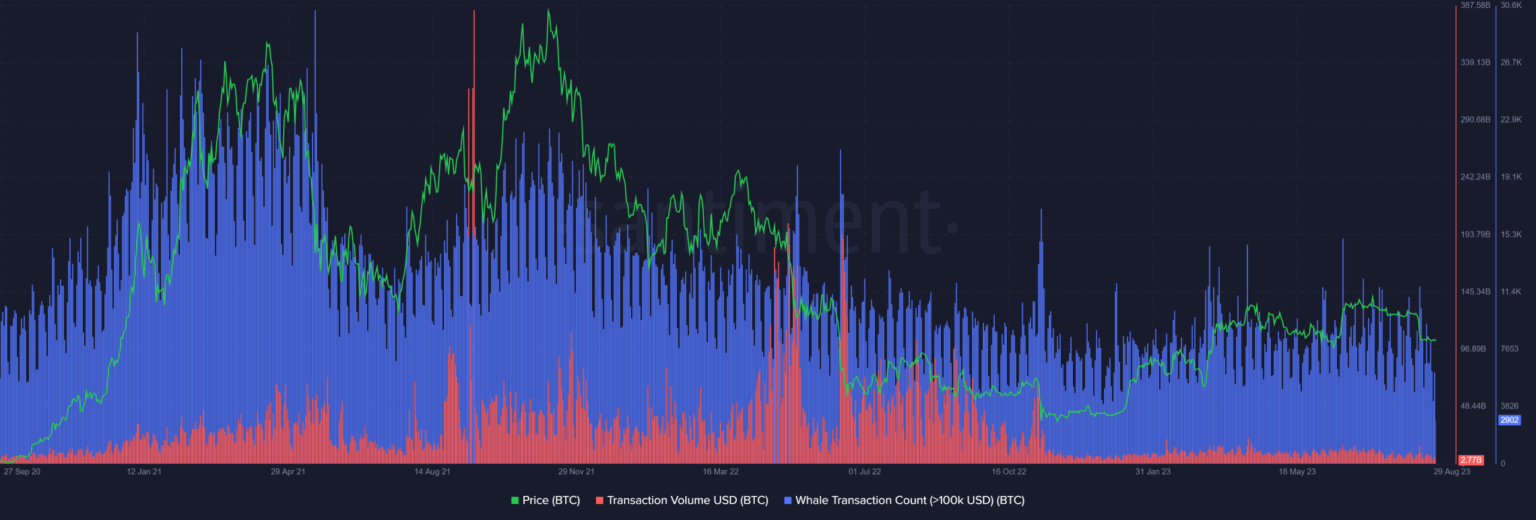

Through the bear market, whale transaction counts have dropped, as has BTC’s transaction quantity.

Supply: Santiment

Nonetheless, whereas its value remained low, Bitcoin adoption has been on the rise. As an illustration, BlackRock just lately turned the second-largest shareholder within the 4 high Bitcoin mining companies.

Not solely that, however as reported earlier, MicroStrategies introduced a further buy of 467 bitcoins, growing the corporate’s property underneath administration to 152,800 models.

Whereas BTC value motion remained bearish, its provide on exchanges plummeted and its provide exterior of exchanges elevated. Furthermore, the overall variety of BTC holders additionally went up constantly, reflecting elevated accumulation.

This clearly indicated elevated adoption of BTC not solely by institutional buyers but additionally retail buyers.

Supply: Santiment

Nonetheless, if marginal value actions are to not be thought-about, buyers may need to attend longer for BTC to succeed in new highs. Probably, Bitcoin’s upcoming halving in 2024 might act as a set off.

Over the past halving in Might 2020, the coin took a couple of months earlier than initiating its bull rally. Subsequently, if historical past is to be believed, BTC’s subsequent bull rally may not be across the nook.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Something in retailer within the short-term?

Within the quick time period, although, BTC’s value can see a hike as a couple of market indicators had been bullish. For instance, each Bitcoin’s Relative Energy Index (RSI) and Cash Circulation Index (MFI) had been in oversold zones, which might improve shopping for strain.

Moreover, the MACD displayed the opportunity of a bullish crossover, growing the probabilities of a northbound value motion within the coming days. On the time of writing, BTC was buying and selling at $25,957.73 with a market capitalization of over $505 billion.

Supply: TradingView