- 1 Uniswap V3 permits to work in bounded ranges lesser than (0,∞)

- 2 It gives UNI governance along with design completely different price buildings

- 3 In Uniswap V3, it’s doable to create a number of swimming pools for every pair of token that too with completely different swap charges

A sophisticated model to Uniswap V1 and Uniswap V2, Uniswap V3 is Automated Market Maker (AMM) which supplies liquidity suppliers increased management over worth ranges through which the capital deposited by them is used with out considerably affecting liquidity fragmentation and fuel effectivity.

Uniswap V3 additionally works on the same fixed product [x*y=k] with added options. These are:

Concentrated Liquidity: The flexibility to pay attention liquidity by bounding it inside an arbitrary worth vary is given to liquidity suppliers. In earlier variations, liquidity was distributed alongside the reserve curve [x*y=k] the place, x and y are reserves of the belongings X and Y respectively whereas okay is a continuing. With the sooner model, liquidity was supplied throughout your complete worth vary (0, ∞) whereas with V3 liquidity is supplied throughout the smaller (finite) vary than (0, ∞). Liquidity concentrated in a finite vary generally known as Place. A place solely wants to take care of liquidity reserve to facilitate commerce between this vary and subsequently acts like fixed product swimming pools inside bigger reserves referred to as digital reserves throughout the vary.

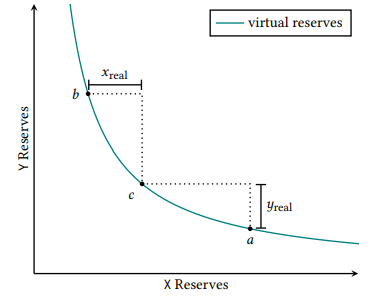

Determine: Simulation of digital liquidity

A place wants to carry sufficient belongings in reserve X to cowl the worth actions to its higher restrict as a result of price-rise would result in depletion of X reserves. And in case of Y, it must holds sufficient Belongings within the reserve Y to cowl the downward worth motion to its decrease restrict. Within the above graph, the connection is proven for a place on a variety [pa,pb] and a present worth pcЄ [pa,pb] and xreal and yreal represents the place’s actual reserves.

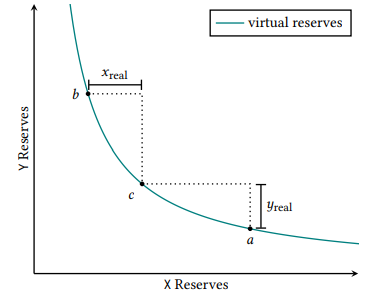

What occurs when the worth exits the place vary? The place’s liquidity is not energetic and doesn’t earn charges. At this level, the reserve consists of a single Asset because the reserves of the opposite asset should have been fully depleted. If the worth once more re-enters within the place, liquidity turns into energetic once more. The actual reserve of the place are calculated utilizing

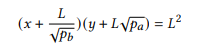

the place, L is the quantity of liquidity supplied and is calculated as √okay. The graphical illustration of above equation is

Determine: Actual Reserves

This lets the market determine the place to allocate liquidity they usually can create as many as positions as could be match into the worth vary. Rational Liquidity Suppliers can scale back price of their capital by concentrating their liquidity in a slender band across the present costs after which carry on including/ eradicating tokens as the worth strikes.

Architectural Adjustments: Among the adjustments that occurred from V1 and V2 to V3 have been essential to help concentrated liquidity positions whereas some are enhancements typically. The enhancements embrace (i) A number of Swimming pools Per Pair: Uniswap V3 permits a number of pool for every pair of token, with completely different swap charges whereas all of the swimming pools are created by the identical manufacturing unit contract and permits contract creation with three completely different price classes 0.05%, 0.30% and 1% whereas it was 0.30% solely in V1 and V2. In V3, extra price buildings could be applied. (ii) Non-Fungible Liquidity: In V3, compounding of charges isn’t doable as charges are saved individually and are held as tokens through which charges are paid.

Governance: In Uniswap V3, UNI governance has extra flexibility to vary the fraction of the swap charges that’s relevant on the protocols and in addition, it is ready to implement extra layer of price buildings. It additionally has energy to switch possession to a different addresses.

Oracle: V3 doesn’t require customers of the oracle to trace earlier values of accumulator externally. In V3, it’s doable to calculate arithmetic imply TWAP (Time-weighted Common Worth) and geometric imply TWAP (V3 tracks the sum of log costs). It provides a liquidity accumulator which is tracked alongside the worth accumulator that accumulates 1/L for every second.

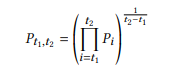

Geometric imply TWAP could be calculated as between time interval t1 and t2,

Implementing Concentrated Liquidity

- Ticks and Ranges: Ranges are specified as a variety of signed integer tick indices: a decrease tick (il) and a higher tick (iu). Ticks signify the costs at which the digital liquidity of the contract can change. There’s a tick at each worth p, an integer energy of 1.0001. Representing ticks by an integer index i, costs are given by,

p(i) = 1.0001i

When liquidity is added to a variety, if one or each of the ticks should not already used because the higher or decrease limits, in any of the present positions, then the tick is initialized. Not all of the ticks could be initialized. The pool is initialized with a parameter generally known as tick spacing so all of the ticks that may very well be initialized ought to be divisible by tick spacing. If tick spacing is smaller than it permits for tighter and extra exact ranges.

- World State: The World State of the contract contains seven storage variables related to swaps and liquidity positions.

Out of Liquidity and Worth, just one adjustments at a time. Worth adjustments when swapping inside a tick and liquidity adjustments when crossing a tick or when minting or burning liquidity. L is calculated as x.y and P is calculated as y/x.

Present tick could be calculated on the idea of P . At any given level of time, the equation ought to be true is ic=[log1.0001P]

In Uniswap V3, charges are collected within the tokens themselves relatively than liquidity. The worldwide state of charges represents the full quantity of charges which were earned per unit of Digital Liquidity L. The worldwide state tracks the full gathered uncollected protocol charges in every token and this may be collected by UNI governance.

Swapping in a Single Tick: When swapping one token for the opposite, the pool contract first compute the brand new P utilizing method P= y/L and to compute the quantity of token0 or token1 to be ship out utilizing both of the 2 formulation: y=P .L or x=(1/P). L

Tick- Listed State: Contract must retailer details about every tick so as to observe the quantity of web liquidity that ought to be added or eliminated when the tick is crossed, in addition to to trace the charges earned above or under that tick.

Place- Listed State: Every Place construction tracks three values together with liquidity, decrease tick and higher tick to know the liquidity and uncollected charges place.