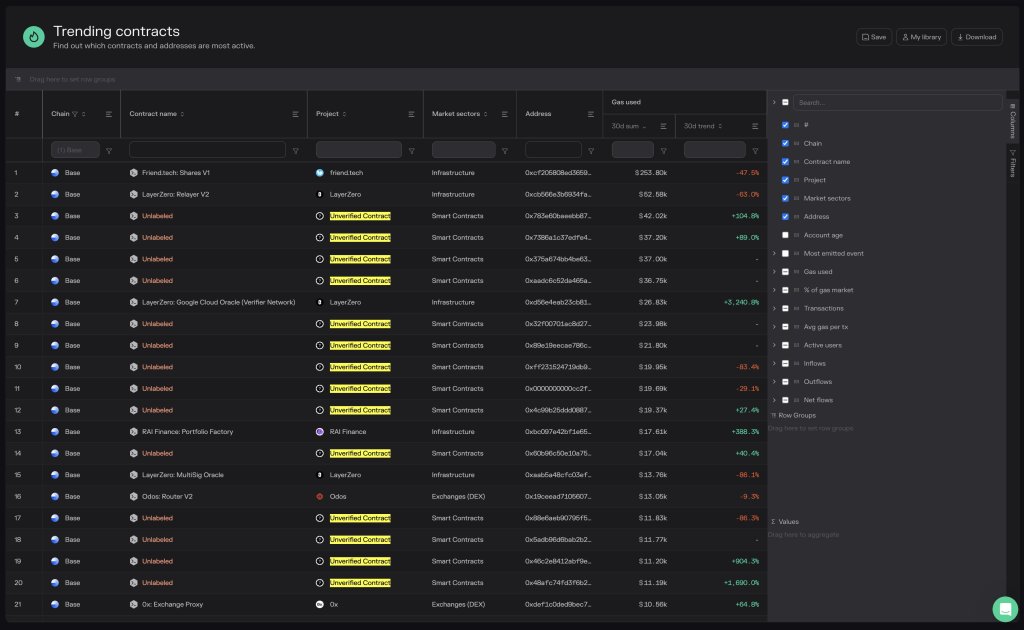

14/21, or 66%, of the highest gas-consuming sensible contracts on Base, a layer-2 platform for constructing and deploying sensible contracts, are unverified. In keeping with Token Terminal data on October 24, the identical contracts are among the most actively used, studying from gasoline price tendencies over the past month.

Buddy.tech Leads The Fuel Race On Base

Base is a layer-2 scaling answer and considered one of OP Mainnet and Arbitrum’s rivals. The platform depends on the Optimistic Rollup approach, permitting transactions to be batched off-chain earlier than being confirmed on the mainnet. This is identical strategy rivals, together with Arbitrum and OP Mainnet, adopted.

As of October 24, probably the most gas-consuming protocol already labeled and identified to be deployed from a given developer is Buddy.tech. Nonetheless, the developer stays nameless.

The decentralized social media protocol permits customers to purchase and promote keys to one another’s X accounts. On this manner, buying and selling events can entry unique in-app chatrooms and content material by a given consumer.

By deploying on Base, Buddy.tech customers take pleasure in decrease buying and selling charges than they’d have launched on the mainnet. Past charges, the protocol also can scale for the reason that layer-2 answer can deal with increased throughput than the mainnet.

Within the final month, Buddy.tech generated over $253,000 in gasoline charges. The execution price, typically referred to as layer-2 price, on Base, which makes use of Optimism, is ready by the community and is flat.

The price prevents customers from spamming the community and rewards nodes that show all transactions submitted on the platform. The opposite price is the approximate for confirming the identical transaction batch on the mainnet. This price is mostly increased than the execution price.

The Case Of Common However Unverified Good Contracts

Whereas gasoline charges generated by Buddy.tech is over $253,000, it’s down over 47% within the final month. This might counsel that buying and selling exercise fell for the reason that price generated by a community is straight proportional to how regularly it’s used.

Buddy.tech charges, when writing, stay suppressed, underperforming the exercise of unverified sensible contracts, charges generated over the past month. Over the earlier 30 days, one unverified contract has seen a 104% enhance in buying and selling charges, reaching $42,000. One other contract has elevated by 1,690%, exceeding $11,000 in the identical interval.

Because the title suggests, these unverified codes have but to be confirmed by a 3rd social gathering. This could imply there isn’t any assure that the identical developer constructed and deployed code on Base. On the similar time, the code may comprise malicious code that might steal from addresses it interacts with.

Characteristic picture on Canva, chart from TradingView