- Bitcoin’s value moved previous $38,000 after the software program agency revealed particulars of its latest buy.

- BTC has the potential to retrace within the brief time period, the MVRV ratio indicated.

The aftermath of MicroStrategy’s latest Bitcoin [BTC] buy has left bears questioning if instances have modified. It is because the Bitcoin value didn’t nosedive as many would have anticipated. Nevertheless, BTC jumped and was capable of reclaim $38,000.

Led by government chairman and Bitcoin maximalist Michael Saylor, MicroStrategy confirmed that it bought a further 16,130 BTC. The corporate, in its communiqué on thirtieth November, famous that it now holds a complete of 174,530 BTC.

At press time value, the worth of the brand new buy was price round $611 million. This makes the latest buy the best MicroStrategy has purchased in about two years.

Though the Enterprise Intelligence (BI) agency talked about that these cash have been purchased in November, plainly the once-criticized Bitcoin technique adopted by the agency is now seen as a powerful determination.

What’s higher than one worthwhile wager? Extra?

MicroStrategy adopted the Bitcoin commonplace in August 2020. Its first Bitcoin buy at the moment was 21,454 BTC. At the moment, this was price roughly $250 million.

However after Bitcoin went on a downward spiral in 2022, the belongings held by the agency fell into a large unrealized loss.

Many feedback additionally appeared to tear Saylor into items for placing his agency into such a decent place.

Nevertheless, this yr has confirmed to be a big one for MicroStrategy. It is because Bitcoin’s restoration has ensured that the corporate now holds billions of {dollars} in unrealized earnings.

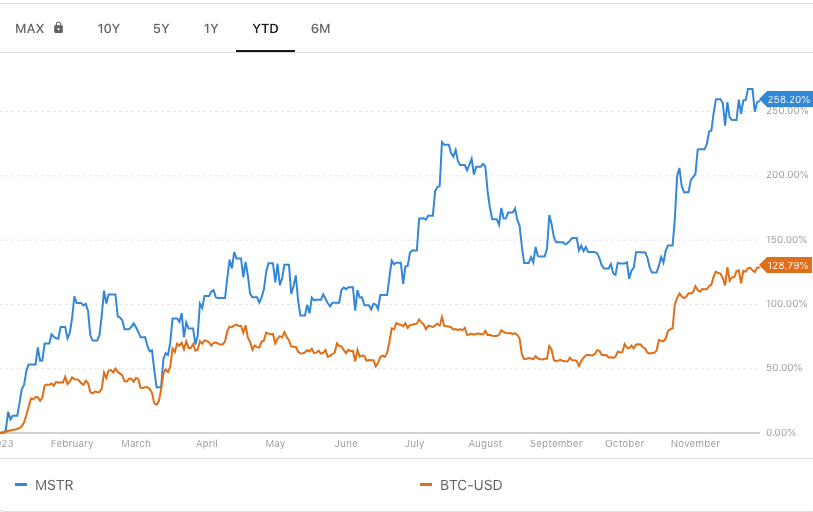

Not solely did Bitcoin’s value affect MicroStrategy positively, its inventory MSTR has additionally performed the identical. On a 12 months-To-Date (YTD) foundation, BTC has elevated by 258.20%. MSTR, alternatively, has additionally jumped by 128.78%.

Supply: PortfoliosLab

Nevertheless, AMBCrypto’s evaluation of each belongings confirmed that MSTR has been extra unstable than BTC at 12.76% to 11.79% respectively. Because of this the inventory has had greater value fluctuations than Bitcoin in latest instances.

Additionally it is essential to notice that Bitcoin and MSTR are nonetheless down from their All-Time Excessive (ATHs). Whereas BTC is down 43.99% from its ATH, MSTR nonetheless has a whopping 60.16% to meet up with its earlier excessive.

Each situation will not be the identical

A take a look at the Market Worth to Realized Worth (MVRV) ratio confirmed that members might have to be cautious about shopping for Bitcoin for the brief time period. At press time, the MVRV ratio was 1.79, as indicated by Glassnode.

Supply: Glassnode

This metric signifies if a cryptocurrency is at honest worth or not. Values under 1 imply that the majority holders are at a loss, and are seen as a purchase sign. Nevertheless, when the MVRV ratio is above 1, it implies earnings for holders.

However on the similar time, it preaches warning about accumulating for short-term good points which was the case this time. Moreover, the MVRV ratio talked about is probably not a legitimate promote sign contemplating the present market situation.

Is your portfolio inexperienced? Examine the BTC Revenue Calculator

One motive for this assumption is the optimism round a possible Bitcoin ETF approval. So, it’s probably that the Bitcoin value will fail to nosedive within the coming days.

Many additionally imagine that an approval would shoot up the BTC worth. Ought to this be the case, then MicroStrategy holdings could be price greater than the $6.50 billion it was.