- DOT might rise as excessive as $17 if it breaks by the important thing resistance round $10.

- On-chain metrics confirmed that spot consumers have been shopping for DOT aggressively.

Based on analyst Michaël van de Poppe, Polkadot’s [DOT] upswing within the final 24 hours could possibly be the beginning of a run that drives the worth to an all-time excessive.

Within the put up, the analyst thought-about DOT’s efficiency versus Tether [USDT] and the one towards the Bitcoin [BTC] pair. van de Poppe talked about that the token fashioned increased highs and decrease lows towards USDT.

North is the route

A better excessive and decrease low is taken into account a bullish sign. It exhibits that an asset can resist a downward pattern and attain the next worth.

From the chart the analyst shared, DOT had established an uptrend from $8.97. Nevertheless it confronted a vital resistance across the $10 area.

Supply: X

Because it stands, an in depth above the resistance might foreshadow the pattern that set off a rally towards $17. Moreover, if DOT hits $17, a breakout may happen and drive the worth towards an all-time excessive.

Regarding its efficiency towards Bitcoin, AMBCrypto, just like the analyst, noticed that it was at a cycle low. This situation validated the long-term bullish thesis for the token.

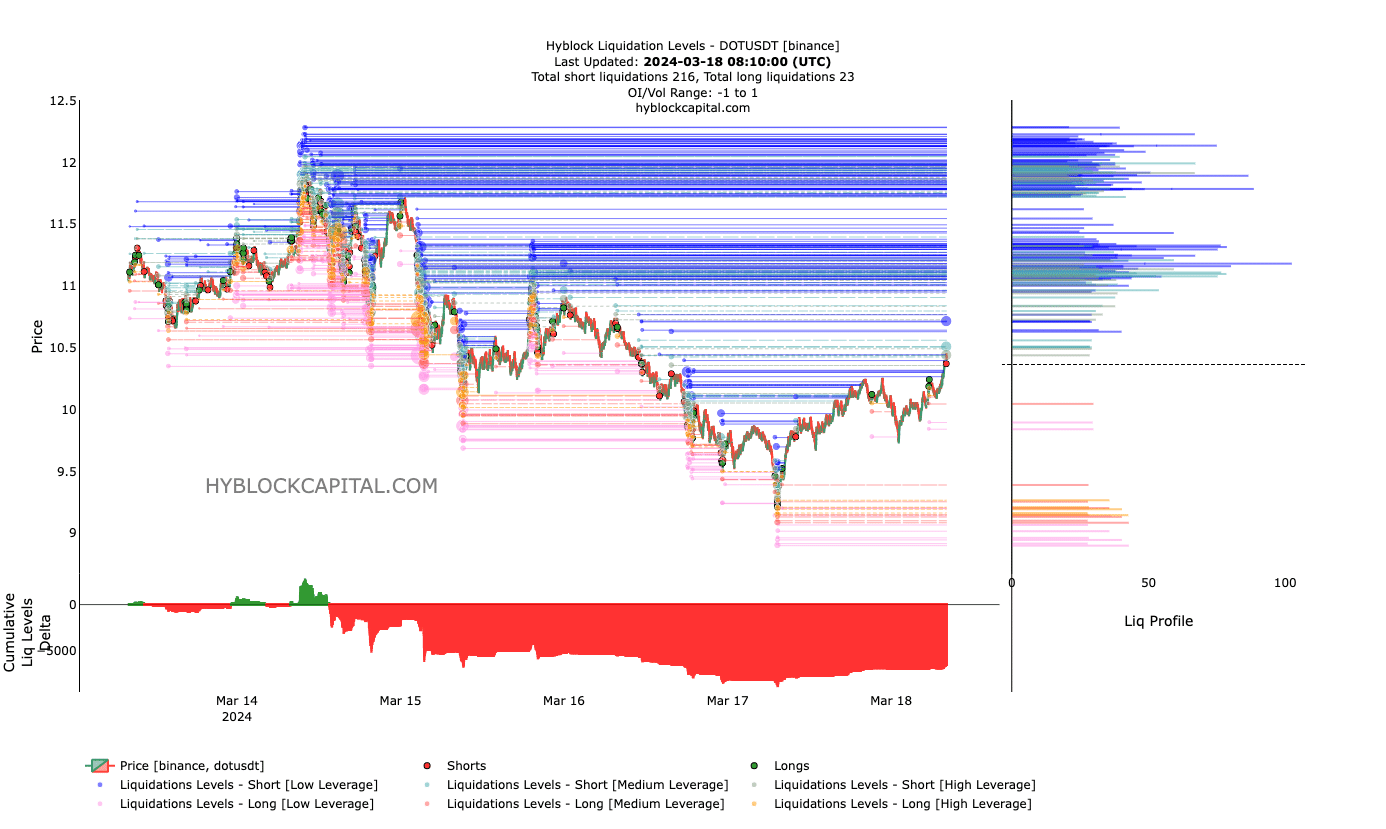

Nevertheless, it is usually vital to evaluate DOT utilizing different indicators. The primary indicator we ran to was the Liquidation Ranges out there on HyblockCapital’s platform.

Liquidation ranges present estimated value factors the place liquidation occasions may happen. On the plot, there may be additionally a bit for the Cumulative Liquidation Degree Delta (CLLD).

This CLLD tells if actions within the derivatives market are fueling a bullish or bearish bias.

It’s not wanting good for shorts

At press time, AMBCrypto observed that there was no cluster of liquidity between $10.36 and $10.96. Due to this fact, DOT may discover it simple to climb towards $11.

Nevertheless, above the aforementioned worth, numerous liquidation might happen, particularly for high-leverage merchants.

On the CCLD half, the inference we acquired was that shorts with medium to excessive leverage may need their positions worn out. This was as a result of the CLLD had dropped into destructive territory.

Supply: HyblockCapital

The destructive studying recommended that shorts have been making an attempt to catch the dip as DOT’s value barely decreased. However lengthy liquidation ranges have been additionally getting hit from the fast restoration.

Thus, this affords a bullish thesis for the token.

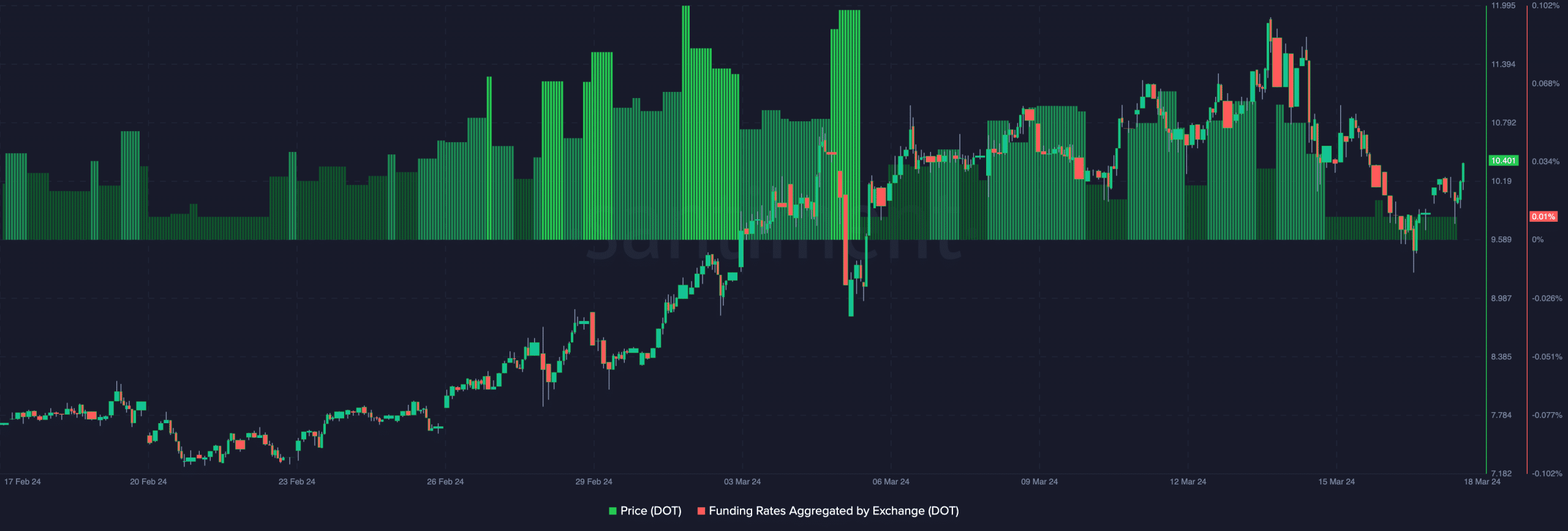

As well as, the Funding Fee was optimistic, indicating that open lengthy positions have been paying shorts to maintain their positions.

For the uninitiated, funding is a product of the distinction between the spot value and perp value. One factor AMBCrypto observed was that the Funding Fee was changing into decrease as DOT’s value climbed.

Learn Polkadot’s [DOT] Value Prediction 2024-2025

This indicated that spot consumers have been accumulating aggressively, whereas perp sellers have been in disbelief. For the worth of the token, this was a bullish sign.

As such, DOT’s northward run may proceed over the approaching weeks.

Supply: Santiment