Quick-term Bitcoin holders have been happening a shopping for spree recently, accumulating over 1.2 million BTC since December 2023, in line with Glassnode. Bitcoin has obtained main curiosity from traders because the starting of the yr, and rightly so, contemplating the quantity of consideration introduced by the launch of Spot Bitcoin ETFs within the US.

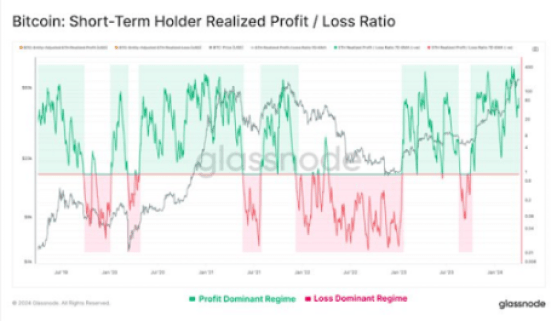

Whereas the cryptocurrency has gone via an prolonged interval of bullish motion, nearly all of the buildup pattern has largely been attributed to whales and addresses holding massive quantities of Bitcoin for lengthy intervals. Nevertheless, current information from Glassnode has revealed an fascinating accumulation pattern amongst short-term holders. On the similar time, the revenue/loss ratio of this cohort of trades has remained effectively inside the revenue zone because the starting of the yr, with revenue taking outsizing losses by 50x.

Curiosity In Bitcoin Amongst Retail Traders

Traders have seen Bitcoin struggling to commerce above the $70,000 value stage because the center of March. Nevertheless, Bitcoin on-chain information has just lately revealed an fascinating accumulation pattern from Bitcoin’s holding addresses. Notably, 21,400 BTC, price round $1.40 billion, have been moved into these addresses previously few days, indicating the shopping for strain could be again already.

The collective holding of short-term holders has been quickly climbing since December 2024 whereas the long-term holders have been distributing. Quick-term holders are these wallets that maintain Bitcoin just for a couple of weeks or months at a time. The truth that so many new cash have entered short-term holder wallets just lately reveals that many traders have been pouring into the market. This, in flip, may recommend the cryptocurrency has lastly achieved full-scale adoption, which may result in continued value development over time.

Revenue/loss information reveals short-term holders have collectively been in revenue because the starting of the yr. In response to Glassnode, short-term holders have been shopping for and promoting at a revenue for almost all of 2024 to this point. The truth is, the short-term holder revenue has outsized losses by 50 occasions. Because of this over 49 out of fifty short-term holders have been promoting their Bitcoin for a better value than what they paid.

Supply: Glassnode

Apparently, Bitcoin’s current ascent to a brand new all-time excessive noticed the short-term holder realized revenue/loss ratio reaching its highest level ever on the 7D Exponential Shifting Common.

Retail Curiosity To Push BTC Value?

The shopping for spree by each short-term and long-term holders means that each retail and institutional curiosity in Bitcoin is now at its highest level. Fundamentals level to the seemingly continuation of this pattern all through April, particularly with the strategy of the subsequent Bitcoin halving.

On the time of writing, Bitcoin is buying and selling at $66,903, up by 1.87% previously 24 hours.

BTC value drops under $67,000 | Supply: BTCUSD on Tradingview.com

Featured picture from Yahoo Finance, chart from Tradingview.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal danger.