Are you trying to begin your buying and selling journey, or improve your buying and selling technique? If that’s the case, you will have to discover ways to spot crypto chart patterns.

On this article, we are going to talk about a number of the commonest chart patterns that merchants use to make choices. We may even present examples of every sample. So, if you happen to’re able to find out about crypto chart patterns, preserve studying!

What Are Chart Patterns?

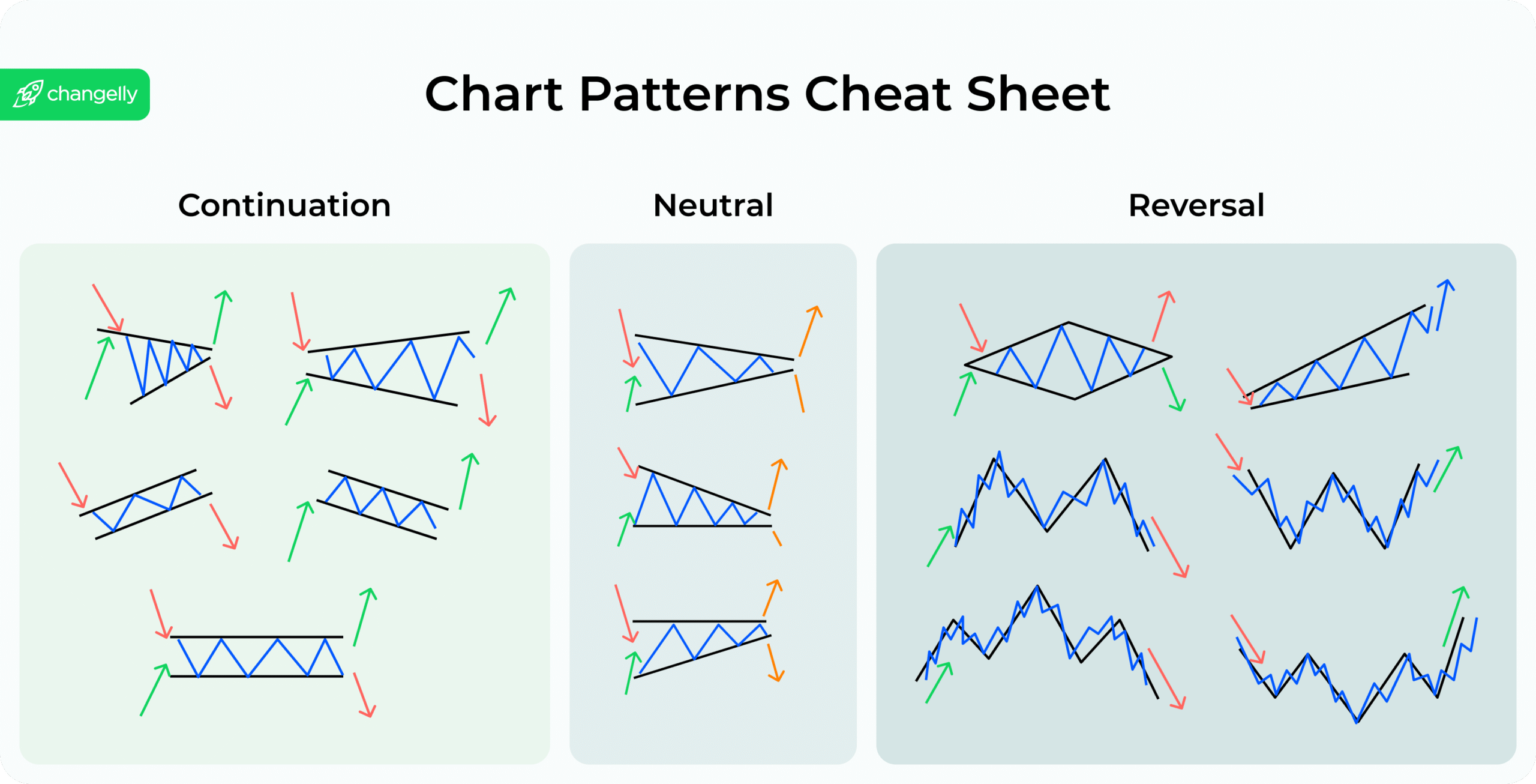

Chart patterns and development traces are utilized in technical evaluation to assist determine potential buying and selling alternatives. Merchants use them to acknowledge turning factors and robust reversals that would point out shopping for or promoting alternatives out there.

Buying and selling patterns are available many sizes and shapes. Being widespread formations that happen on a value chart, they’ll sign to merchants {that a} sure value motion might happen. These patterns might help predict future value actions.

Development traces are a key part of technical evaluation. They’re used to determine areas of help and resistance, point out a prevailing market development, forecast potential value targets, and filter out noise costs. Development traces will be drawn utilizing information factors similar to highs or lows on the chart. Whereas drawing one, it’s additionally essential to trace shifting averages, determine explicit market circumstances, and research the slope of the development line. These development traces assist merchants determine entry/exit factors of their trades in addition to modify their positions based mostly on future market actions. In the end, they provide merchants higher probabilities at recognizing worthwhile buying and selling alternatives within the markets.

How you can Learn Crypto Chart Patterns?

Studying to learn crypto chart patterns is a helpful ability for buying and selling and investing in cryptocurrencies. Right here’s a step-by-step information tailor-made for newbies, together with recommendation on the instruments you must use and recommendations on the way to begin:

Step 1: Perceive the Fundamentals of Chart Patterns

Chart patterns are formations that seem on the value charts of cryptocurrencies and characterize the battle between consumers and sellers. These patterns can point out potential value actions. Familiarize your self with the most typical patterns, like head and shoulders, cup and deal with, flags, and triangles. For those who wrestle initially, don’t be discouraged — like all ability, with follow and expertise, you’ll quickly be capable of determine these patterns effortlessly.

Step 2: Select a Charting Software

A great charting instrument is important for viewing and analyzing crypto charts. Some standard choices embrace:

- TradingView: Extremely standard for its vary of instruments and social sharing options.

- Coinigy: Provides in depth instruments for buying and selling immediately from the chart.

- CryptoCompare: Supplies a much less superior, user-friendly interface appropriate for newbies.

Step 3: Be taught to Determine Patterns

This step tends to be essentially the most time-consuming, however with the fitting sources, you possibly can grasp it effectively.

Begin by figuring out easy patterns. Make the most of instruments similar to our chart sample cheat sheets and buying and selling tutorials on YouTube to information your studying. Give it a go along with two or three of the preferred patterns, similar to head and shoulders, cup and deal with, or triangles. Follow recognizing these patterns on precise charts. By actively looking for these patterns your self, you’ll develop a eager eye for figuring out potential market actions, which is essential for profitable buying and selling.

Step 4: Follow with Historic Information

Use your charting instrument to have a look at historic value actions and attempt to determine the patterns. Most platforms will let you “replay” the market from an earlier date to simulate how patterns might need helped predict actions.

Step 5: Apply Fundamental Technical Evaluation

Whereas memorizing chart patterns is helpful, understanding some fundamental technical evaluation can improve your means to learn charts. If you’re a newbie, I might recommend to find out about:

- Assist and Resistance Ranges are costs at which the crypto constantly stops falling or rising, respectively.

- Quantity helps affirm the energy of a value transfer. Patterns with excessive quantity on the breakout are extra dependable.

- Shifting Averages easy out value information to create a single flowing line, which makes it simpler to determine the route of the development. Easy shifting averages (SMA) and exponential shifting averages (EMA) are good beginning factors.

- The Relative Power Index (RSI) measures the velocity and alter of value actions on a scale of 0 to 100. Typically, an RSI above 70 signifies overbought circumstances (presumably a promote sign), whereas under 30 signifies oversold circumstances (presumably a purchase sign).

- Shifting Common Convergence Divergence (MACD) is a trend-following momentum indicator that exhibits the connection between two shifting averages of a cryptocurrency’s value. The MACD is calculated by subtracting the 26-period EMA from the 12-period EMA.

- A Stochastic Oscillator is a momentum indicator that compares a specific closing value of a cryptocurrency to a spread of its costs over a sure interval. It helps to determine overbought and oversold ranges, offering perception into potential reversal factors.

Step 6: Follow on a Demo Account

Earlier than investing actual cash, follow your expertise utilizing a demo account. Many buying and selling platforms supply demo accounts the place you possibly can commerce with pretend cash however actual market information.

Step 7: Keep Up to date and Versatile

Influenced by information and international occasions, the crypto market is extremely risky. Hold your self up to date with the newest cryptocurrency information. Be versatile and able to adapt your technique because the market adjustments.

Is Memorizing Chart Patterns Sufficient?

Memorizing chart patterns is an efficient begin, but it surely’s not sufficient for constant success in crypto buying and selling. Understanding the context during which these patterns develop and the market sentiment and complementing them with different types of technical evaluation like development traces, quantity, and indicators like Shifting Averages or RSI can present a extra complete buying and selling technique.

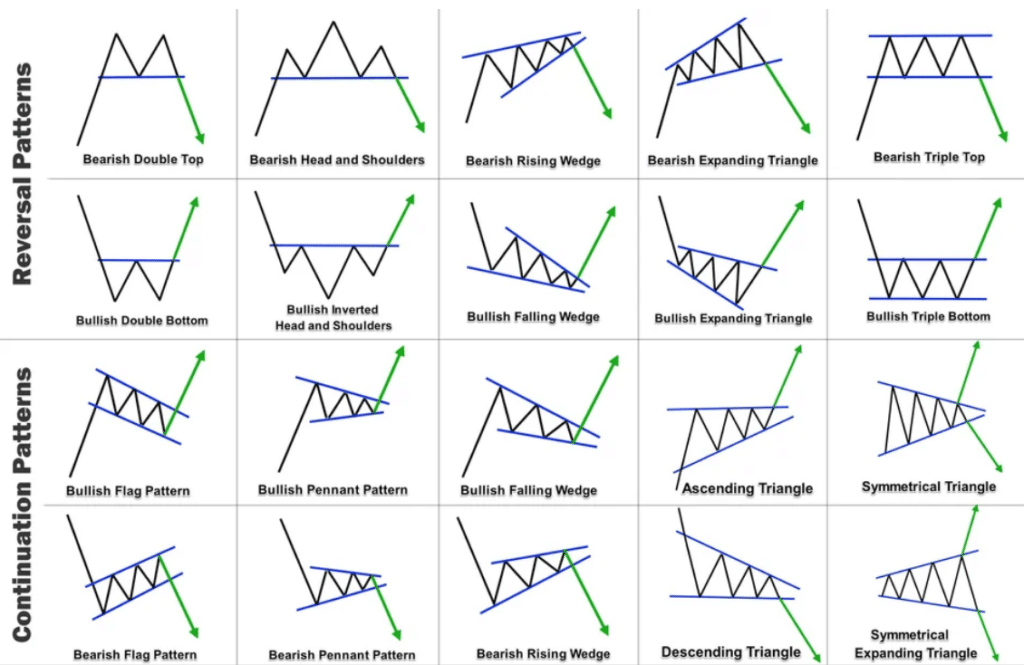

Triangle Crypto Chart Patterns

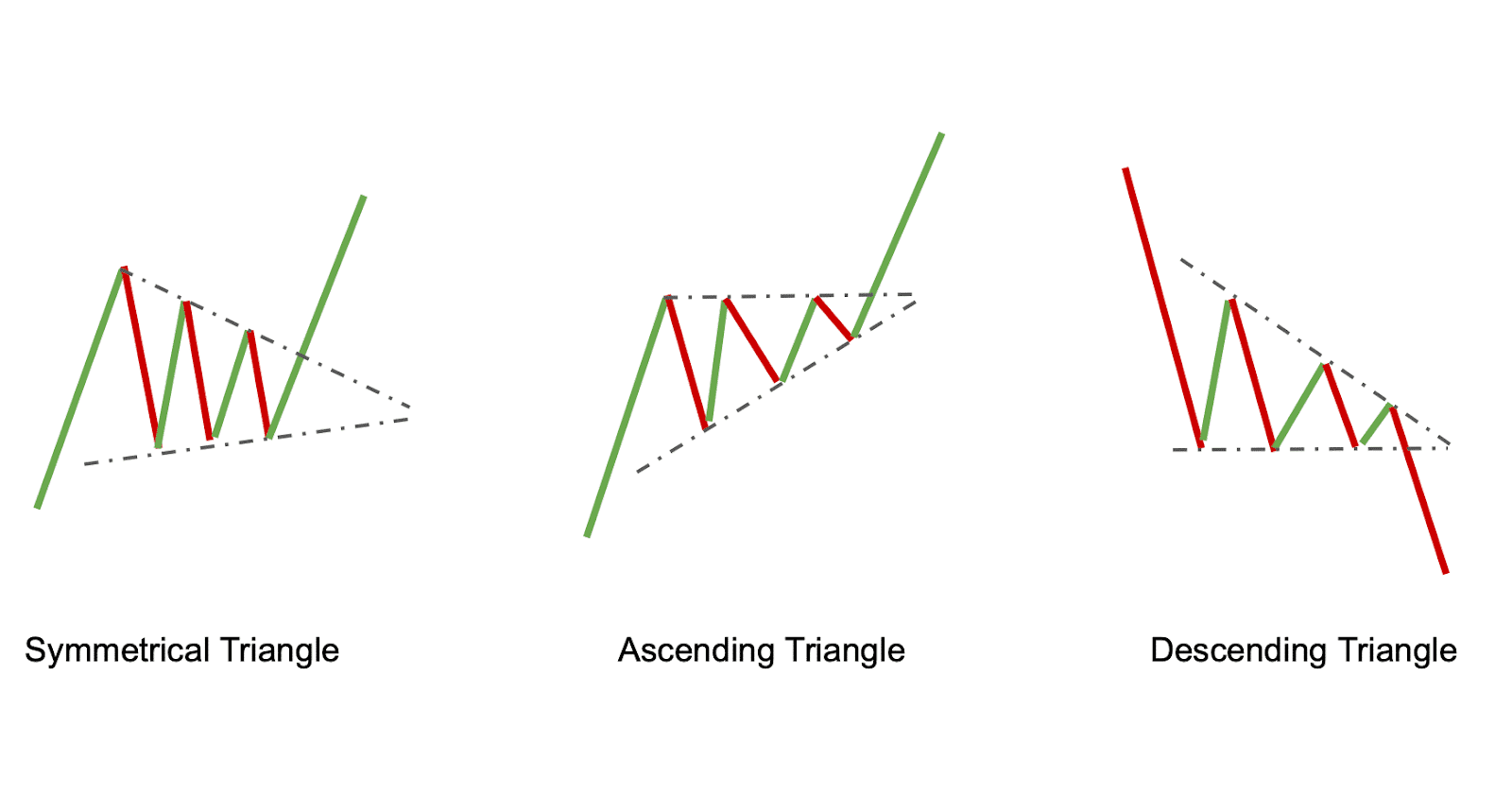

One of the crucial widespread chart patterns is the triangle, fashioned by an asset’s converging development traces. There are three varieties of triangles:

- Ascending (bullish chart sample)

- Descending (bearish sample)

- Symmetrical

Ascending and descending triangles are continuation chart patterns, which implies that they usually happen in the course of a development and sign that the development will proceed. Symmetrical triangles are thought-about to be reversal patterns, which suggests they’ll happen on the finish of a development and sign that the value might reverse its course.

Triangles are a number of the long-lasting patterns: they’ll take a number of months and even years to type.

Ascending Triangle

An ascending triangle sample is created when the value of an asset types larger highs and better lows. This sample is taken into account a bullish continuation sample — so it provides a purchase sign.

Listed below are some widespread defining traits of an ascending triangle:

- The worth is forming larger highs and better lows.

- There’s a horizontal resistance line at a sure value stage.

- The chart sample is often discovered in the course of an uptrend.

Descending Triangle

A descending triangle is a bearish continuation sample that, similar to the identify suggests, is the other of the ascending triangle. It happens when the asset value types decrease highs and decrease lows. A descending triangle often provides a promote sign as it’s a signal {that a} bearish development will most likely proceed.

There are a number of methods to determine a descending triangle. These are a number of the issues you possibly can search for.

- The asset value types decrease highs and decrease lows.

- You possibly can observe horizontal help.

- It’s the center of a downtrend.

Symmetrical Triangle

A symmetrical triangle chart sample emerges when the value of an asset types larger lows and decrease highs. This chart sample will be discovered on the finish of a development; it alerts that the value might reverse its course. The symmetrical triangle sample will be both bullish or bearish.

Listed below are some indicators that the sample you’re seeing is perhaps a symmetrical triangle:

- The worth types larger lows and decrease highs.

- There isn’t any clear development.

- It’s the finish of a development.

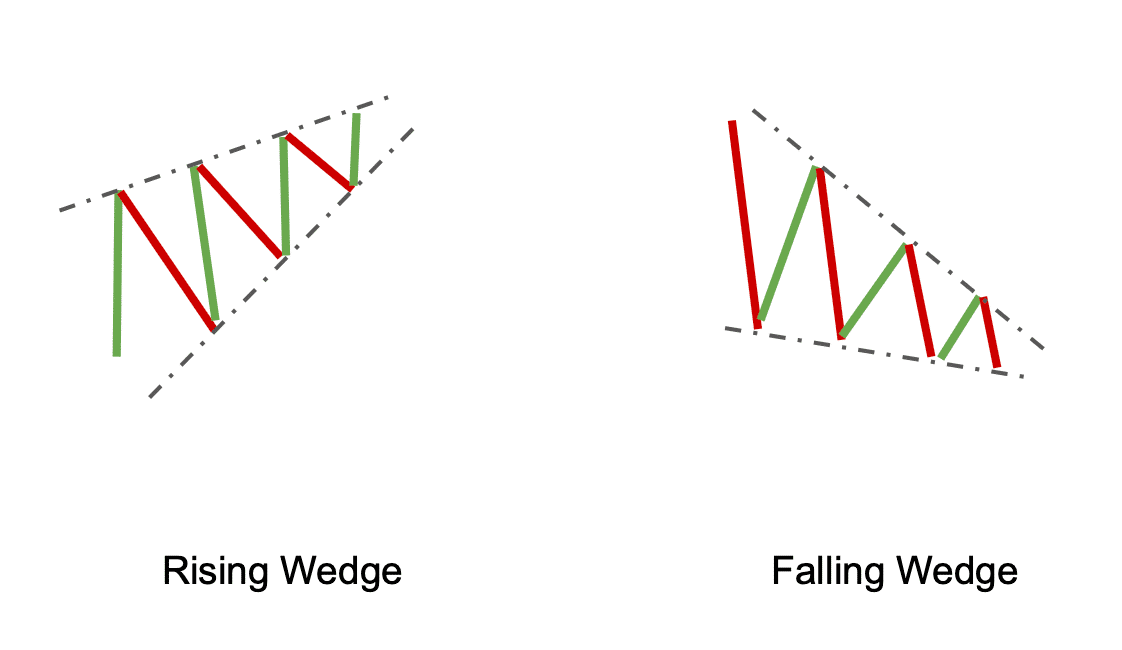

Rising Wedge Crypto Graph Patterns

Wedges are one other subtype of triangle chart patterns. A rising wedge is a bearish reversal sample that involves life when the value of an asset types decrease highs and better lows. This sample alerts that the value is more likely to proceed to fall. It provides a promote sign.

Listed below are some issues that may level in the direction of a sample being a rising wedge:

- The worth types decrease highs and better lows.

- There may be horizontal resistance at a sure value stage.

- It’s the center of a downtrend.

Falling Wedge

A falling wedge is a bullish reversal sample that, similar to the identify suggests, is the other of the rising wedge. It happens when there are larger highs and decrease lows on the value chart. A falling wedge often provides a purchase sign as it’s a signal that an uptrend will most likely proceed.

There are a number of methods to determine a falling wedge. These are a number of the issues you possibly can search for:

- The asset types larger highs and decrease lows.

- You possibly can observe horizontal help.

- It’s the center of an uptrend.

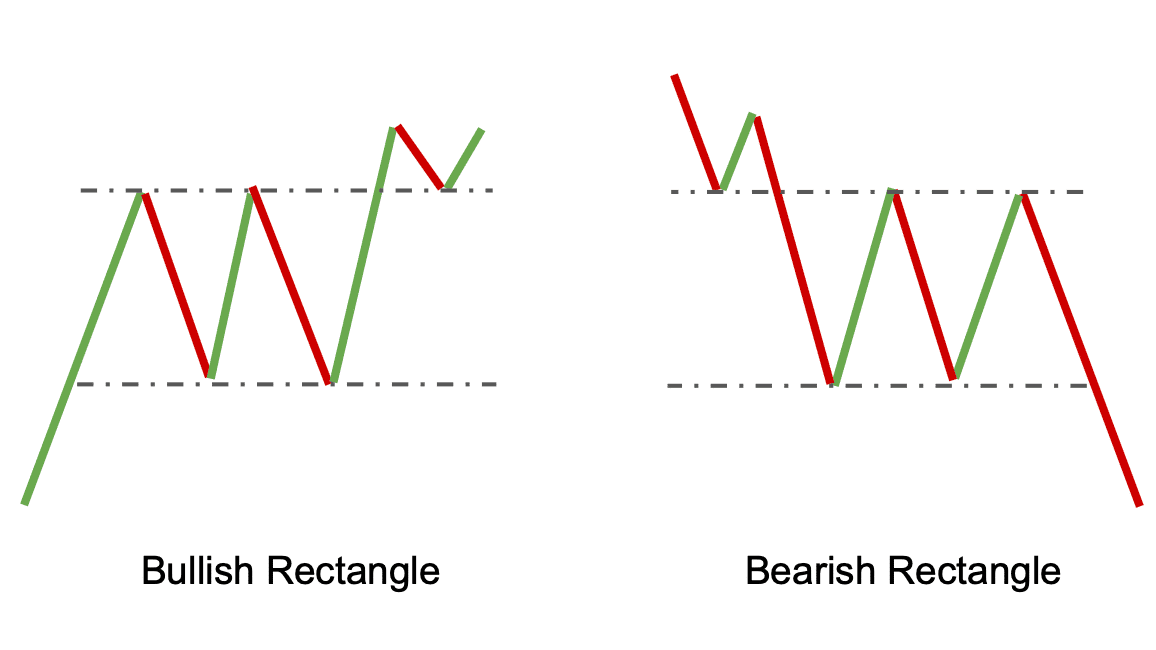

Rectangle Chart Patterns

A rectangle chart sample is created when the value of an asset consolidates between two horizontal ranges of help and resistance. This chart sample can sign that the value is about to interrupt out in both route.

Bullish Rectangle

A bullish rectangle is a chart sample that’s created when the value of an asset can’t escape by both the highest or the underside horizontal line and finally ends up consolidating between the help and resistance ranges. This chart sample alerts that the value is more likely to escape to the upside — so it provides a purchase sign.

Listed below are the defining traits of a bullish rectangle:

- Worth consolidation between two horizontal ranges of help and resistance.

- This chart sample is often discovered on the finish of a downtrend.

Bearish Rectangle

A bearish rectangle is the other of the bullish rectangle. It occurs when asset value “will get caught” in between two horizontal ranges of help and resistance. A bearish rectangle often provides a promote sign as it’s a signal that the value is more likely to proceed to fall.

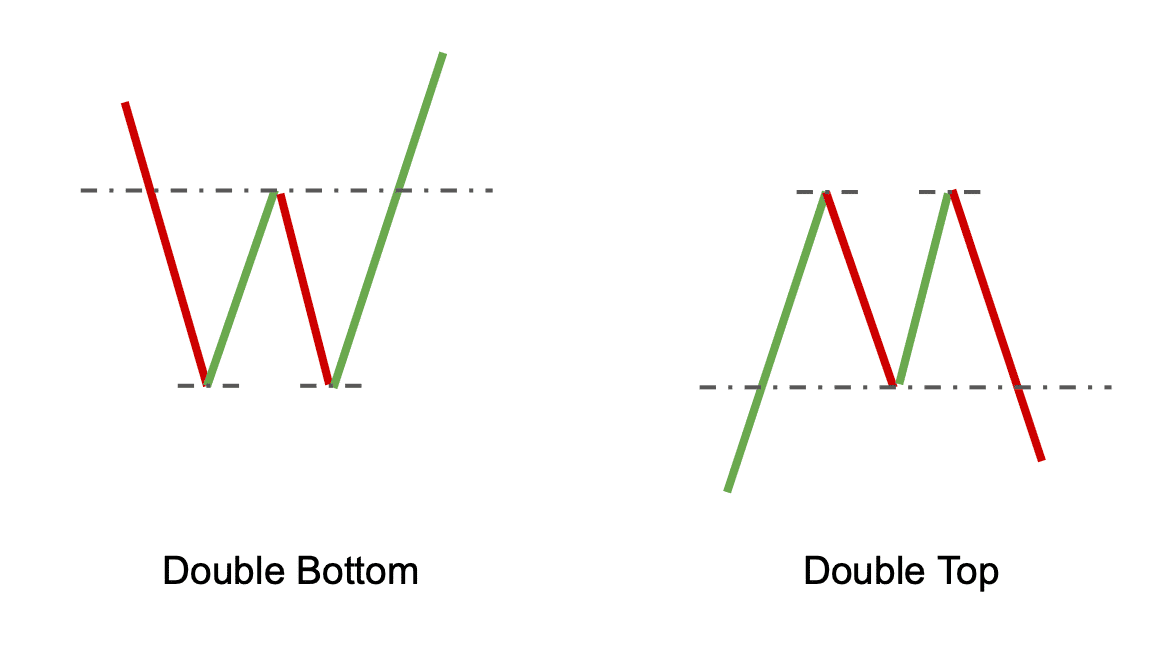

Double High Crypto Sample

A double high is without doubt one of the commonest crypto chart patterns. It’s characterised by the value capturing up twice in a brief time period — retesting a brand new excessive. If it fails to return to that stage and cross over the higher horizontal line, it usually signifies {that a} sturdy pullback is coming. It is a bearish reversal sample that offers a promote sign.

Double Backside Crypto Sample

A double backside is a chart sample that, as will be seen from its identify, is the other of the double high. It happens when the asset value assessments the decrease horizontal stage twice however then pulls again and goes up as a substitute. A double backside often provides a purchase sign as it’s a signal that there’ll probably be an uptrend.

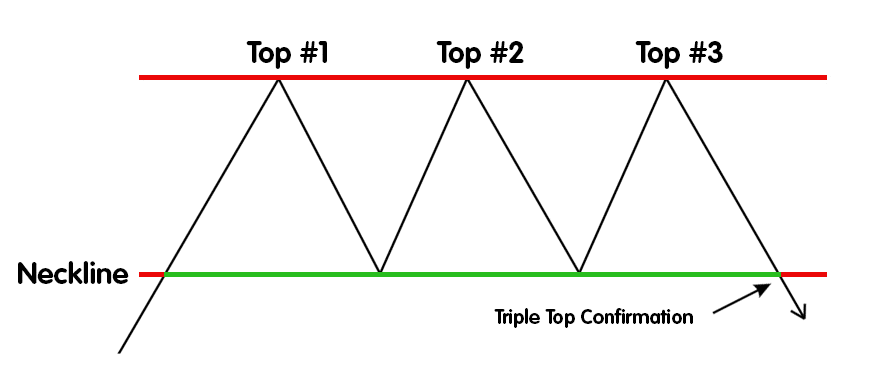

Triple High

The triple high and backside patterns are similar to their “double” counterparts. The triple high additionally happens when the value of an asset assessments the higher horizontal line however fails to cross over it — however for this sample, it occurs thrice. It’s a bearish reversal sample that alerts an upcoming downward development.

Triple Backside

The triple backside crypto chart sample is noticed when asset value reaches a sure stage after which pulls again two occasions earlier than lastly kicking off a bullish development.

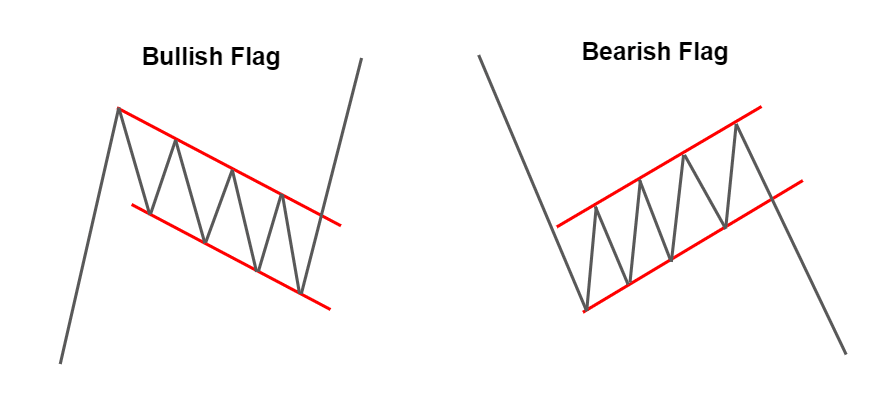

Pole Chart Patterns

Pole chart patterns are characterised by the value of an asset reaching a sure stage after which pulling again earlier than returning to that stage. These patterns get their identify from the “pole” current in them — a speedy upward (or downward) value motion.

Bullish Flag Sample

A bullish flag is a chart sample that happens when the asset value reaches a sure stage after which pulls again earlier than reclaiming that stage. A bullish model of this crypto flag sample often provides a purchase sign as it’s a signal that an uptrend will most likely proceed. You possibly can learn extra about it right here.

Probably the most distinctive factor about this sample is, unsurprisingly, its form: a pole adopted by a flag. Right here’s the way it’s structured:

- Drastic upward value motion

- A short consolidation interval with decrease highs

- A bullish development

Bearish Flag

A bearish flag is the exact opposite of a bullish flag crypto chart sample. It’s fashioned by a pointy downtrend and consolidation with larger highs that ends when the value breaks and drops down. These flags are bearish continuation patterns, so they provide a promote sign. You possibly can be taught extra about them on this article.

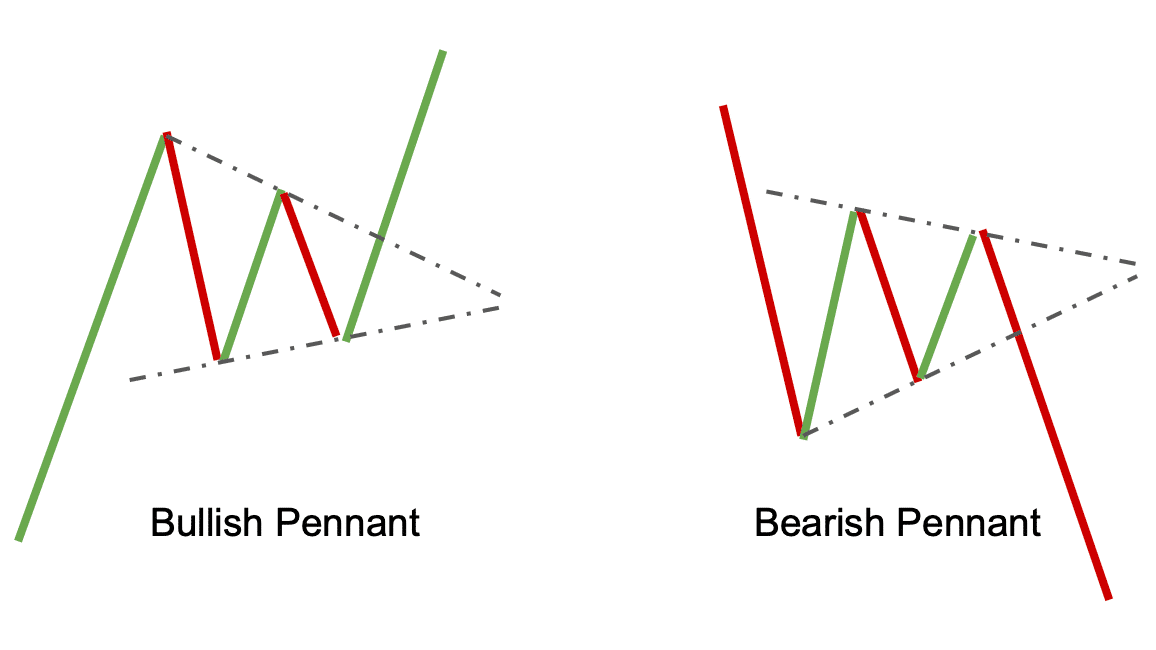

Bullish Pennant

A bullish pennant is a bullish pole chart sample quite just like a bullish flag. It additionally has a pole — a shart uptrend — adopted by a short (or not so temporary) consolidation, after which a continued uptrend. In contrast to the flag, nonetheless, its consolidation interval is formed like a triangle: it has larger lows and decrease highs. It provides a purchase sign.

Bearish Pennant

A bearish pennant is, naturally, the other of a bullish pendant. Its pole is a pointy downward value motion, and it’s adopted by a value lower. It provides a promote sign.

Pennants are additionally outlined by buying and selling quantity: it needs to be exceptionally excessive throughout the “pole” after which slowly whittle down throughout consolidation. They often final between one and 4 weeks.

Different Chart Buying and selling Patterns

There are additionally a number of different chart patterns that you would be able to search for when buying and selling cryptocurrencies. Listed below are a couple of of the most typical ones.

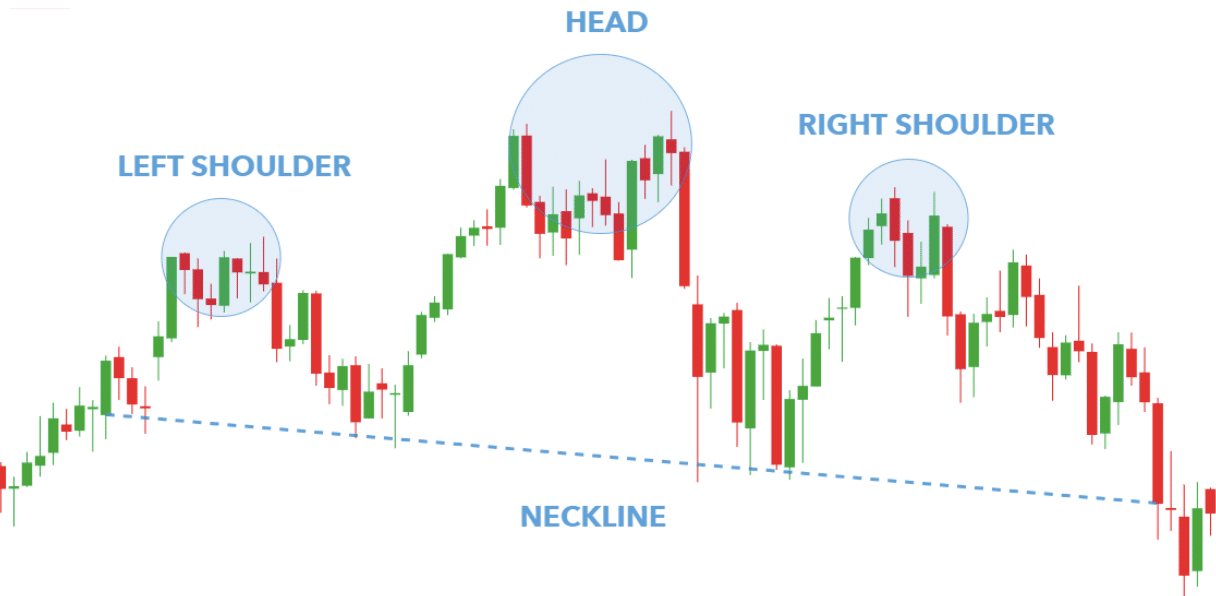

Head and Shoulders Crypto Graph Patterns

Chart evaluation is without doubt one of the greatest instruments in buying and selling crypto. Right here’s the way to determine a head and shoulders sample.

A extra superior chart sample, the top and shoulders chart sample, happens when the value of an asset reaches a sure stage after which pulls again earlier than retaking that stage. This chart sample will be both bullish or bearish, relying on the place it happens out there cycle.

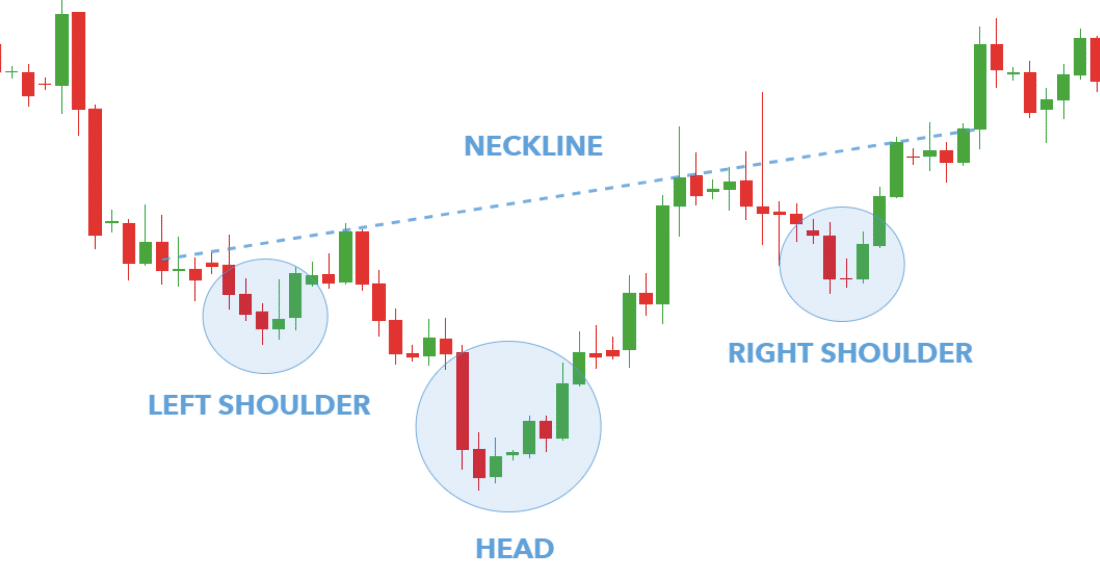

Inverted Head and Shoulders

One of many extra superior technical evaluation patterns, inverted head and shoulders, needs to be used with different indicators earlier than taking a place.

The inverted head and shoulders chart sample is created when the value of an asset reaches a sure stage after which pulls again earlier than reaching that stage once more. This chart sample is often bullish and offers a purchase sign as it’s a signal that an uptrend will most likely proceed. Identical to the identify suggests, it’s the inverted model of the normal head and shoulders sample.

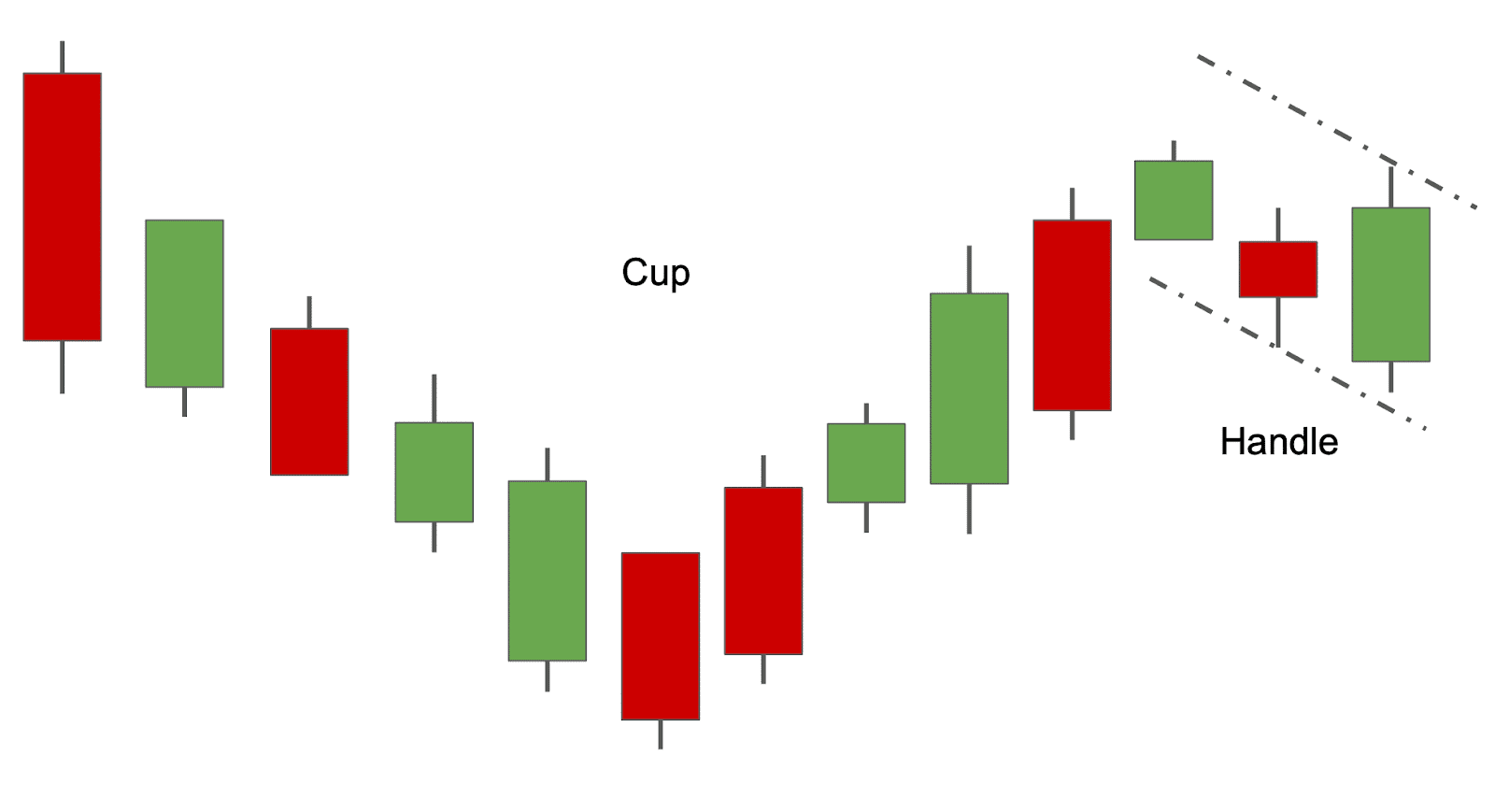

Cup and Deal with

The cup and deal with is a sample that may be noticed when the value of an asset reaches a sure stage after which pulls again earlier than reclaiming that stage. It’s named like that as a result of it really seems to be like a cup.

This chart formation is sometimes called the bullish reversal sample. Nevertheless, it can provide both a bullish or a bearish sign — all of it depends upon what level of the cycle it’s seen in.

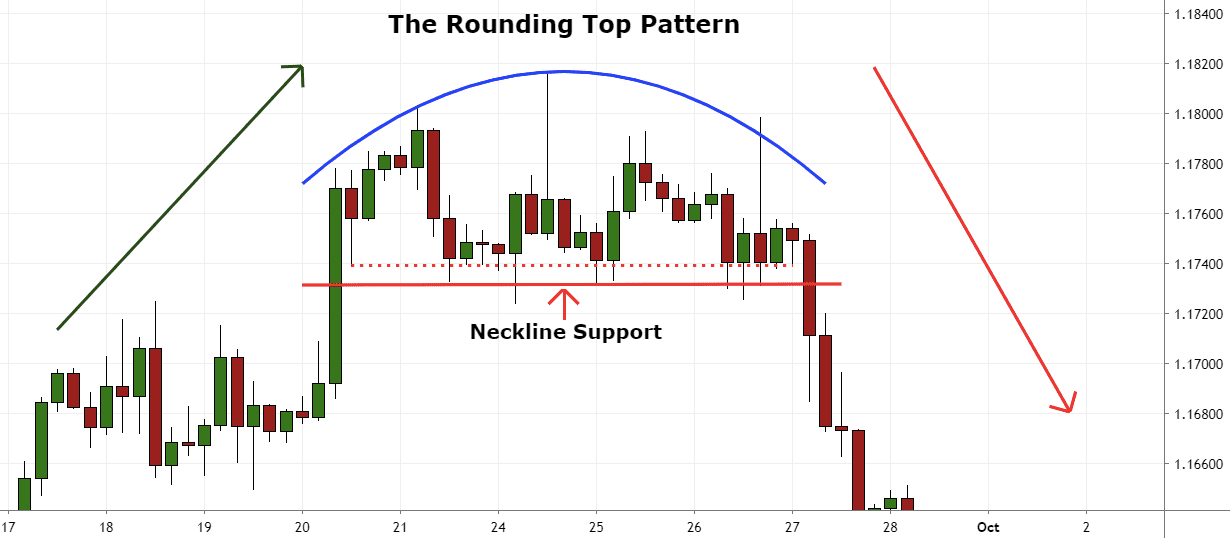

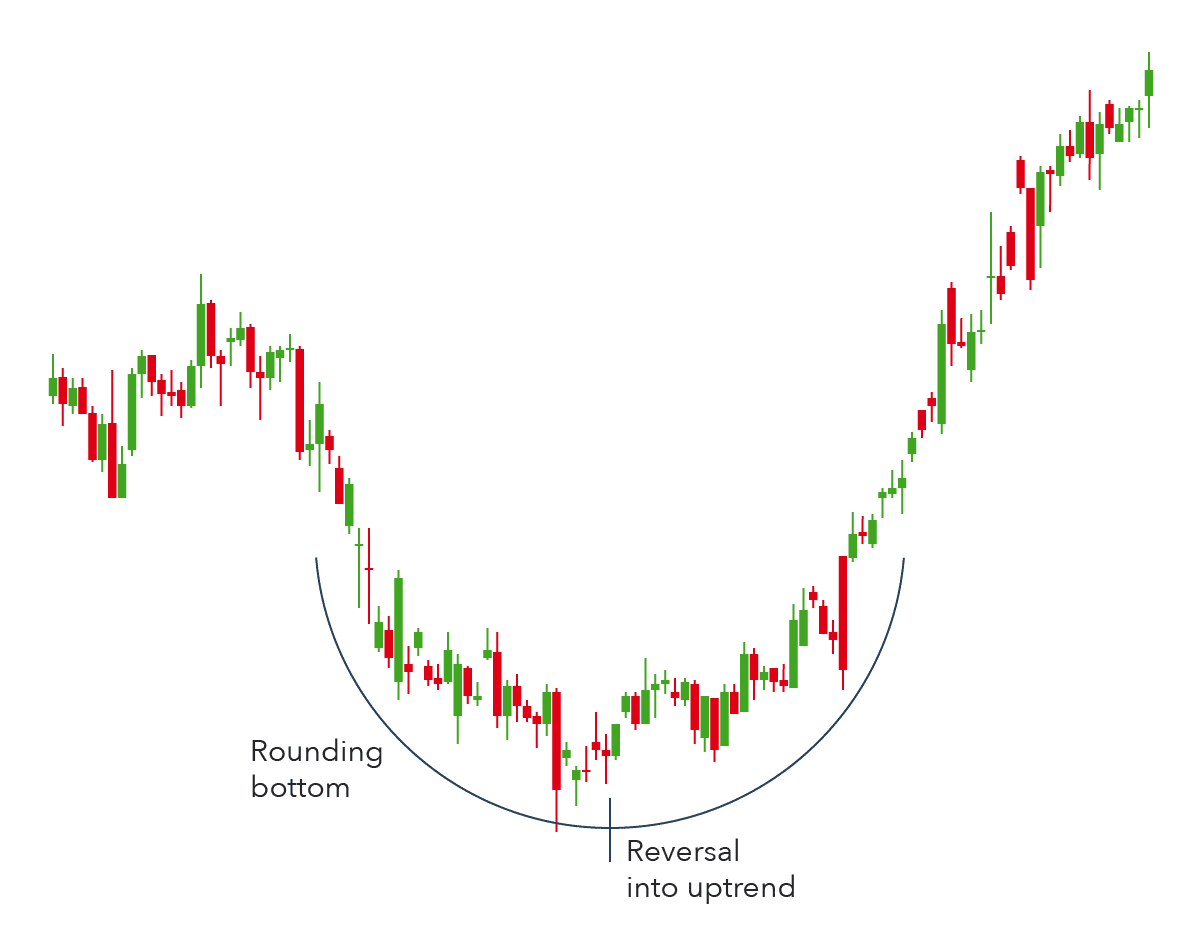

Rounded High and Backside Crypto Chart Sample

The rounded high and backside chart sample seems when the value of an asset reaches a sure stage after which pulls again earlier than retaking that stage. This chart sample will be both bullish or bearish, relying on the place it happens out there cycle.

This crypto chart sample usually happens proper earlier than a development reversal. The “high” sample alerts a doable bearish reversal, creating a possible shorting alternative. The “backside” sample is the other and sometimes precedes a reversal from a downward development to an upward one.

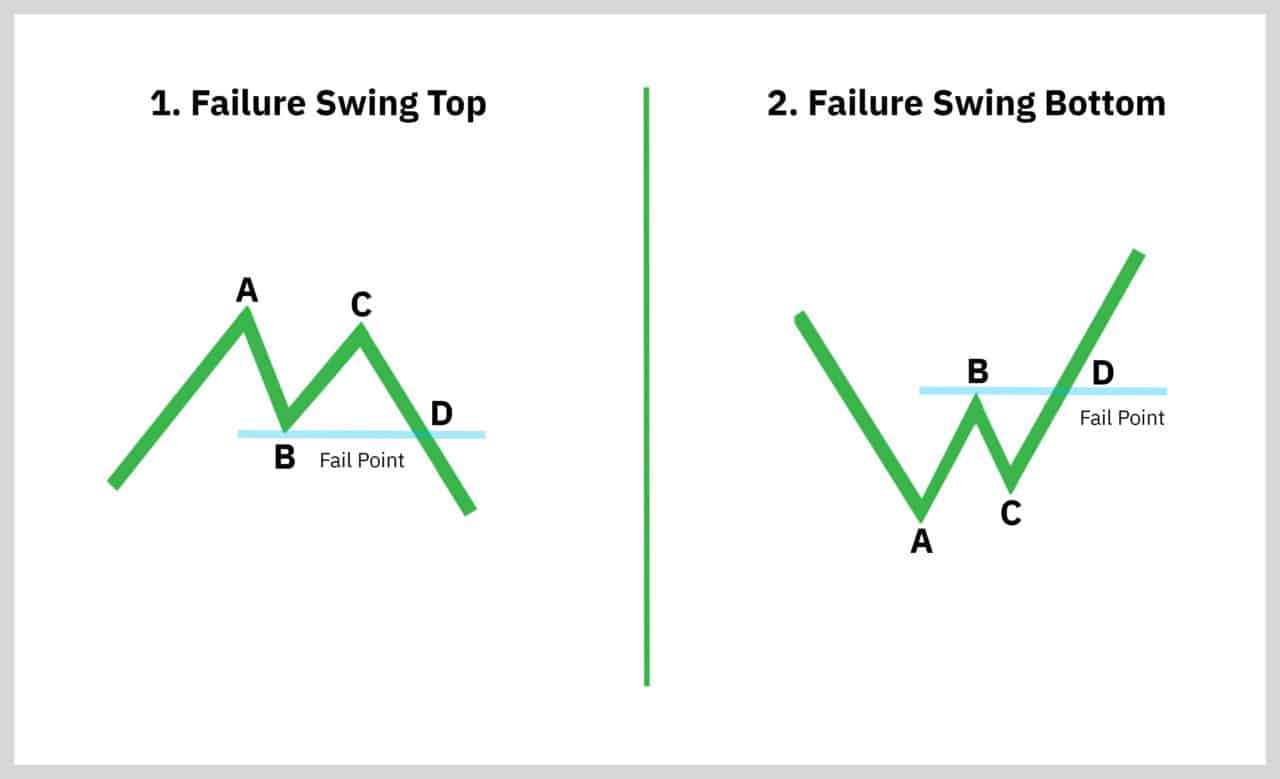

The Failure Swing Buying and selling Crypto Chart Sample

The failure swing chart sample occurs if the asset value reaches a sure stage after which pulls again earlier than reaching that stage once more. Widespread failure chart patterns usually contain development traces, similar to breakouts earlier than a fail level, or descending triangles. When these patterns seem on charts, they might point out {that a} reversal or pullback is due; nonetheless, false alerts can happen if the underlying circumstances or fundamentals don’t help the formation of the sample.

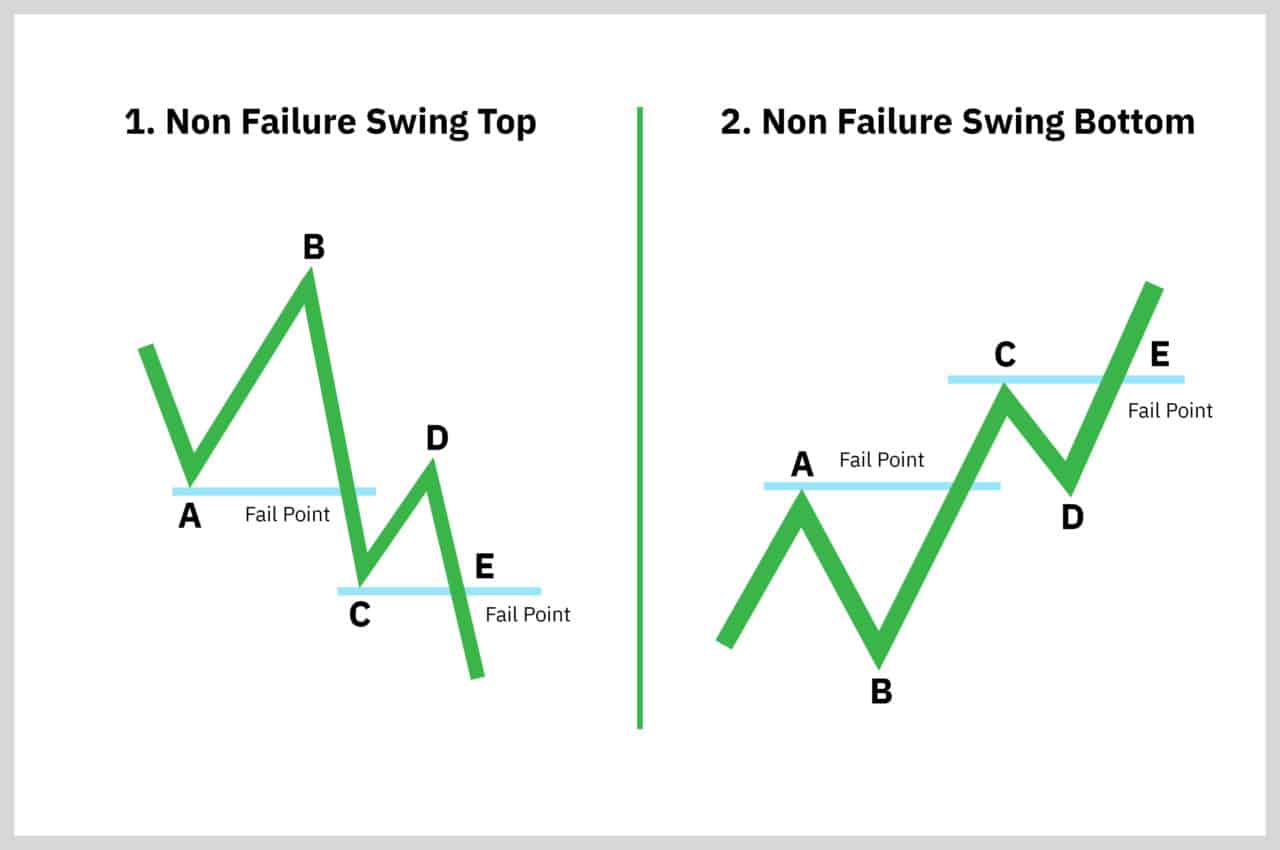

Non-failure swing chart patterns are just like failure swing charts, however they contain the second peak staying above the primary one (an upward continuation). Non-failure swings can point out sturdy traits and sustained value actions. One ought to have a look at each varieties of patterns together with different market indicators to validate their accuracy.

How you can Commerce Crypto Utilizing Chart Patterns

So, you’ve noticed a sample on a crypto chart. What must you do subsequent? Whereas the crypto market strikes quick and waits for nobody, it’s sensible to heed the recommendation of seasoned merchants and take a radical method to maximise the advantages of your chart sample.

To take advantage of out of chart patterns in crypto buying and selling, take note of these important points:

- Worth Motion: Observe whether or not there are larger highs or decrease lows, which may point out the energy of a development.

- Assist and Resistance Ranges: These are important areas the place the value might stall or reverse.

- Development Stage: Decide whether or not the development is at its starting, center, or finish to raised gauge potential strikes.

Listed below are different important tricks to improve your buying and selling technique:

- Be sure that the chart sample is legitimate. Because of this it ought to meet the entire standards we mentioned earlier on this article.

- Look ahead to a affirmation sign earlier than coming into a commerce. A affirmation sign is one thing like a breakout or a candlestick sample.

- Make the most of technical indicators. They might help crypto merchants determine potential entry and exit factors, in addition to decide the general development out there.

- Take note of totally different time frames. Brief-term merchants might deal with hourly or day by day charts, whereas long-term traders might have a look at the larger image — weeks or months.

- Have a correct risk-reward ratio. Because of this your potential income needs to be larger than your potential losses.

- Have a plan for exiting the commerce. This consists of setting a revenue goal and a stop-loss order.

If you’re an skilled dealer or have a higher-than-average danger urge for food, you possibly can attempt to commerce patterns earlier than the affirmation. Nevertheless, please do not forget that it’s extremely dangerous — to not point out insanely onerous. Whereas these patterns are straightforward to determine looking back, they are often not-so-easy to note when they’re simply occurring. In fact, ыщьу instruments and indicators (and even bots) might help with that, and you’ll get higher at catching them as you follow extra, however they’ll nonetheless be extremely treacherous.

Crypto Chart Sample Success Price

There are various totally different chart patterns that you should use to commerce crypto, however not all of them are equally efficient.

Some chart patterns have the next success price than others. For instance, the top and shoulders sample has successful price of about 70%. Then again, the cup and deal with sample has successful price of about 80%.

It’s vital to notice that the success of those patterns will be influenced by a number of elements:

- Chart Timeframe: Patterns on longer timeframes are typically extra dependable than these on shorter ones.

- Sample Sort: Continuation patterns may carry out otherwise in bull markets in comparison with bear markets.

- Exterior Elements: Black swan occasions, sudden information releases, and main bulletins can closely influence market circumstances, usually disrupting established patterns.

Due to this fact, whereas chart patterns generally is a helpful instrument for merchants, they need to be used at the side of a complete understanding of the general crypto market, particularly in day buying and selling, the place market sentiment can shift quickly. Correct danger administration and technique alignment are important to maximise their effectiveness.

On the finish of the day, what issues most is utilizing the patterns that suit your buying and selling technique greatest, in addition to using correct danger administration.

Threat Administration

Threat administration is extremely vital in the case of buying and selling crypto chart patterns. Regardless of how good or outstanding the chart sample is, issues can all the time go mistaken. So, it’s essential to have a strong danger administration technique in place earlier than you begin buying and selling and modify it accordingly. Listed below are some issues to remember:

- Set a cease loss. That is most likely an important factor you are able to do by way of danger administration. A cease loss will assist you to restrict your losses if the commerce goes towards you.

- Use a take revenue goal. A take revenue goal will assist you to lock in income if the commerce goes in your favor.

- Use a trailing cease. A trailing cease is an effective way to guard your income as a result of it should routinely promote your place if the value begins to fall.

- Handle your place dimension. Place dimension additionally issues. You don’t need to danger an excessive amount of of your account on one commerce.

Hedging can also be an vital idea to know when buying and selling chart patterns. It includes opening a place in a single asset to offset the danger related to one other asset.

For instance, let’s say you’re lengthy on BTC, and also you’re apprehensive a few potential market crash. You would hedge your place by going brief in altcoins. This manner, if the market does crash, your losses might be offset by your good points in altcoins.

These are just some issues to remember in regard to danger administration when buying and selling chart patterns. For those who can grasp danger administration, you’ll be effectively in your solution to success as a dealer.

FAQ

Do chart patterns work for crypto?

Sure, chart patterns will be extraordinarily helpful for buying and selling crypto. They will not be 100% dependable, however they’ll undoubtedly assist you to make extra knowledgeable buying and selling choices.

As with every different asset on the market, combining chart patterns with different types of technical and elementary evaluation gives a extra complete buying and selling technique. This combine might help mitigate the dangers related to deceptive alerts from any single technique.

What’s the greatest sample for crypto buying and selling?

There’s nobody “greatest” sample for buying and selling cryptocurrencies as a result of it actually depends upon what works greatest for you. Nevertheless, if you happen to’re simply beginning out, it’s a good suggestion to deal with easier patterns which are simpler to identify and have a tendency to work effectively. Some good ones embrace Horizontal Resistance, Ascending Triangle, Channel Down, Falling Wedge, and Inverse Head and Shoulders. These patterns might help you determine when to purchase and are usually extra dependable, which may make buying and selling a bit much less daunting for newbies.

What technical evaluation instruments are one of the best for cryptocurrency buying and selling?

There are a couple of technical evaluation instruments that may be actually helpful for cryptocurrency buying and selling. A number of the hottest ones embrace:

- Shifting Common (MA)

- Bollinger Bands

- Relative Power Index (RSI)

- MACD indicator

How you can catch a crypto pump?

Predicting a crypto pump is not any straightforward process, however there are some things you possibly can look out for which will provide you with some clues. These embrace:

- Elevated social media exercise

- Frequent occurrences of FOMO in the neighborhood

- Pump and dump teams

- Uncommon buying and selling exercise on exchanges

What number of chart patterns are there in crypto?

Loads of chart patterns that can be utilized in crypto buying and selling. In technical evaluation, whose fundamentals work for all monetary markets, there are about 30 formations. These embrace head and shoulders, double tops and bottoms, triangles, wedges, flags and pennants, cups and handles, channels, and ranges. Every sample has its personal distinct traits and can be utilized to determine potential entry or exit factors to make worthwhile buying and selling choices. Totally different crypto patterns will work higher relying on the asset, so it is crucial for traders to know the way every chart sample applies to their particular state of affairs.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.