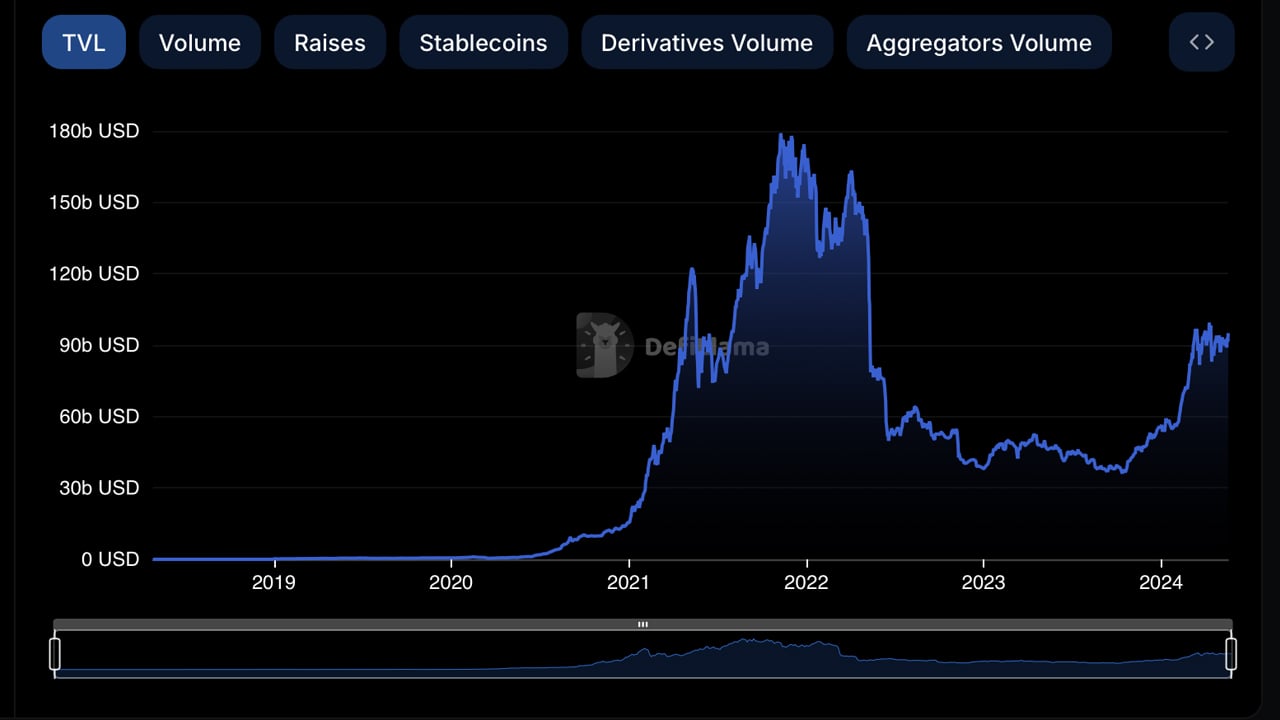

Over the previous 35 days, the whole worth locked in decentralized finance (defi) protocols has expanded by $11.89 billion, recovering from a low of simply over $83 billion on April 13. Though it has not but reached the $100 billion mark, the worth locked in defi is approaching that milestone after hovering slightly below it.

Defi Protocols See $11.89B Enhance

As of Could 18, 2024, the whole worth locked (TVL) in defi stands at $94.93 billion, in keeping with stats from defillama.com. This is a rise of $11.89 billion from the $83.04 billion low recorded 35 days prior. Among the many high 5 protocols by TVL, Eigenlayer skilled the biggest 30-day enhance, with TVL rising by 19.67%.

Whole worth locked in defi on Could 18, 2024, in keeping with defillama.com metrics.

Lido Finance, the biggest defi protocol by TVL measurement, noticed a modest enhance of 1.49% over the 30-day run. Bitcoin.com Information has reported on liquid staking derivatives functions witnessing important withdrawals in current weeks.

Nonetheless, Lido dominates the TVL of $94.93 billion by holding $29.21 billion in worth on Could 18, 2024. Eigenlayer’s TVL in the present day is $15.39 billion and between each Lido and Eigenlayer, the duo’s TVL represents 46.98% of your entire TVL in defi. The remainder of the highest 5 members noticed 30-day will increase as Aave’s TVL spiked by 9.21%, Makerdao’s locked worth elevated by 7.95% and the lending protocol Justlend elevated by 4.96%.

Different notable gainers included Etherfi with 28.91%, and Zircuit Staking with 74.61%. Jito noticed a 31.84% enhance and Marinade Finance expanded by 16.37%. Perfectswap noticed a debilitating 30-day discount of 100% as did eight different defi protocols. Whereas defi continues its regular restoration, with the whole worth locked inching nearer to the numerous $100 billion milestone, it might mirror renewed confidence on this dynamic sector of the cryptocurrency ecosystem.

What do you consider the current motion on this planet of defi and the TVL inching its manner towards $100 billion? Share your ideas and opinions about this topic within the feedback part under.