Cryptocurrency buying and selling is usually a roller-coaster journey, with costs hovering to new heights one second and plummeting the very subsequent. Amidst this volatility, one fixed stays essential for merchants: understanding their Revenue and Loss (PnL).

On this article, we’ll dive deep into what PnL means, calculate it, and why each dealer wants to know it. By the tip of this information, you’ll have a strong grasp of PnL and be higher outfitted to make knowledgeable buying and selling choices.

What Is Revenue and Loss?

PnL, or Revenue and Loss, is a crucial monetary metric that quantifies the online revenue or lack of a person or firm over a selected interval. It may possibly function an important device for measuring monetary efficiency and assessing the viability of enterprise methods.

PnL might be categorized into two sorts: Realized PnL and Unrealized PnL. By monitoring each Realized and Unrealized PnL, merchants and enterprise homeowners can higher strategize their monetary actions, making certain they maximize internet revenue whereas minimizing dangers.

Realized PnL

Realized Revenue and Loss (RPnL) is a crucial facet of monetary efficiency measurement. Instantly indicating the profitability of buying and selling actions or funding methods, it refers back to the features or losses which were formally “realized” when an asset is purchased or bought.

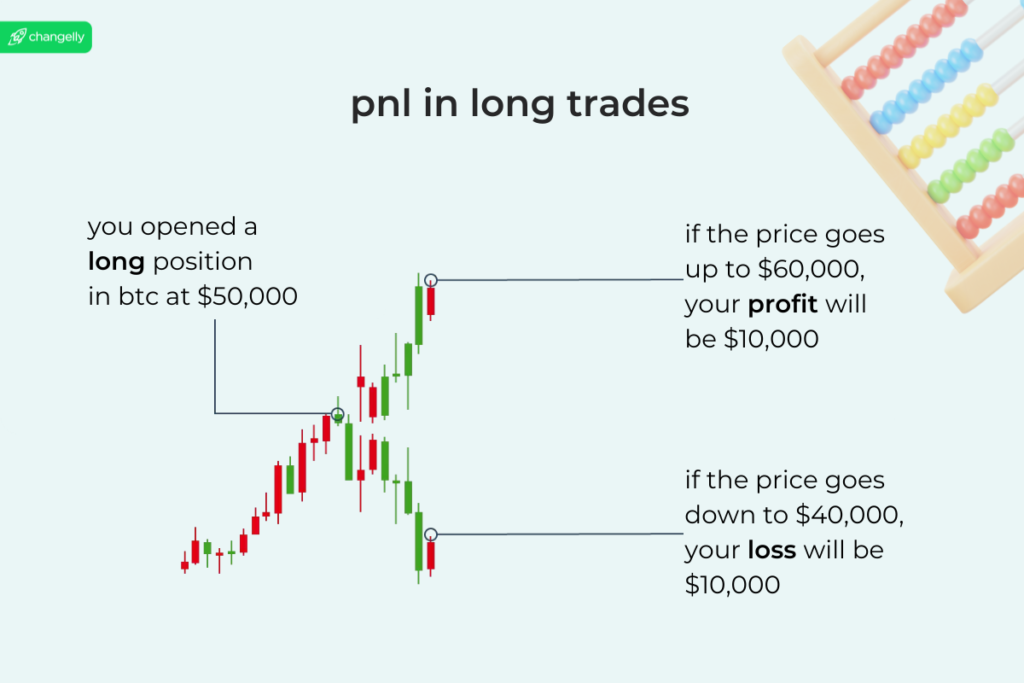

Instance of PnL calculation in a protracted commerce

Executing a protracted commerce entails buying a cryptocurrency with the expectation that its worth will improve over time. The important thing steps embody deciding on a crypto asset, figuring out an entry value, and planning an exit value the place you’ll promote for a revenue.

Suppose you purchase 1 BTC at an entry value of $50,000 — this might be your opening value. Later, you determine to promote it when the worth reaches $60,000 — this might be your closing value. Your complete funding is $50,000, and your complete income from the sale is $60,000.

The realized revenue from this commerce is calculated utilizing the Revenue and Loss (PnL) method:

Realized Revenue = Whole Income – Whole Funding = $60,000 – $50,000 = $10,000

As soon as the commerce is closed, you’ve concretely realized a revenue primarily based on the entry and exit costs, unaffected by future value actions.

Instance in a brief commerce

In a brief commerce, merchants borrow cryptocurrency and promote it on the present market value, anticipating the worth to say no to allow them to purchase it again at a decrease value. This technique permits merchants to revenue from falling markets however carries dangers if costs rise.

Suppose a dealer borrows and sells 1 ETH at an entry value of $2,500. If the market value drops to $2,000, the dealer buys again the ETH at this exit value. The realized revenue is calculated as follows:

Realized Revenue = Entry Worth – Exit Worth = $2,500 – $2,000 = $500

Conversely, if the worth rises to $3,000, the dealer faces a realized loss:

Realized Loss = Exit Worth – Entry Worth = $3,000 – $2,500 = $500

Leveraged Commerce

A leveraged commerce permits merchants to borrow cash from an change to amplify their shopping for energy, letting them handle a bigger buying and selling place than they might with their very own capital. This elevated leverage can lead to increased potential earnings, however it additionally comes with dangers, together with borrowing prices and transaction charges that may erode earnings.

Suppose you utilize 3x leverage to purchase 1 BTC at $30,000 (successfully controlling $90,000 value of BTC), and the worth rises to $35,000. Your revenue calculation is as follows:

- Whole Worth of Place = 1 BTC × $35,000 = $35,000

- Preliminary Funding = $30,000 / 3 = $10,000

- Revenue = (35,000 – 30,000) × 3 = $15,000

Nonetheless, if the worth drops to $25,000, your loss calculation is:

Loss = (30,000 – 25,000) × 3 = $15,000

In leveraged trades, whereas leverage can enlarge features, it additionally amplifies losses, so understanding the related prices of this buying and selling technique is essential for efficient danger administration.

Unrealized PnL

Unrealized Revenue and Loss (UPnL) affords insights into potential features or losses on open positions — the features or losses that haven’t been realized but via the sale of an asset. This metric can play a major position in portfolio administration and monetary evaluation, because it offers traders and HODLers with a snapshot of the present market worth of their holdings towards their preliminary funding.

Right here’s an instance:

Suppose you got 1 ETH at $2,000 and it’s now buying and selling at $2,500. Your unrealized PnL is $500 (excluding charges). This revenue is taken into account unrealized since you haven’t bought the ETH but. If the worth drops earlier than you promote, your unrealized features may disappear.

The right way to Calculate P&L in Crypto?

Although we now have already checked out examples of PnL calculating, this metric might be evaluated otherwise. Listed here are some widespread strategies utilized in crypto buying and selling:

First-in, First-out (FIFO) Methodology

The FIFO methodology assumes that the primary belongings you buy are the primary ones you promote.

For instance, should you purchased 1 BTC on the preliminary value of $30,000 and one other at $32,000, after which bought 1 BTC at $35,000, your realized PnL can be $5,000 utilizing FIFO.

Execs:

- Displays the pure stream of stock and belongings.

- Usually aligns with precise buying and selling practices.

- Simpler to trace and handle for tax functions.

Cons:

- May end up in increased taxable earnings in periods of rising costs.

- Won’t mirror the latest market situations.

Greatest for:

Merchants preferring a simple methodology that aligns with their typical buying and selling methods and wish to reduce complexity in record-keeping.

Final-in, First-out (LIFO) Methodology

The LIFO methodology assumes that the final belongings you buy are the primary ones you promote. Utilizing the identical instance, should you promote 1 BTC at $35,000, your realized PnL can be $3,000 utilizing LIFO.

Execs:

- Can decrease taxable earnings in periods of rising costs.

- Displays more moderen market situations.

Cons:

- Not allowed in some jurisdictions for tax functions.

- May be extra advanced to handle and observe.

Greatest for:

Merchants in jurisdictions the place LIFO is allowed and people who wish to mirror more moderen market situations of their PnL calculations.

Weighted Common Value Methodology

The weighted common value methodology averages the price of all belongings to calculate PnL. For those who purchased 1 BTC at $30,000 and one other at $32,000, your common value can be $31,000. Promoting 1 BTC at $35,000 would offer you a realized PnL of $4,000.

Execs:

- Smooths out value fluctuations over time.

- Supplies a balanced view of asset prices.

Cons:

- May be advanced to calculate manually.

- Could not mirror essentially the most advantageous value foundation for capital features tax functions.

Greatest for:

Merchants on the lookout for a balanced and averaged strategy to calculating PnL; might be particularly helpful for these with giant, numerous portfolios.

Yr-to-Date (YTD) Calculation

YTD calculation tracks PnL from the start of the 12 months to the present date. This methodology helps merchants see their general efficiency all year long. For those who began with $50,000 and your portfolio is now value $70,000, your YTD PnL is $20,000.

Execs:

- Supplies a transparent view of efficiency over a selected interval.

- Helpful for annual efficiency assessments and reporting.

Cons:

- Doesn’t account for particular person commerce specifics.

- May be much less helpful for day-to-day buying and selling choices.

Greatest for:

Lengthy-term traders and merchants who wish to assess their efficiency over a selected interval, sometimes for annual reporting or private analysis.

PnL Proportion

PnL proportion exhibits the proportion acquire or loss relative to the preliminary funding. This metric helps evaluate the efficiency of various trades or portfolios.

For instance, should you invested $10,000 and your PnL is $1,000, the PnL proportion is calculated as follows:

PnL Proportion = (PnL / Preliminary Funding) × 100 = (1,000 / 10,000) × 100 = 10%

This proportion helps you perceive the effectivity of your funding.

PnL Ratio

PnL ratio compares the magnitude of your earnings to your losses. This ratio helps merchants assess their risk-reward efficiency.

In case your complete earnings are $5,000 and your complete losses are $2,000, your PnL ratio is calculated as follows:

PnL Ratio = Whole Income / Whole Losses = 5,000 / 2,000 = 2.5

The next PnL ratio signifies higher efficiency, because it exhibits you’re making extra earnings in comparison with your losses.

Further Ideas

Listed here are some expanded ideas and sources that will help you navigate this advanced panorama extra successfully:

Frequent Errors to Keep away from

- Ignoring Charges: Transaction charges can eat into your earnings or exacerbate your losses if not correctly accounted for. Each commerce, whether or not a purchase or promote, incurs a price charged by the change. These charges can fluctuate considerably between exchanges and even between various kinds of trades (e.g., spot buying and selling vs. futures buying and selling). At all times embody these prices when calculating your PnL. For instance, should you’re buying and selling incessantly, even small charges can add as much as a considerable quantity over time, impacting your internet profitability.

- Not Monitoring Trades: Correct record-keeping is crucial for exact PnL calculations and for assembly tax obligations. Preserve an in depth log of all of your trades, together with dates, portions, costs, and any charges paid. This follow not solely helps in calculating your realized and unrealized PnL precisely but additionally ensures compliance with tax rules. Many merchants use spreadsheets or specialised software program to maintain their data organized and accessible.

- Overleveraging: Whereas leverage can amplify your earnings, it additionally considerably will increase your danger. Buying and selling with excessive leverage implies that even a small opposed value motion can lead to substantial losses, doubtlessly wiping out your funding. It’s essential to know the dangers concerned and to make use of leverage judiciously. Think about setting strict limits on the quantity of leverage you utilize and at all times concentrate on the potential for margin calls if the market strikes towards you.

Instruments and Assets

- Portfolio Trackers: Guide PnL monitoring might be tedious and error-prone, particularly should you commerce incessantly or throughout a number of exchanges. Automated buying and selling bots and portfolio monitoring instruments like CoinTracker or Delta can simplify this course of. These instruments mechanically import your commerce knowledge, calculate your PnL, and supply real-time insights into your portfolio’s efficiency. They’ll additionally enable you to analyze your buying and selling patterns and establish areas for enchancment.

- Tax Software program: Crypto tax software program like CoinTracker or CryptoTrader.Tax can streamline the method of calculating your tax obligations. These instruments combine with main exchanges to import your commerce historical past and generate correct tax experiences. They’ll deal with advanced situations like margin buying and selling, staking rewards, and airdrops, making certain that you just stay compliant with tax legal guidelines and keep away from any disagreeable surprises throughout tax season.

- Schooling: The cryptocurrency market is continually evolving, and staying knowledgeable is essential to sustaining a aggressive edge. Make investments time in educating your self via blogs, on-line programs, and boards. Taking part in on-line communities and boards akin to Reddit’s r/cryptocurrency or Bitcointalk also can present precious insights and let you be taught from the experiences of different merchants.

Subscription to our e-newsletter is one easy method to keep forward of the curve in crypto.

By following the following tips and using the beneficial instruments, you’ll be able to successfully observe your PnL and make extra knowledgeable buying and selling choices. The world of cryptocurrency buying and selling might be difficult, however with the best strategy and sources, you’ll be able to navigate it efficiently. Comfortable buying and selling!

Conclusion

Understanding PnL in crypto buying and selling is crucial for making knowledgeable choices. The strategies mentioned on this article can assist you precisely observe your buying and selling efficiency and optimize your methods. Keep in mind, crypto markets are unstable, and consciousness of your PnL can assist you navigate the ups and downs extra successfully.

Disclaimer: Please observe that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.