Decentralized finance’s (DeFi) use case in conventional finance may develop within the coming years as new protocols try and assist the securitization of real-world property, based on a brand new analysis report from credit standing company S&P World Scores.

The financing of real-world property, or RWAs, will probably be a key focus space for DeFi protocols transferring ahead, S&P stated in a report titled “DeFi Protocols For Securitization: A Credit score Danger Perspective.” Though the trade remains to be in its nascent levels, S&P highlighted a number of advantages DeFi may convey to securitization, together with decreasing transaction prices, enhancing transparency on asset swimming pools, decreasing counterparty dangers and enabling sooner fee settlement for buyers.

“The early growth of DeFi centered totally on purposes offering monetary providers inside the crypto ecosystem, equivalent to lending collateralized by crypto property, funding instruments for crypto property, and crypto buying and selling platforms,” analysts Andrew O’Neill, Alexandre Birry, Lapo Guadagnuolo and Vanessa Purwin wrote, including:

“These preliminary use circumstances had been broadly disconnected from the actual economic system. The financing of RWAs has emerged as a theme within the DeFi house, with lending protocols providing loans originated within the conventional manner, based mostly on borrower underwriting quite than backed by crypto property pledged as collateral.”

DeFi securitizations aren’t with out dangers, nonetheless. S&P recognized authorized and operational dangers related to their issuance, in addition to the potential for a mismatch between fiat currency-denominated property and digital foreign money liabilities. Addressing these dangers may very well be the distinction between a strong DeFi securitization trade and one failing to draw curiosity from conventional finance.

S&P World Scores is among the massive three score companies on Wall Avenue. Whereas the corporate is researching DeFi protocols, it doesn’t presently price any initiatives.

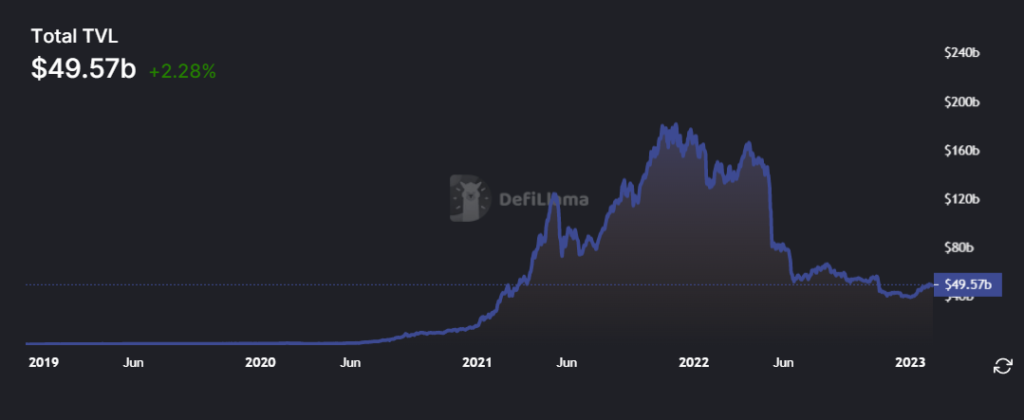

The DeFi trade rose to prominence in mid-2020 because the promise of upper yields and simpler entry to credit score markets attracted crypto-native buyers. In accordance with most metrics, DeFi exercise peaked within the third quarter of 2021 — in November of that yr, the entire worth locked (TVL) on DeFi platforms eclipsed $180 billion.

Associated: Fractional NFTs and what they imply for investing in real-world property

Asset tokenization, or the method of issuing safety tokens representing actual tradeable property, has lengthy been considered as a viable use case for blockchain know-how. In accordance with Ernst & Younger, tokenization creates a bridge between real-world property and their accessibility in a digital world with out intermediaries. The consulting company believes tokenization can “present liquidity to in any other case illiquid and non-fractional markets.”