Lending protocol Aave has frozen stablecoin buying and selling and set the loan-to-value (LTV) ratio to zero in response to latest value volatility on stablecoins after USD Coin (USDC) depegged on March 11.

In response to Aave’s governance discussion board, the buying and selling freeze follows an evaluation from decentralized finance danger administration firm Gauntlet Community, recommending that every one v2 and v3 markets needs to be quickly paused.

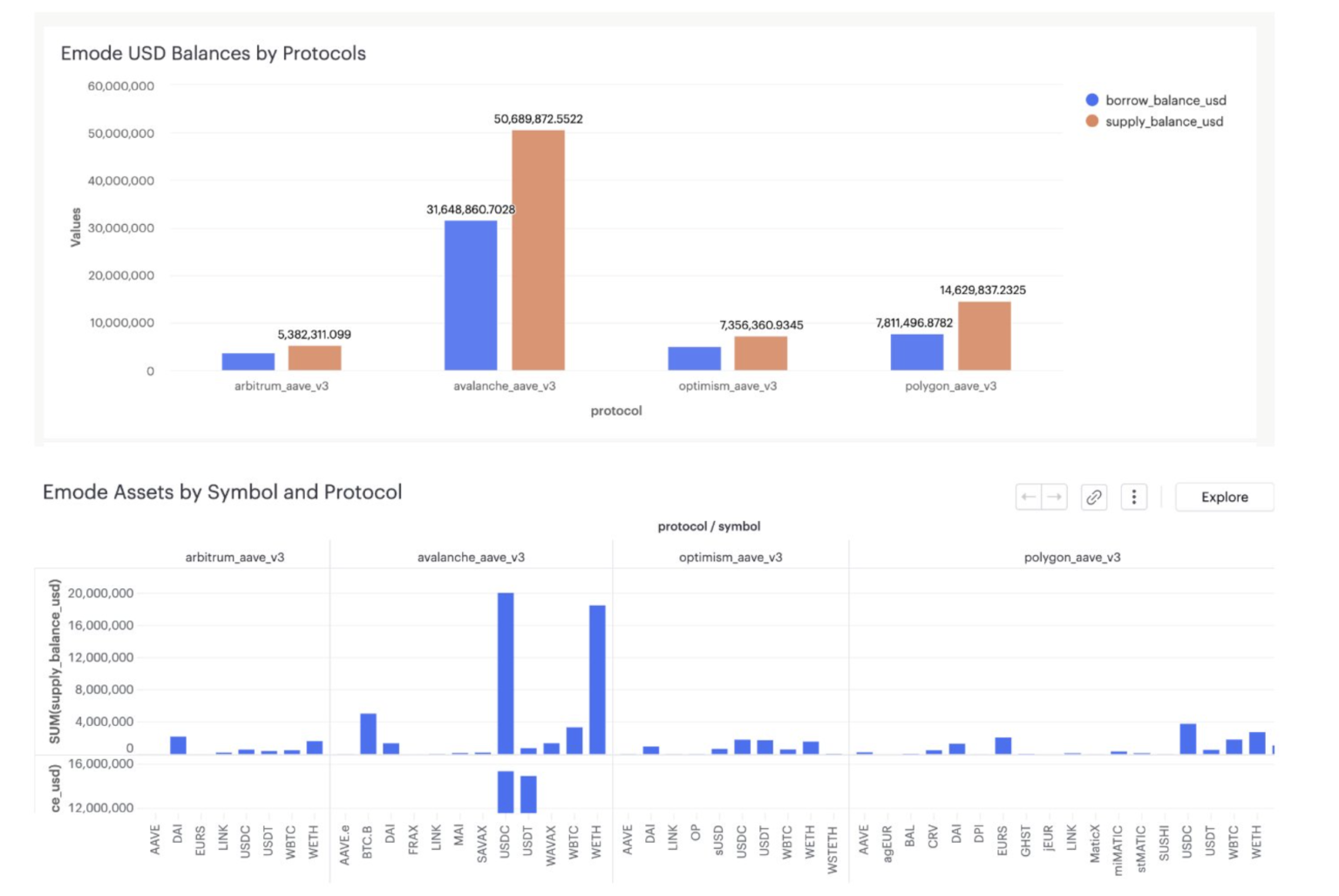

“Setting LTV to 0 undoubtedly helps all over the place, however on the Avalanche v3 Pool, on condition that cross-chain infrastructure doesn’t cowl Avalanche, the Aave Guardian can act instantly. Setting LTV to 0 in practise reductions the “borrowing energy” of the asset, with out affecting the HF of any person place,” famous one participant within the discussion board dialogue.

LTV is a vital metric figuring out how a lot credit score you may safe utilizing crypto as collateral. Expressed as a share, the ratio is calculated by dividing the quantity of credit score borrowed by the worth of the collateral.

Gauntlet’s danger evaluation examined the variety of insolvencies that may happen below completely different eventualities, contemplating that the worth of USDC stabilizes, recovers or declines considerably:

“V3 emode assumes correlation of stablecoin belongings, however presently, these correlations have diverged. The chance has elevated on condition that the liquidation bonus is only one% for USDC on emode. To account for these assumptions that now not stay true, we advocate pausing the markets. […] At present costs, insolvencies are ~550k. These can change relying on the worth trajectory and additional depegs.“

Centralized crypto exchanges have seen a surge in buying and selling quantity prior to now hours following the Silicon Valley Financial institution (SVB) collapse on March 10, based on digital belongings information supplier Kaiko.

Two massive $USDC markets on exchanges seeing heavy promote stress and large volumes in final 24 hours

Regardless of loads of reassurance on crypto twitter, most traders nonetheless promoting USDC at a giant low cost pic.twitter.com/W9uy2HHax4

— Conor Ryder (@ConorRyder) March 11, 2023

SVB was shut down by the California Division of Monetary Safety and Innovation on March 11 after a financial institution run triggered by the financial institution’s newest monetary studies, which confirmed it had offered a big chunk of securities value $21 billion — at a lack of about $1.8 billion. The California watchdog additionally appointed the Federal Deposit Insurance coverage Company because the receiver to guard insured deposits.

Circle, the corporate behind the USDC, disclosed on March 11 that $3.3 billion of its $40 billion reserves have been caught at SBV, leading to its value falling beneath its $1 peg and impacting different stablecoins.