Abracadabra Cash, a cross-blockchain lending platform, has proposed growing the rate of interest on its excellent loans to handle dangers related to its Curve (CRV) publicity. The proposal drew blended reactions from the neighborhood, and several other questioned the tactic of modifying mortgage phrases, whereas others known as it a fantastic plan to chop down publicity to CRV.

Abracadabra protocol permits customers to earn cash through the use of interest-bearing belongings similar to CRV, CVX and YFI as collateral to mint Magic Web Cash (MIM), a USD-pegged stablecoin. Spell is the native governance and staking token of the platform.

Abracadabra is uncovered to vital quantities of CRV danger as a consequence of current exploits on the DeFi protocol, resulting in a liquidity disaster. The incident has modified the liquidity situations that led to the itemizing of CRV as collateral on Abracadabra.

With a purpose to tackle this problem a brand new proposal has been made to use collateral-based curiosity to each CRV cauldrons. CRV cauldrons are liquidity swimming pools on the lending protocol. The development proposal known as for a rise within the rate of interest to be able to scale back Abracadabra’s complete CRV publicity to round $5 million borrowed MIM.

Associated: Moral hacker retrieves $5.4M for Curve Finance amid exploit

The proposal goals to use collateral-based curiosity much like what the decentralized autonomous group (DAO) did with the WBTC and WETH cauldrons. All curiosity can be charged straight on the cauldron’s collateral and can instantly transfer into the protocol’s treasury to extend the reserve issue of the DAO.

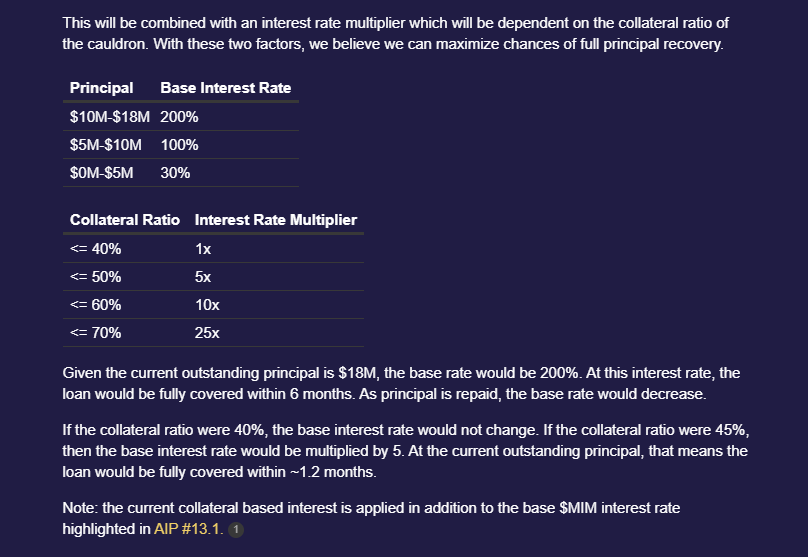

The DeFi protocol proposal estimated that for an $18 million principal mortgage quantity, the bottom fee could be 200%. At this rate of interest, the mortgage could be absolutely coated inside six months. The proposal famous that because the principal is repaid, the bottom fee would lower.

Rate of interest hike proposal, Supply: Abracadabra

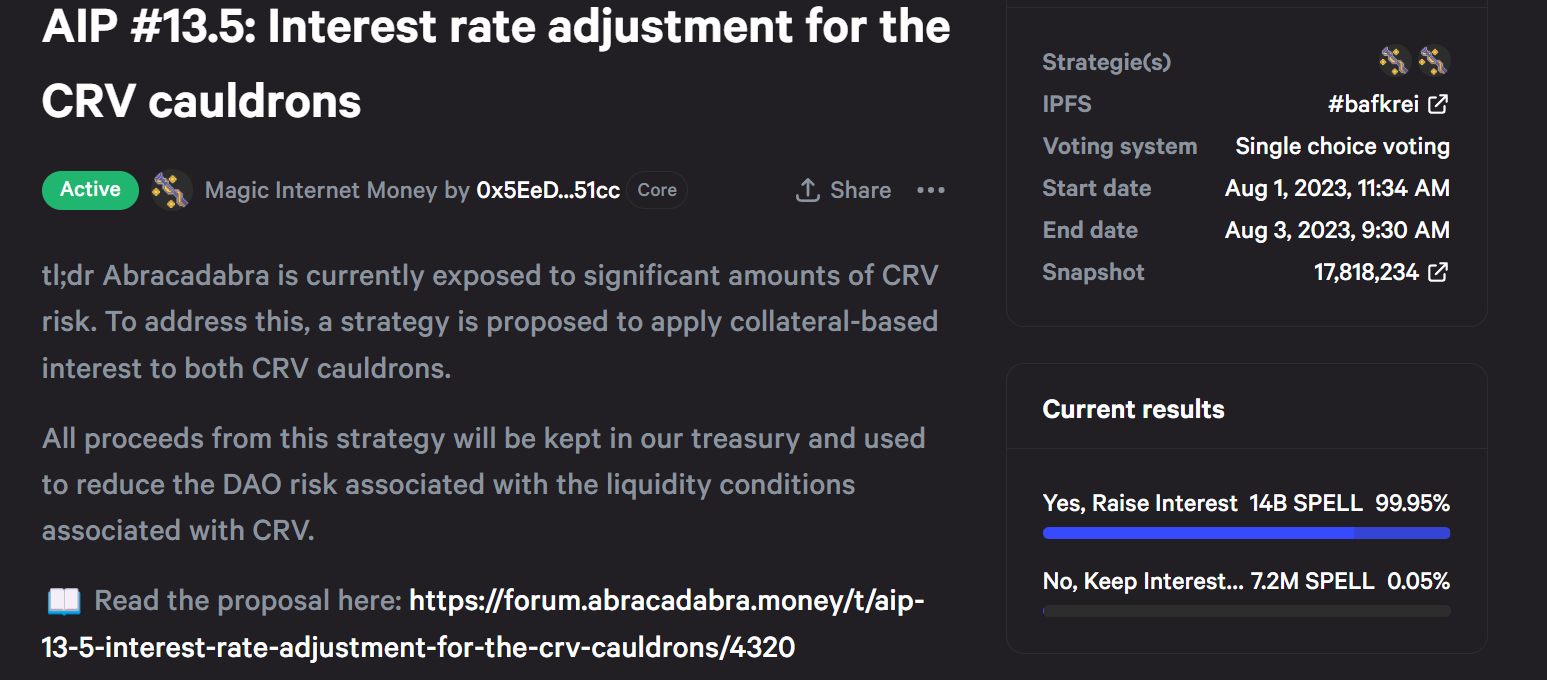

The voting for the proposal opened on Aug. 1 and can final till Aug. 3, and at press time a mammoth 99% of the votes had been forged in favor of the proposal.

Abracadabra enchancment proposal voting snapshot, Supply: Abracadabra

The proposal additionally drew numerous reactions from the crypto neighborhood together with Frax Finance govt Drake Evans who known as it a governance rug.

I am sorry however jacking rates of interest to 200% through governance is a rug. Altering the elemental phrases of a mortgage (10x rate of interest) in a single transaction could be very dangerous and we must always name it out.

Very sympathetic to defending protocol integrity however rugging just isn’t the best way https://t.co/sqWy7R0YPq

— Drake Evans (model 3) (@DrakeEvansV1) August 2, 2023

Others supported the proposal claiming it might very effectively assist the lending protocol eliminate CRV publicity.

If @MIM_Spell actually tries this, I would say there is a good probability $MIM loses all $CRV gauges pretty shortly.

41m MIM (61% of complete mcap) is on Curve!$SPELL #DeFi https://t.co/vpm3bH4xct

— DefiMoon (@DefiMoon) August 2, 2023

Curve founder Michael Egorov has almost $100 million in loans throughout numerous lending protocols backed by 427.5 million CRV which is 47% of the circulation provide of the Curve token. With the value of Curve experiencing a stress take a look at, the chance of a token dump has elevated. Within the meantime, most of the lending protocols are on the lookout for methods to clear from their CRV publicity.

Acquire this text as an NFT to protect this second in historical past and present your assist for impartial journalism within the crypto area.

Journal: Ought to crypto initiatives ever negotiate with hackers? In all probability