Wallets linked to the bankrupt Alameda Analysis turned lively once more on Feb. 7, transferring hundreds of thousands value of FTX Tokens (FTT). The Alameda pockets exercise post-FTX chapter submitting has been an enormous concern for the crypto neighborhood, with many questioning the deserves of the regulation enforcement companies and the way these wallets are being accessed.

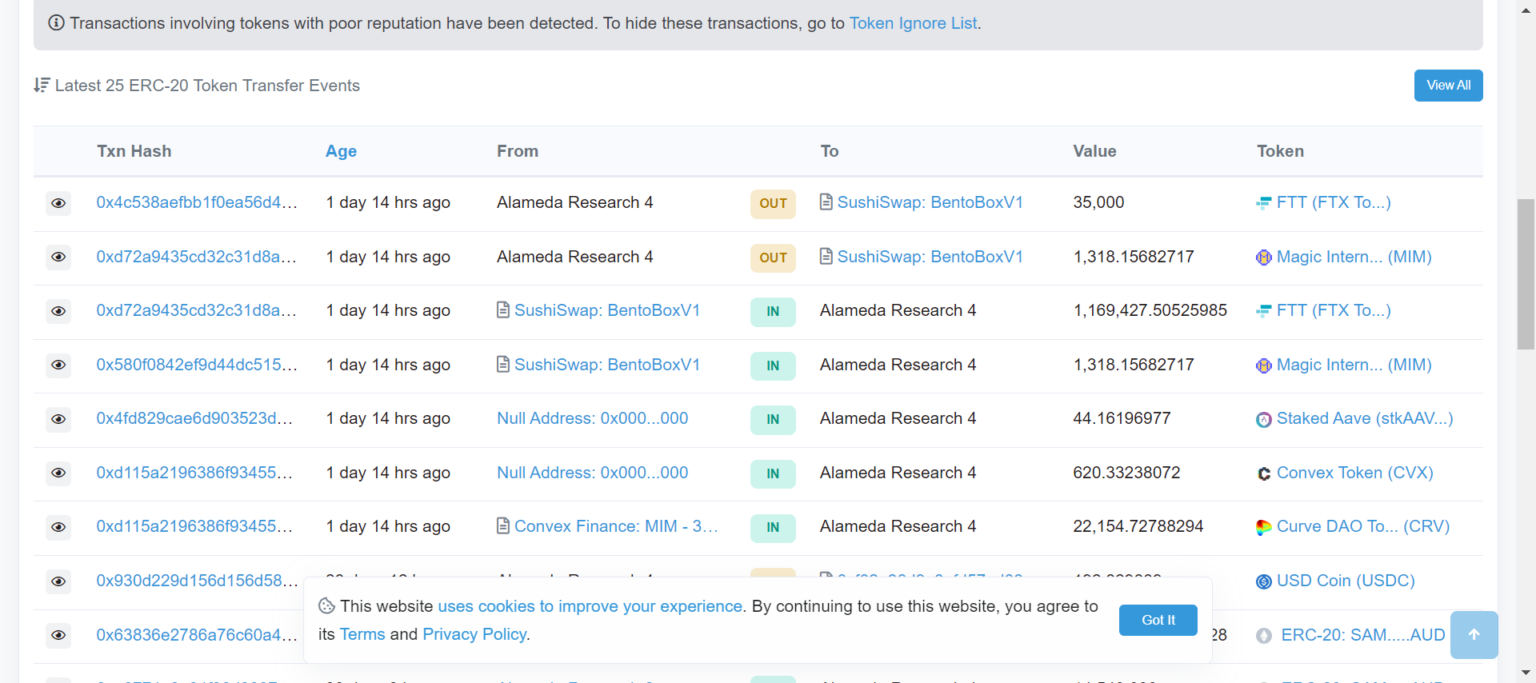

The Alameda pockets tackle, ‘brokenfish.eth’, transferred practically $2 million value of FTT tokens from the BentoBox sensible contract on SushiSwap. The sensible contract in query serves because the central vault for your complete Sushi ecosystem. Former FTX CEO Sam Bankman-Fried has a historical past with SushiSwap that dates again to 2020 when he took over the protocol from former prime developer Chef Nomi.

The “Alameda Analysis 4” pockets purchased greater than 1 million FTT (roughly $2.3 million) within the $1.86–$1.87 vary. The pockets additionally opened a mortgage place on Abracadabra, at the moment mortgaging 73,000 FTT and $31,000.

Many linked the motion of funds to the continued chapter proceedings and believed John Ray III, the court-appointed CEO of FTX, sanctioned the fund actions. Ray III has made no secret of his need to grab management of the alternate’s property and people of its subsidiaries to repay its money owed. On Jan. 17, FTX introduced that it had found over $5.5 billion in liquid property all through its investigations, with greater than $3 billion owed to its prime 50 debtors.

Associated: Hodlnaut works with potential consumers to promote agency and FTX claims: Report

This was not the primary occasion in February that Alameda-linked wallets moved funds. On Feb. 2, Blockchain safety agency PeckShield alerted that “Alameda Consolidation” obtained $13 million value of crypto property from three completely different wallets.

#PeckShieldAlert ~$13M value of cryptos have been transferred to Alameda consolidation-labeled tackle, together with ~6M $USDT & 1,545 $ETH ($2.5M) from Bitfinex, ~4.6M $USDC from 0x7889

Questioning why Bitfinex transferred ~$8.5M value of cryptos to Alameda consolidation tackle pic.twitter.com/YU8RNcrdxs— PeckShieldAlert (@PeckShieldAlert) February 2, 2023

The primary is owned by the crypto alternate Bitfinex. It despatched roughly 6 million Tether (USDT) and 1,545 Ether (ETH), totaling roughly $8.5 million. The opposite unidentified people transferred roughly $6 million in USD Coin (USDC) to the Alameda Consolidation tackle.