After a tumultuous 2022, Bitcoin (BTC) is poised for a outstanding resurgence in 2024, based on a consensus of business consultants. This complete evaluation delves into the important thing elements driving this constructive sentiment, together with the extremely anticipated Bitcoin halving occasion, surging institutional adoption, and the introduction of spot Bitcoin exchange-traded funds (ETFs).

The Halving Occasion: A Catalyst For Shortage, Value Appreciation

The Bitcoin halving occasion, scheduled for April 2024, stands as a pivotal second within the cryptocurrency’s historical past. This occasion, occurring each 4 years, reduces the block reward for miners by half, successfully diminishing the availability of recent BTC. This shortage, coupled with regular or growing demand, has traditionally triggered substantial worth will increase.

A retrospective evaluation of earlier halving occasions reveals the transformative impression on Bitcoin’s worth. Within the 12 months following the 2012 halving, BTC’s worth skyrocketed by an astounding 10,000%, whereas the 2016 halving was adopted by a outstanding 2,000% surge. These historic precedents present a compelling foundation for optimism relating to the upcoming halving occasion’s potential to ignite a brand new bull run.

Institutional Adoption: A Surge Of Confidence And Liquidity

The rising institutional adoption of Bitcoin represents one other key driver of its bullish outlook. Institutional traders, recognizing the cryptocurrency’s potential as a hedge in opposition to inflation and forex devaluation, are more and more allocating funds to this rising asset class.

This inflow of institutional capital, coupled with the current launch of spot Bitcoin ETFs in america and Hong Kong, has considerably enhanced the accessibility and legitimacy of Bitcoin as an funding car.

Spot Bitcoin ETFs, not like their futures counterparts, enable institutional traders to instantly purchase and promote the precise cryptocurrency, eliminating the necessity for intermediaries. This added flexibility, mixed with the growing regulatory readability surrounding cryptocurrencies, is predicted to draw much more institutional cash into the market, additional fueling demand and worth appreciation.

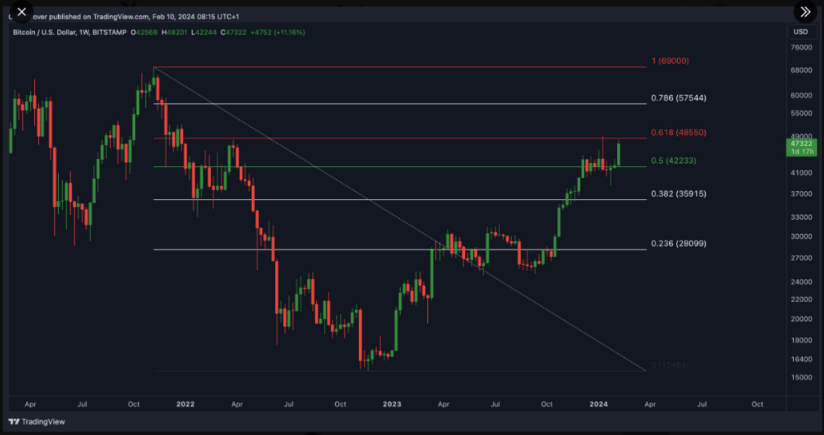

Bitcoin at the moment buying and selling at $48,204 on the each day chart: TradingView.com

Bitcoin Value Predictions: Consultants Weigh In

Outstanding crypto analysts and market consultants have supplied their predictions for Bitcoin’s worth trajectory in 2024. Crypto Rover, a famend market analyst, believes that Bitcoin may embark on a bullish development if it surpasses the $48,500 resistance degree and reaches the 0.618 Fibonacci degree.

I feel #Bitcoin will hit a brand new ATH in 2024.

— Crypto Rover (@rovercrc) February 10, 2024

On the time of writing, Bitcoin was buying and selling at $48,234 up 0.2% and 13.7% within the each day and weekly timeframes, information by Coingecko reveals.

As soon as #Bitcoin breaks the $48,500 mark, higher stated, the 0.618 Fibonacci degree,

that may mark the official development reversal to a bull market. I’m maintaining an in depth eye on this degree! pic.twitter.com/ne2SvugHRp

— Crypto Rover (@rovercrc) February 10, 2024

TradingView Chart by Crypto Rover

The CEO of analytics platform CryptoQuant, Ki Younger Ju, predicts that by the top of the 12 months, the worth of a bitcoin would possibly soar to an astounding $112,000 per unit.

#Bitcoin may attain $112K this 12 months pushed by ETF inflows, worst-case $55K.https://t.co/HrkV3TU8Ul pic.twitter.com/jBn6HWpt9b

— Ki Younger Ju (@ki_young_ju) February 11, 2024

A 12 months Of Transformation And Progress

In gentle of the upcoming Bitcoin halving occasion, the surge in institutional adoption, and the introduction of spot Bitcoin ETFs, 2024 emerges as a pivotal 12 months for the cryptocurrency. Whereas worth predictions could fluctuate, the overwhelming consensus amongst consultants factors to important potential for development and appreciation.

Featured picture from Adobe Inventory, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal danger.