- APE noticed a slight uptick in its market capitalization throughout the intraday buying and selling session on 24 July.

- With the regular decline in APE accumulation, a major worth development could not happen any time quickly.

Main memecoin Apecoin [APE] kicked off the brand new buying and selling week with a slight rally in its market capitalization, information from Santiment revealed. This comes although Bitcoin [BTC], with which APE has proven a statistically important constructive correlation, continued to commerce inside a slim vary.

🐶 The week has kicked off with some #memecoin magic, as #Dogecoin, #ShibaInu, & #Apecoin have loved minor market cap rises. As is often the case with these kind of property, excessive social quantity spikes will sign tops. $DOGE pleasure is heating up. https://t.co/Z0w3UXZDzz pic.twitter.com/h0mriBIpXh

— Santiment (@santimentfeed) July 24, 2023

Lifelike or not, right here’s APE’s market cap in BTC’s phrases

Data from the on-chain information supplier additionally confirmed that the market cap rally was accompanied by a surge in APE’s social exercise. In response to Santiment, for property like APE, “excessive social quantity spikes will sign tops” and are sometimes adopted by a worth reversal.

This metric decries the thought of one other native prime

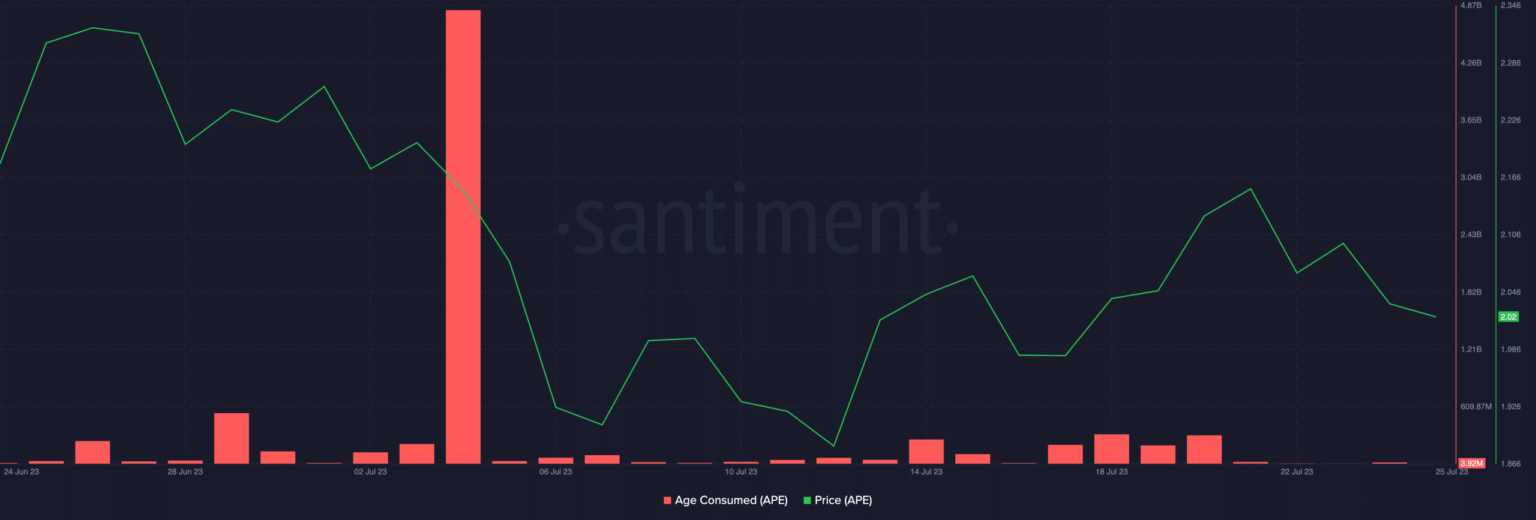

To correctly time an asset’s native prime, the Age Consumed Metric is a key on-chain metric that proves environment friendly. In response to Santiment, it tracks the variety of tokens altering addresses on a sure date, multiplied by the point since they final moved.

Sometimes, a surge in Age Consumed suggests {that a} important variety of once-idle tokens have begun to vary handle, hinting at a sudden and robust shift within the habits of long-term holders.

An evaluation of APE’s Age Consumed revealed that the alt skilled a spike on 4 July. The uptick was adopted by a fall in APE’s worth, which means that the altcoin clinched a neighborhood prime at $2.15 and launched into an uptrend.

Though APE tried an uptrend just a few days later, on 12 July, its worth nonetheless rested beneath its final native prime. With no spikes in Age Consumed noticed at press time, one other native prime was but to be reached, lowering the potential of a worth correction.

Supply: Santiment

How a lot are 1,10,100 APEs price as we speak?

Any “prime” is way from sight

An evaluation of APE’s worth actions on a D1 chart revealed that the alt has moved sideways since 7 July. Moreso, its worth was down by nearly 15% within the final month, in keeping with information from CoinMarketCap.

APE accumulation has waned within the final month, with some key momentum indicators positioned beneath their heart strains. For instance, the meme coin’s Chaikin Cash Movement (CMF) returned a unfavorable -0.13 at press time and remained southbound.

A CMF worth beneath the zero line is an indication of weak spot available in the market, because it signifies liquidity exit. This, coupled with worth consolidation, limits the potential of any worth rally which may end in a neighborhood prime being reached.

Additional, the Relative Power Index (RSI) trended downwards at press time and has been so positioned since 21 July. This confirmed that promoting strain exceeded APE accumulation amongst day merchants.

Lastly, consumers’ energy has declined considerably since mid-June, as was gleaned from the alt’s Directional Motion Index. At press time, the unfavorable directional index (crimson) rested above the constructive directional index (crimson), suggesting that APE sellers managed the market.

Supply: APE/USDT on TradingView