- Bitcoin whale addresses have elevated to over 2,000.

- BTC strikes nearer to the $70,000 worth zone.

The approval of the Bitcoin [BTC] spot ETF in america generated diversified reactions throughout totally different metrics.

One such metric indicated that whales elevated their accumulation as costs soared to all-time highs. How worthwhile have their holdings been over the previous few months?

Bitcoin whales present ETF pleasure

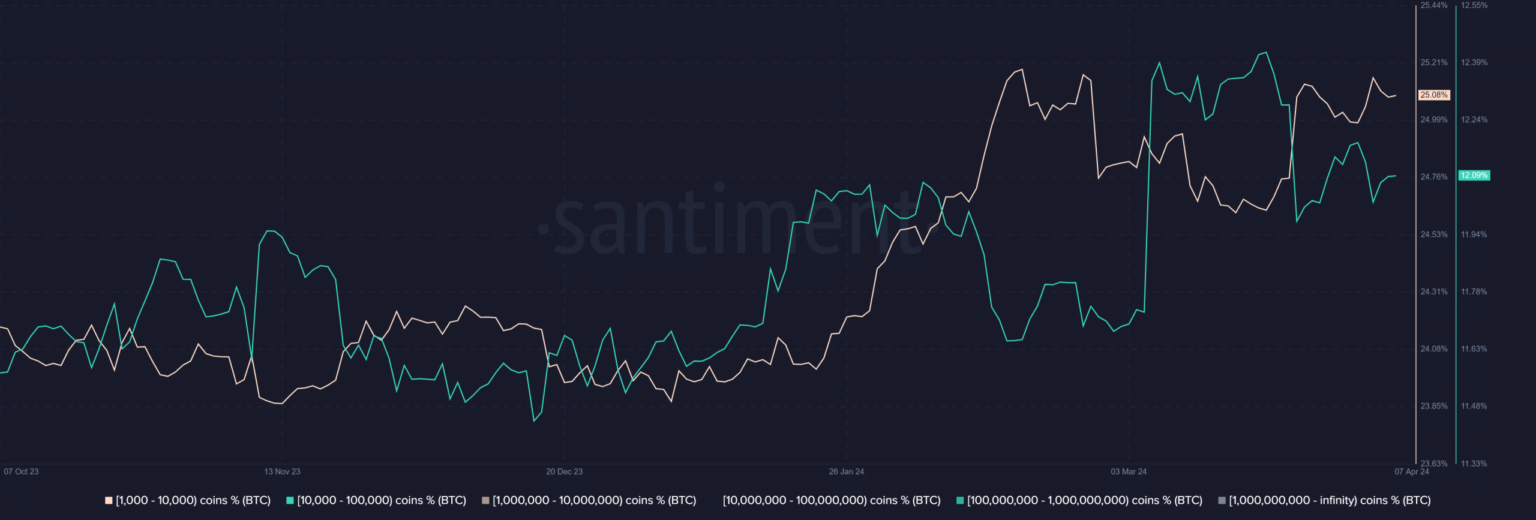

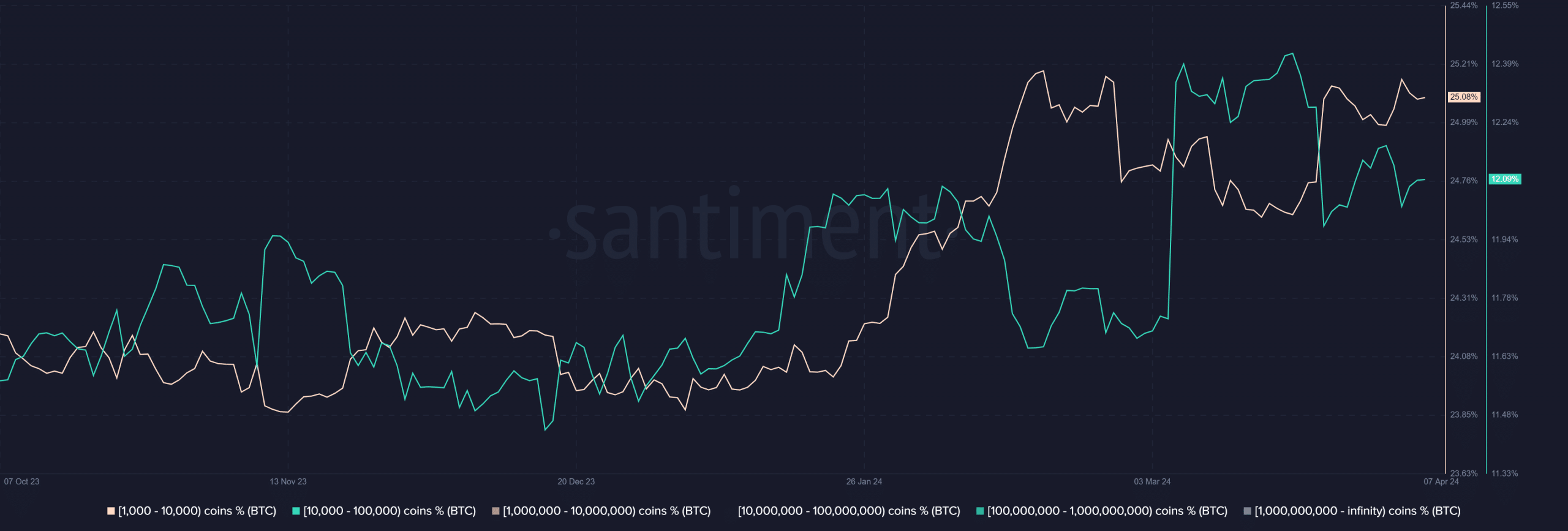

An evaluation of whale addresses holding 1,000 or extra Bitcoin revealed a big enhance following the approval of the spot ETF in January.

The chart confirmed an increase within the variety of addresses from round 1,800 to over 2,000.

Supply: Santiment

Regardless of a slight drop in current weeks, the quantity remained above the two,000 threshold. The stability held by these addresses surged by over 220,000 BTCs, equal to round $14 billion.

This steered that the approval of the spot ETF spurred elevated exercise amongst whales, with extra of those addresses accumulating extra BTC.

Bitcoin whale stays within the worthwhile zone

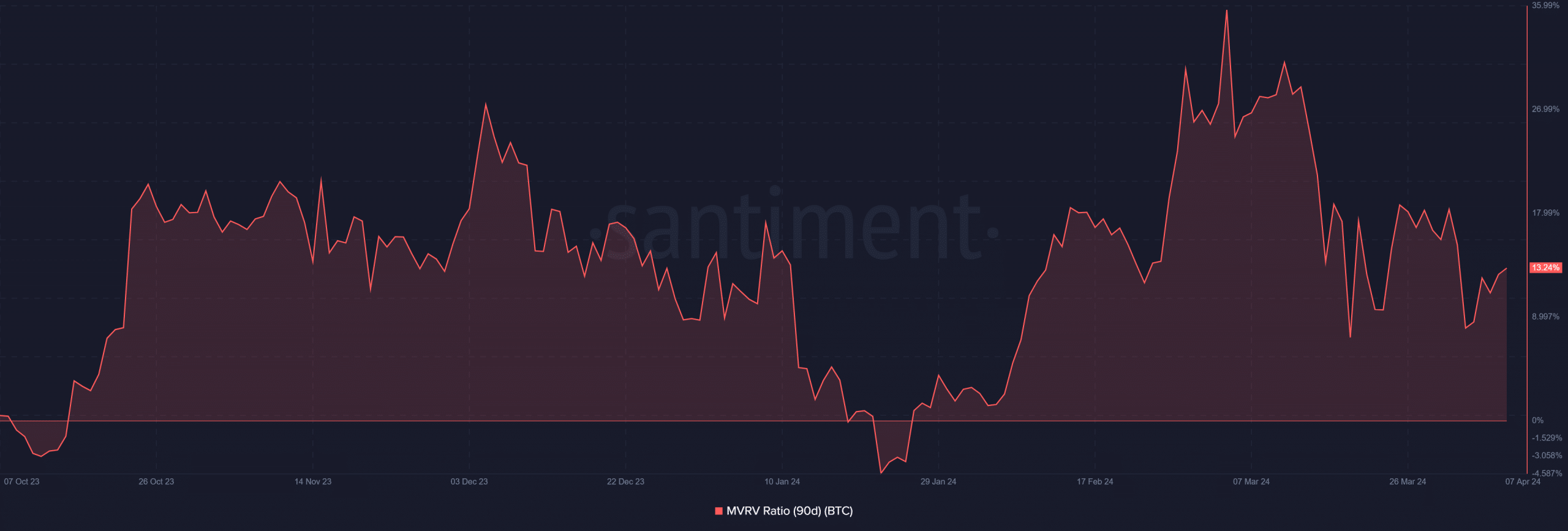

The property collected by these whales within the months following the ETF approval have confirmed worthwhile. Evaluation of the Bitcoin 90-day Market Worth to Realized Worth ratio (MVRV) confirmed it has been above 0.

Supply: Santiment

Subsequently, the MVRV surged to over 35% in March earlier than experiencing a big decline.

On the time of this writing, the MVRV had decreased to round 13.24%, returning to the area it was in earlier than the approval. This decline is attributed to the current worth lower noticed in BTC.

Nevertheless, regardless of this decline, the present state of the MVRV means that whales who bought throughout this era are nonetheless holding at a revenue.

BTC strikes nearer to $70,000

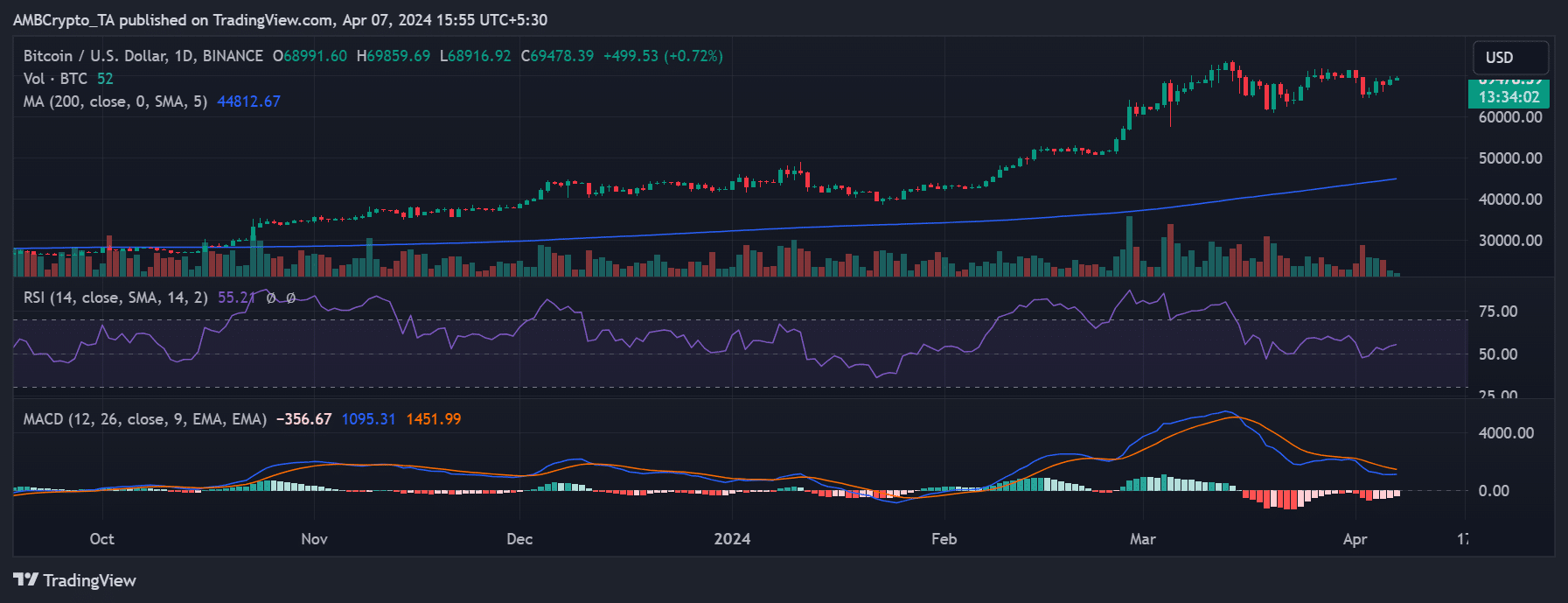

AMBCrypto’s evaluation of Bitcoin’s worth development on a day by day timeframe chart revealed a notable surge following the approvals, reaching new highs.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Nevertheless, the value has been moderated in current weeks, dipping under the established threshold of over $70,000. Regardless of the decline, it remained near the $70,000 worth zone.

On the time of this writing, BTC was buying and selling over $69,000. Moreover, it was in a bullish development, as indicated by its Relative Energy Index (RSI) being above 50.

Supply: TradingView