- Polkadot social metrics underscored a rising curiosity within the community.

- Nevertheless, DOT’s improvement exercise caught to its lows all through April.

In case you have been following up on blockchain networks main when it comes to improvement, you will have observed that Polkadot is amongst them. This robust presence within the record of prime networks when it comes to improvement has not gone unnoticed.

Is your portfolio inexperienced? Try the Polkadot Revenue Calculator

One of many newest updates pertaining to the Polkadot community provided an summary of its social metrics in April. The findings revealed that the community achieved internet constructive progress within the final 4 weeks in key social metrics.

They embody social mentions, dominance, engagement, and contributors. For instance, social dominance was up by 97.8%, whereas Twitter quantity grew by 100.5%.

📈👀 Try the newest Polkadot Month-to-month Social Metrics Overview!

There’s a large enhance in:

✅ Social mentions

✅ Social Engagement

✅ Social Dominance

✅ Social ContributorsTest the element under #Polkadot #DOT pic.twitter.com/1O8TxDYFlS

— Polkadot Insider (@PolkadotInsider) May 2, 2023

Favorable social metrics are essential as a result of they underscore rising visibility to potential buyers. However will the favorable social metrics have an effect on the demand for Polkadot and its native crypto DOT within the subsequent few weeks? Effectively, a number of different components come into play.

These Polkadot metrics paint a much less inspiring image

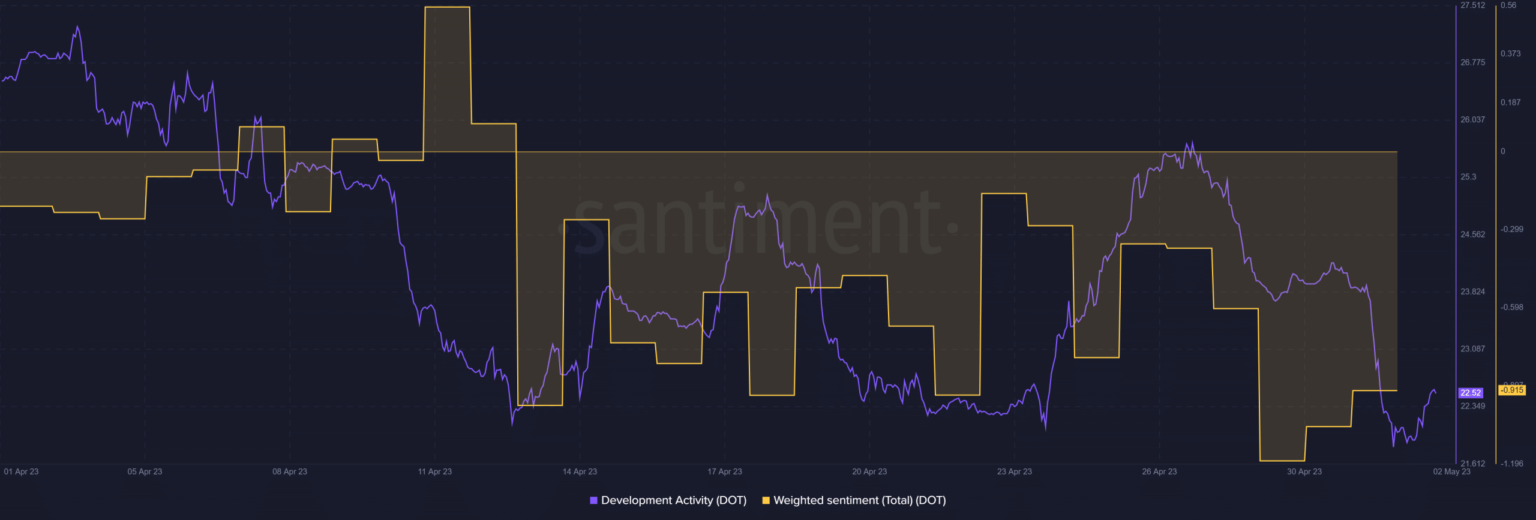

Polkadot’s improvement exercise noticed a little bit of a slowdown in April and it kicked off Could by falling to a brand new four-week low. Equally, DOT’s weighted sentiment concluded April at its lowest month-to-month degree.

Supply: Santiment

Each the weighted sentiment and improvement exercise demonstrated some restoration after bouncing again barely from their four-week lows. However will these findings have an effect on the demand for DOT? Binance and DYDX funding charges registered a drop into unfavourable territory within the final 24 hours.

Supply: Santiment

A key motive for this shift is that DOT kicked off the primary day of Could with a surge in lengthy liquidations which ensured a bearish final result. Except for general promote stress, over $600,000 value of lengthy positions have been liquidated in comparison with simply barely under $9,000 quick liquidations.

Because of this, extra merchants embraced quick positions in an effort to reap the benefits of the next draw back as seen on Coinglass.

Supply: Coinglass

What number of are 1,10,100 DOTs value right this moment

Word that the liquidations solely account for simply six common exchanges, therefore it doesn’t present the total scope of the potential liquidations. However, the promoting stress in the previous couple of days ensured sub $6 costs. DOT traded at $5.73 at press time.

DOT’s newest worth underscores the push and pull that has been occurring between the bulls and the bears for the reason that final week of April. In different phrases, Polkadot’s social metrics haven’t had a lot of an influence on DOT’s worth motion.