- BTC was down by greater than 3% final week and was buying and selling at $26,887.08.

- Although the value motion was bearish, on-chain metrics turned bullish.

Bitcoin [BTC] managed to raise its worth above $27,000, however final week, issues once more turned in bears’ favor. This occurred as a result of BTC witnessed a significant worth correction, pushing its worth down.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Due to this fact, let’s check out BTC’s efficiency on a number of fronts final week to see what’s truly cooking.

Bitcoin falls beneath $27,000

After reaching practically $28,000 on 9 October, the king of crypto’s worth witnessed a worth correction. Over the past seven days, BTC’s worth has remained underneath $27,000. At press time, it was buying and selling at $26,887.08 with a market capitalization of over $524 billion.

Notably, James V. Straten, a well-liked crypto analyst, lately identified how Bitcoin carried out during the last week on a number of fronts.

To sum up this week for #Bitcoin

Almost certainly spot ETF approval (subsequent 6 months. #GBTC closed increased.

Max worry: STHs offered the second most quantity of #Bitcoin at a loss this yr with report divergence with LTHs (Wednesday).

Hypothesis is close to all time lows, STH provide in any respect…

— James V. Straten (@jimmyvs24) October 14, 2023

For example, short-term holders offered the second-largest quantity of Bitcoin at a loss this yr, with report divergence from long-term holders. This considerably additionally mirrored on the coin’s provide.

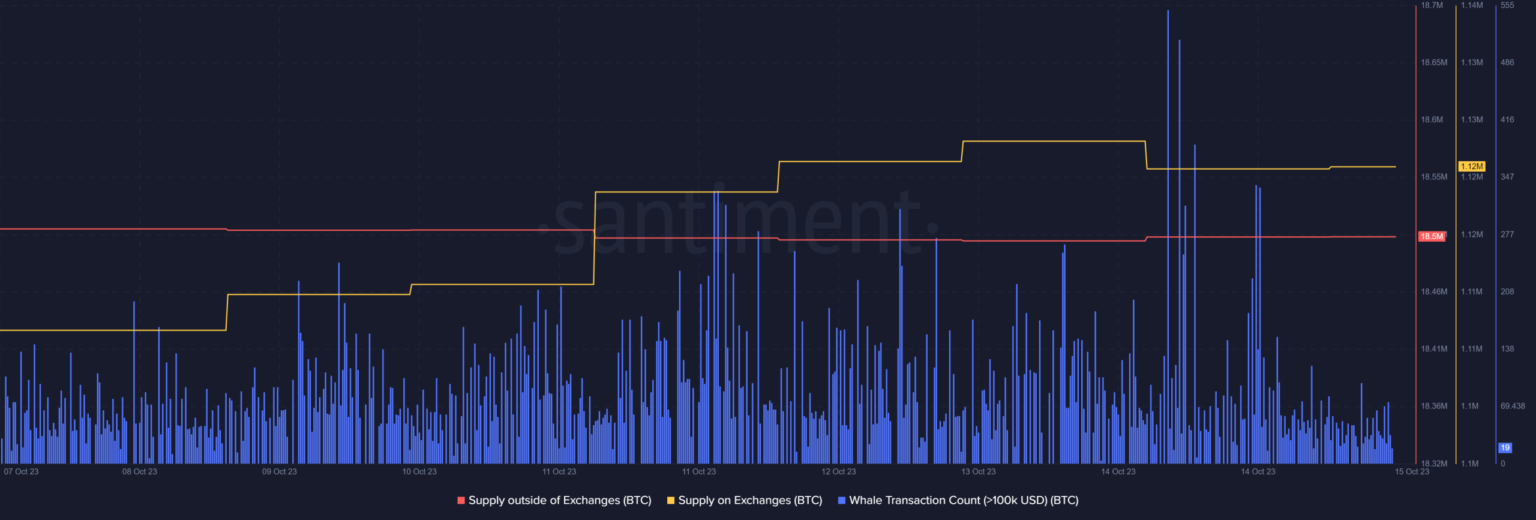

BTC’s Provide outdoors of Exchanges remained flat whereas its Provide on Exchanges elevated final week, which mirrored buyers’ worry of an extra worth plummet. Nonetheless, whale exercise round BTC remained excessive, as evident from its Whale Transaction Depend.

Supply: Santiment

A take a look at Bitcoin’s mining sector

Bitcoin’s upcoming main occasion can be drawing in, because the blockchain is anticipating its halving in 2024. In reality, BTC is lower than 28,000 blocks away from halving. BTC’s hash price reached an all-time excessive, with issue adjusting 6% increased this weekend.

Whereas the occasion attracts nearer, miners have began to promote their holdings. Glassnode’s knowledge identified that miners’ stability registered a pointy decline during the last month.

Supply: Glassnode

Not solely that, however as per CryptoQuant, miners have been truly promoting their belongings at a loss in comparison with their one-year common. Although this mirrored the truth that miners weren’t assured in BTC, it might additionally point out a potential market backside.

What to anticipate from BTC

Although the final week didn’t go in buyers’ favor, the upcoming days may look totally different, as few of the metrics regarded bullish on BTC. For instance, Bitcoin’s Binary CDD was inexperienced, that means that long-term holders’ motion within the final seven days was decrease than common.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Its NULP revealed that the market was in a “worry” stage, which is often a constructive signal. On high of that, BTC’s derivatives market indicators additionally regarded optimistic.

Notably, its Taker Purchase Promote Ratio and Funding Charge have been inexperienced, which meant that purchasing sentiment was dominant within the derivatives market.

Supply: CryptoQuant