- Avalanche community’s income and costs spiked on 11 March.

- Metrics had been bullish, however market indicators supported the sellers.

Avalanche [AVAX] witnessed a serious decline in key metrics final week, which was regarding for the community’s total well being.

AVAX Day by day, a preferred Twitter account that posts updates associated to the Avalanche ecosystem, identified in its newest weekly report that AVAX’s every day energetic addresses declined by over 22%.

Not solely did energetic addresses decline, however AVAX’s market capitalization additionally adopted the identical development, because of the dominant bearish market sentiment of the final week.

🔺Avalanche Ecosystem Weekly Highlights🔺

Value gainers$BETS @BetSwirl$GENI @Genicrypto$SURE @InsureToken$PENDLE @pendle_fi

TVL gainers@emdx_io$RADIO @RadioShack$IBEX @ImpermaxFinance$SIS @symbiosis_fi#AVAX #Avalanche #DEFI $AVAX pic.twitter.com/DSUeRzPQck

— AVAX Day by day 🔺 (@AVAXDaily) March 12, 2023

Learn Avalanche’s [AVAX] Value Prediction 2023-24

A shocking episode

Whereas AVAX’s energetic addresses went down, reflecting much less utilization of the community, Token Terminal’s information revealed an fascinating improvement. The community’s income and costs spiked on 11 March, suggesting a change in development.

Supply: Token Terminal

AVAX to regain management

The expansion in income and costs signified that community utilization had certainly elevated, opening the door to the potential for AVAX regaining customers’ confidence within the blockchain.

The identical risk was additional established by AVAX’s latest worth motion, which was in buyers’ favor.

As per CoinMarketCap, Avalanche’s worth elevated by greater than 10% within the final 24 hours. On the time of writing, AVAX was buying and selling at $16.14 with a market capitalization of over $5.2 billion.

Metrics in favor?

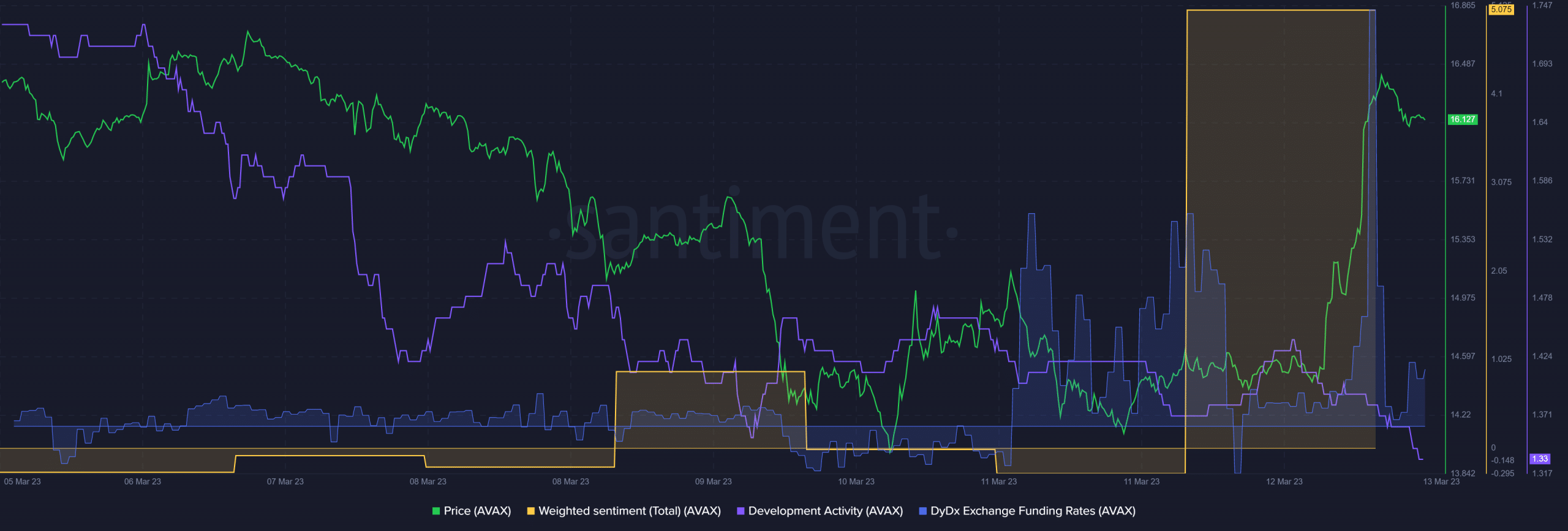

Santiment’s chart revealed that the market’s confidence in AVAX appeared to have improved drastically as its weighted sentiment shot up.

The token’s demand within the derivatives market additionally elevated of late, which was evident from the rise in AVAX’s DyDx funding fee.

Nonetheless, the potential for the feelings turning towards AVAX can’t be dominated out but as Avalanche’s improvement exercise declined sharply final week.

Supply: Santiment

How a lot are 1,10,100 AVAXs value immediately?

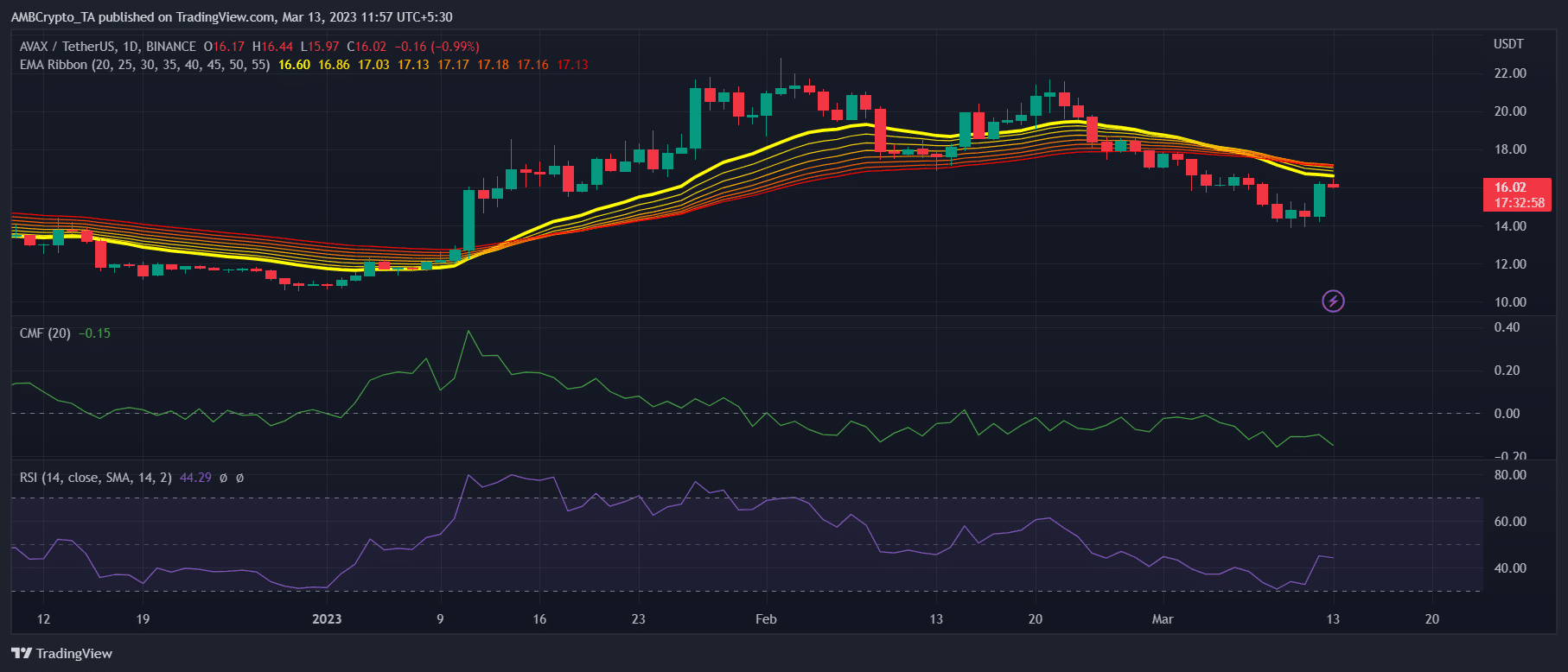

In the meantime, a have a look at AVAX’s every day chart gave fairly just a few causes for concern, because it indicated that the nice days may be short-lived.

Many of the market indicators together with the Relative Power Index (RSI), supported the bears as they registered a slight downtick.

Regardless of the latest worth pump, AVAX’s Chaikin Cash Movement (CMF) failed to maneuver up, which was additionally a bearish sign. The Exponential Shifting Common (EMA) Ribbon displayed a bearish crossover, additional growing the possibilities of a development reversal quickly.

Supply: TradingView