Govt Abstract: After the profitable conclusion of the Merge and the removing of lock-up intervals, curiosity in Ethereum staking is growing quickly. However staking comes at the price of liquidity. Platforms that supply liquid staking spinoff (LSD) tokens mix the perfect of each worlds – passive earnings from staking rewards mixed with the liberty to commerce and make investments staked ETH on DEXs and DeFi platforms by spinoff tokens.

LSD tokens come in several designs and architectures – rebasing contracts, non-rebasing tokens, single tokens, and dual-token fashions are the first examples. Traders should study concerning the execs and cons of every token and choose one which aligns with their long-term objectives, threat tolerance, and liquidity wants.

Staking rewards from LSD tokens vary from a low of two.00% all the way in which as much as 9.00% APY. For DeFi tasks, non-rebasing, dual-token techniques provide the perfect efficiency. Decentralized providers are preferable to centralized platforms as a result of decreased threat of community assault vulnerabilities.

What are Liquid Staking Derivatives (LSDs)?

Clarify Like I’m 5: Liquid staking derivatives are like borrowing a toy that appears and feels identical to your favourite toy, so you possibly can play with it whereas holding your authentic toy secure. You can provide the borrowed toy again while you’re accomplished and get your authentic toy again. It’s a method to make use of your locked-up cryptocurrency with out truly unlocking it.

Liquid staking derivatives are an attention-grabbing new breed of crypto tokens that arose in late 2020. Just like the spinoff devices in conventional finance, LSDs are monetary devices that derive their worth from an underlying asset – on this occasion, staked tokens in Proof-of-Stake (PoS) blockchains like Ethereum.

LSDs are the native token discovered on liquid staking platforms. Rocket Pool, LIDO, and StakeWise are standard examples of liquid staking service suppliers. If you stake your PoS tokens on these platforms, you obtain an equal quantity of a local LSD token in alternate. (Stake your ETH in Coinbase, get cbETH in return.)

The spinoff tokens are minted on-demand in a 1:1 ratio while you deposit your tokens into the platform. And they’re destroyed as quickly as you withdraw your staked tokens. The LSD tokens can then generate further yield by strategies like yield farming.

Any earnings you generate by these strategies is along with your staking earnings. If you happen to want instant liquidity, you possibly can commerce these tokens on spinoff exchanges or use them as collateral for DeFi loans.

LSD tokens are much like different crypto tokens since they’re totally transferable and fractional. They maintain a price that’s much like the underlying token. Their essential objective is to beat the restrictions related to common staking.

Why Spend money on Liquid Staking Derivatives?

By January 2023, over 16 million ETH was locked away in staking. Liquid staking swimming pools like Lido and Rocket Pool accounted for 42.7% of the overall, price round $10.7 billion. The success of those platforms signifies the large demand for ETH staking regardless of the lengthy lock-up interval.

Though the Shanghai-Cappella improve in April 2023 eliminated the withdrawal restrictions, it has not resulted in a sustained exodus of staked ETH from validator swimming pools. As a substitute, deposits exceeded withdrawals barely a month after the improve, indicating renewed curiosity in Ethereum staking.

And it isn’t arduous to see why. To this point, Ethereum staking has yielded rewards price 1 million ETH. Within the absence of obligatory lock-ups and the liberty to withdraw, the validators are prone to improve. When that occurs, the common yield (APR) from staking will lower additional, particularly for staking swimming pools.

Moreover, even after the Shapella improve, buyers searching for considerable staking returns will nonetheless should lock their tokens away for sustained intervals of as much as a 12 months or extra. This, mixed with the specter of decrease staking rewards, makes liquid staking derivatives much more enticing for anybody who can not afford to run their very own validator nodes.

Finest Staking Spinoff Charges

Rocket Pool rETH

Rocket Pool rETH

Minimal Stake: 0.01 ETH

Whole Worth Locked (TVL): $1.17 billion

Market Share: 7.16%

Rocket Pool is among the oldest Ethereum staking tasks. The challenge was launched in 2016 when the Ethereum neighborhood was nonetheless debating the blockchain’s transition to the Proof-of-Stake mannequin.

Though it has been overtaken by others like Lido and the newer Coinbase liquid staking protocol, Rocket Pool continues to be the third-largest liquid staking challenge for ETH. It retains a loyal following amongst crypto lovers resulting from its heavy concentrate on decentralization.

The governance token of the challenge is RPL. The LSD token you get in alternate for staking ETH is named rETH. Anybody with 16 ETH and 1.6 ETH price of RPL can create a Rocket Pool ETH staking node.

The remaining 16 ETH is collected from different ETH holders searching for to take part in liquid staking by permissionless staking. The minimal stake required is sort of low at simply 0.01 ETH or round $20 at present alternate charges.

The node operators obtain a payment starting from 5 to twenty% of the staking rewards for his or her effort. Rocket Pool gives comparatively modest yields of round 5.17%. The protocol earns earnings solely by RPL token emissions.

As it’s considerably much less centralized than Lido, with over 2000 validators in comparison with the latter’s 21, Rocket Pool poses minimal threat to the Ethereum blockchain. Not like Lido’s stETH, Rocket Pool’s rETH just isn’t a rebasing token.

The worth of rETH consistently appreciates over time to replicate your staking rewards. As well as, non-rebasing tokens are simpler to deploy in DeFi tasks. These are a number of the essential causes Rocket Pool maintains its reputation amongst safety-conscious stakers.

StakeWise sETH2

StakeWise sETH2

Minimal Stake: 1 wei

Whole Worth Locked (TVL): $163.94 million

Market Share: 1.00%

StakeWise is among the many liquid staking protocols that appeared available on the market after the launching of the Beacon Chain for the Ethereum Merge in December 2020. The LSD token awarded to ETH depositors on the staking service is named sETH2.

Aside from sETH2, the protocol additionally has a devoted token for staking rewards known as rETH2, which shouldn’t be confused with the rETH of Rocket Pool. Stakewise LSD token holders will begin receiving rETH2 rewards inside 24 hours of depositing their ETH.

StakeWise makes use of a decentralized system that anybody can apply to turn into node operators. However qualification just isn’t assured since there’s a rigorous vetting course of, and candidates should garner the approval of the protocol DAO members.

For the odd ETH stakers, the principle enchantment of StakeWise sETH2 lies in its simplicity and promise of quick rewards. The service accepts minimal stakes beginning on the lowest attainable fraction of ETH, or 1 wei.

The twin-token system additionally helps the protocol keep away from the frequent pitfalls related to rebasing tokens. The APY reward potential can be among the many highest, making StakeWise a gorgeous selection for stakers who desire a smaller, extra decentralized, and DeFi-friendly different to Lido.

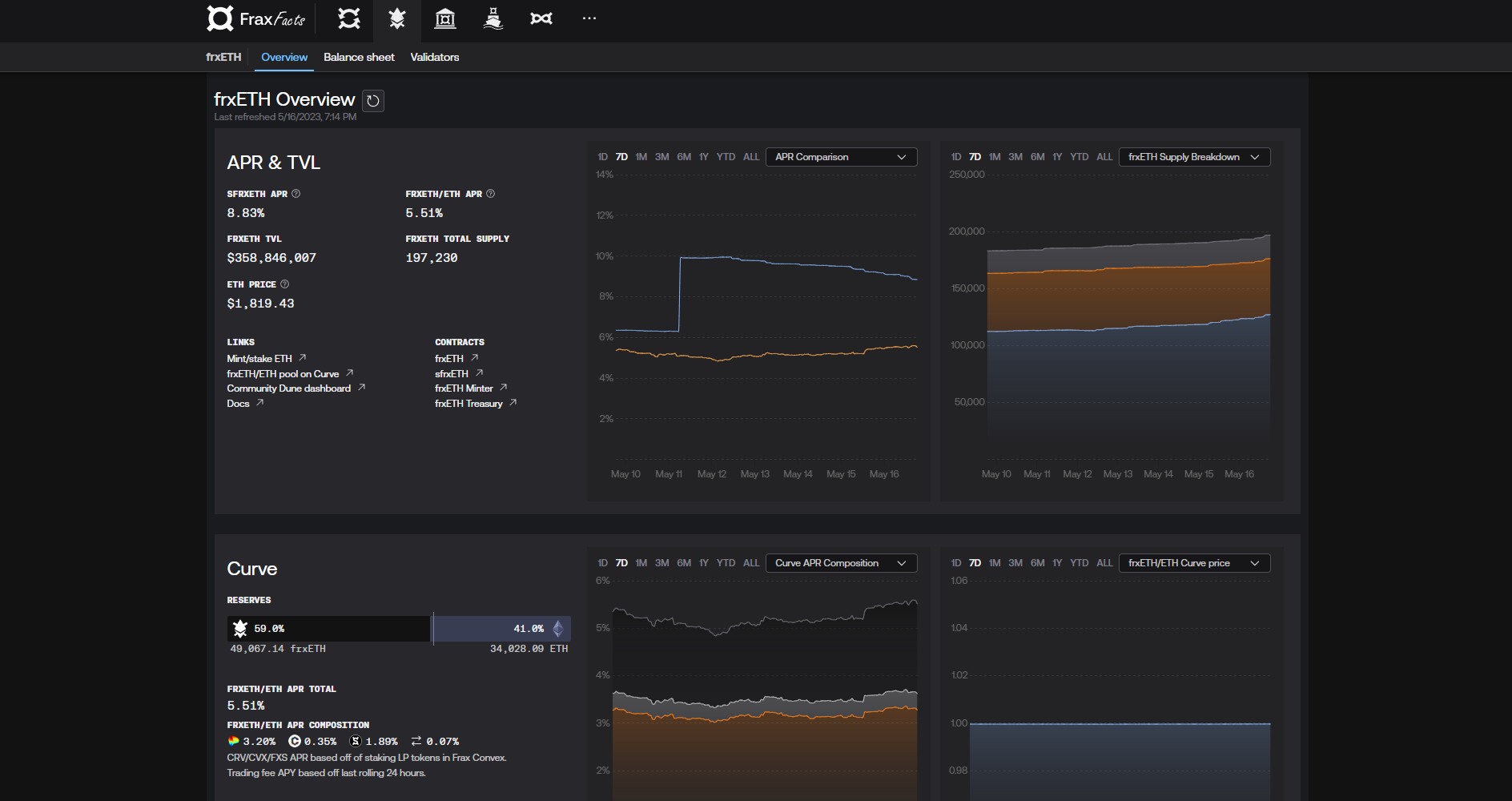

Frax Ether sfrxETH

Frax Ether sfrxETH

Minimal Stake: 1 wei

Whole Worth Locked (TVL): $356.03 million

Market Share: 2.17%

Frax Finance is the issuing authority of the staked Frax Ether token. Moreover, they’re the issuers of the FRAX stablecoin, the primary fractional reserve stablecoin pegged to the US Greenback. Additionally it is one of many newer entries to the market, with a smooth neighborhood launch in October 2022 and an official launch in January 2023.

The liquid staking service at Frax Ether follows the identical primary precept as StakeWise, with separate tokens for liquidity (frxETH) and staking rewards (sfrxETH). To take part, ETH holders can deposit their tokens into the Frax ETH Minter good contract.

Depositors obtain frxETH in a 1:1 ratio. You’ll be able to commerce or take part in different DeFi actions utilizing the frxETH token on the Curve platform. To entry the staking rewards, it’s essential to convert the frxETH into sfrxETH tokens.

Regardless of its late launch, Frax Ether has attracted over $350 million in TVL with a 40% improve in staking inside a number of months of launch. It at the moment sits above older, extra mature liquid staking providers like StakeWise. It additionally boasts the very best returns of all LSD tokens, with APY approaching 9.10%.

The primary dangers related to Frax are associated to its algorithmic stablecoin in mild of the current collapse of Luna/Terra. However to counter that, Frax Finance has collateralized the stablecoin as much as 90% utilizing USDC and maintains deep liquidity on the Curve platform.

Lido stETH

Lido stETH

Minimal Stake: 1 wei

Whole Worth Locked (TVL): $12.22 billion

Market Share: 74.52%

With a market share that has touched 90% prior to now, Lido is the dominant participant in liquid staking by a big margin. It was the primary mover within the liquid staking enterprise after the start of the Ethereum Merge in December 2020, a bonus it has retained within the final two years. The protocol accounts for almost 30% of all ETH staked.

Customers can stake any quantity of ETH on the platform and obtain the stETH token in alternate at a charge of 1:1. Not like different LSD tokens on this web page, stETH is a standalone token used for liquidity and staking rewards.

The tokens are minted when a person deposits ETH on Lido. And they’re burned away when the person withdraws the ETH at a later date. stETH is a rebasing token – its provide is automated by a wise contract to take care of worth stability.

The amount of stETH in provide could change each day at 12PM UTC if there are any adjustments in ETH2 deposits or ETH rewards. Whereas worth stability and decentralization are apparent benefits of rebasing, in addition they have some notable flaws.

Many DeFi apps are merely incompatible with rebasing tokens, probably minimizing the variety of obtainable tasks for stETH holders. In excessive market volatility, the rebasing operate can even backfire, contributing to cost instability as an alternative of stopping it.

Lido can be a sufferer of its personal success. The entity’s gigantic market share is a priority as it may possibly result in centralization and improve the danger of community assaults. Efforts are underway to reduce this threat and scale back the centralization of the protocol.

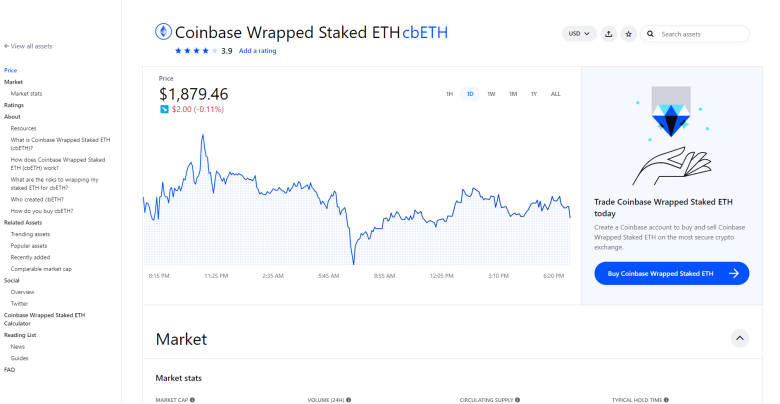

Coinbase Wrapped cbETH

Coinbase Wrapped cbETH

Minimal Stake: 1 wei

Whole Worth Locked (TVL): $2.14 billion

Market Share: 12.58%

Coinbase is a significant centralized cryptocurrency alternate primarily based in the US. The platform launched its liquid staking providers in August 2022. With the inherent benefit of its massive person base, Coinbase has shortly turn into the second-largest liquid staking protocol with over $2 billion TVL inside 12 months.

The LSD utility token on the platform is named the Coinbase Wrapped Staked ETH, or simply cbETH for brief. It’s an ERC-20 token generated in alternate in your staked ETH in a 1:1 ratio. However since it’s a wrapped token, the costs of cbETH will are typically decrease than the market worth of ETH, and the 1:1 worth just isn’t pegged.

You should buy and stake ETH utilizing the Coinbase app. The wrapped cbETH will be traded on the alternate or moved on-chain and be utilized in numerous different DeFi tasks on platforms like Curve Finance and Aave. As a substitute of staking ETH, you may as well purchase the wrapped token straight.

Because of the platform bills and different charges concerned, cbETH staking rewards are typically decrease than different decentralized protocols within the liquid staking scene. If you happen to already use Coinbase actively for buying and selling and staking ETH, cbETH could possibly be a very good choice for the sheer sake of familiarity and ease of entry.

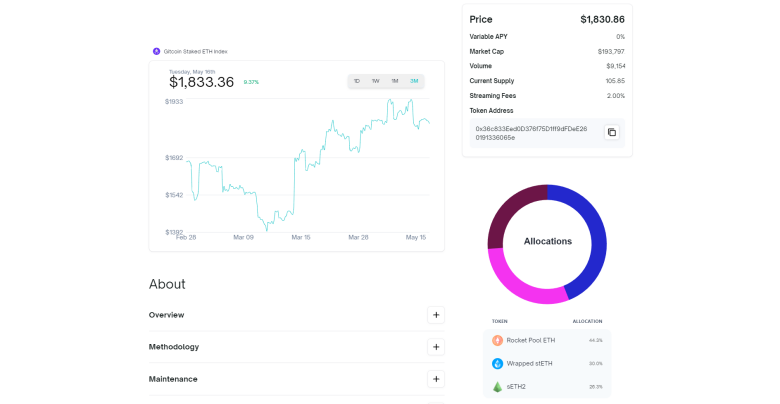

Gitcoin Staked Ethereum Index

Gitcoin Staked Ethereum Index

Minimal Stake: 1.01 ETH

Whole Worth Locked (TVL): N/A

Market Share: N/A

Investing in a single LSD token can expose you to some extent of threat from volatility. Spreading your ETH throughout a number of liquid staking providers can mitigate this to some extent, however it isn’t very handy.

Investing in an index token that offers you publicity to the highest LSD tokens available in the market is a extra handy and secure different. One such choice on this area comes from a DAO known as Index. It was launched by Set Labs in October 2020 with the purpose of decentralizing the blockchain finance ecosystem.

Index has launched a number of index tokens that concentrate on main LSD tokens from Lido, Rocket Pool, and StakeWise. One such token with a public service motive is the Gitcoin Staked Ethereum Index. The LSD token right here is named gtcETH.

Shopping for gtcETH offers you publicity to the key LSD tokens whereas accruing staking rewards. Index collects a 2.00% streaming payment on the platform. Out of this, 1.75% is paid out to Gitcoin, an open-source, decentralized platform that focuses on funding public items tasks within the Ethereum ecosystem.

Investing in gtcETH is like not directly subscribing to Gitcoin – you’re mainly contributing funds to their tasks whereas concurrently incomes a portion of staking rewards. As a consequence of that streaming payment, rewards on gtcETH are among the many lowest of all liquid staking providers. It’s a worthy choice for ETH stakers who need to diversify whereas contributing to Gitcoin initiatives.

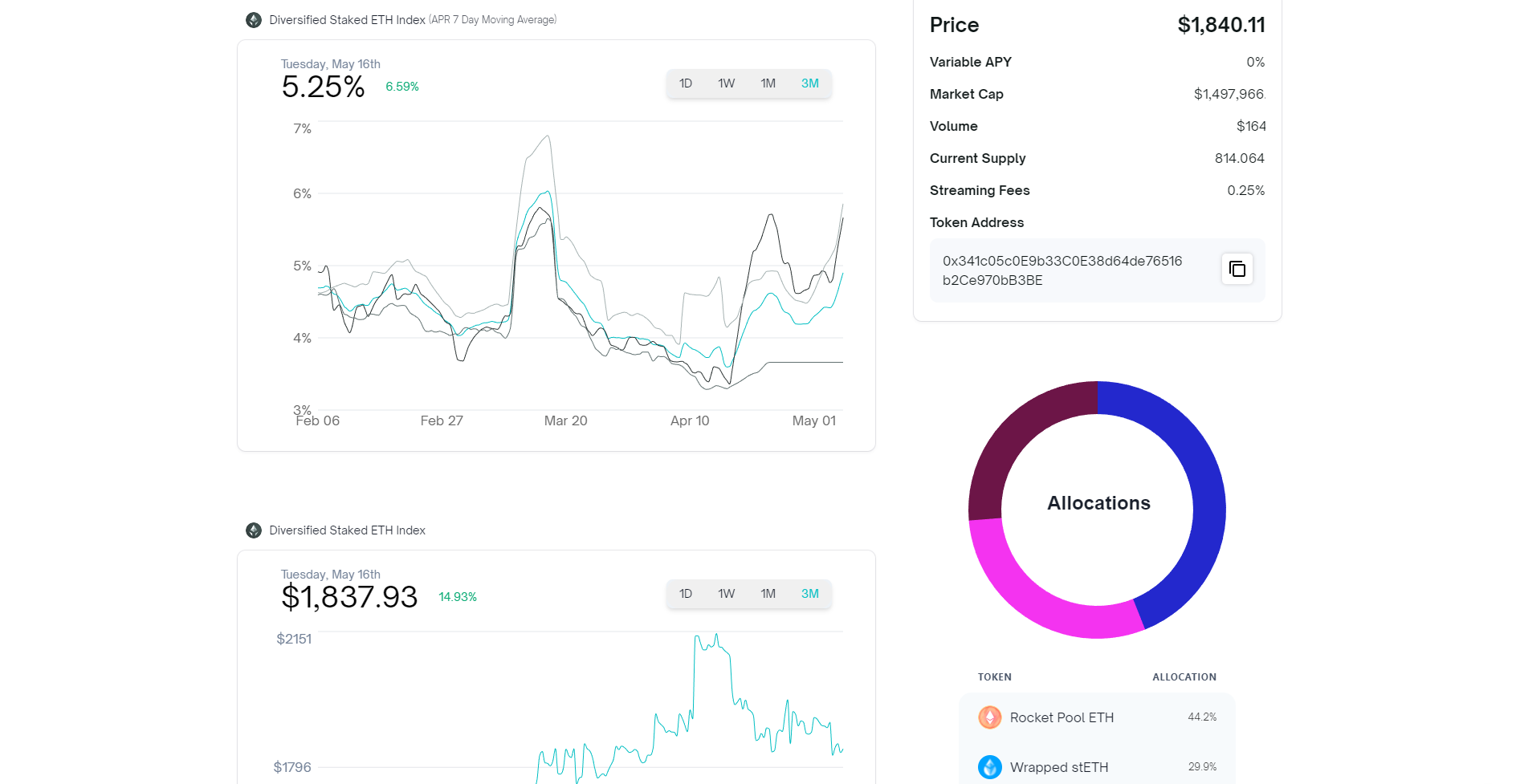

Diversified Staked Ethereum Index

Diversified Staked Ethereum Index

Minimal Stake: 1.01 ETH

Whole Worth Locked (TVL): N/A

Market Share: N/A

That is the second index token from Index DAO. Just like the Gitcoin Index, the Diversified Index tracks the key liquid staking tokens like Lido’s stETH and Rocket Pool’s rETH. However in contrast to the opposite challenge, this one guarantees greater rewards.

Streaming charges exist, however right here, you’re simply paying the essential 0.25% payment to the Index Coop. The LSD token is named dsETH, and you should buy it on most decentralized exchanges. An alternative choice is to get it by redeeming ETH on the Certainly Coop App by a course of dubbed Flash Minting.

Each gtcETH and dsETH are nearly equivalent, save for the extra funding to Gitcoin within the former. They each enable holders to earn passive earnings whereas spreading the danger throughout a number of LSD tokens within the market.

Within the course of, you may as well contribute to the general decentralization of the Ethereum staking ecosystem. dsETH rewards are akin to different main LSD tokens like Rocket Pool or Coinbase, at a mean of 5% APY.

Investor Takeaway

The liquid staking spinoff area is a quickly evolving market. Traders have already got entry to a plethora of LSD tokens, every with distinctive benefits and weaknesses.

For buyers who need the token with essentially the most market share, Lido is the undisputed champion. However issues exist concerning its potential menace to the long-term decentralization of the Ethereum community.

If excessive returns are a precedence, Frax and StakeWise are the optimum decisions with the very best APY amongst main tokens.

For buyers involved about over-centralization within the Ethereum ecosystem, there’s most likely no higher choice than Rocket Pool.

If you happen to prioritize diversification above all else and need to reduce threat as a lot as attainable, take into account investing in an index token like dsETH on the Index Coop app.

And if you’re a Coinbase common, the on-chain cbETH might be the most secure, best choice for buyers who don’t thoughts the centralized structure.