Binance clients don’t appear to be significantly affected by the Securities and Trade Fee’s (SEC) lawsuit towards the world’s largest crypto trade by buying and selling quantity.

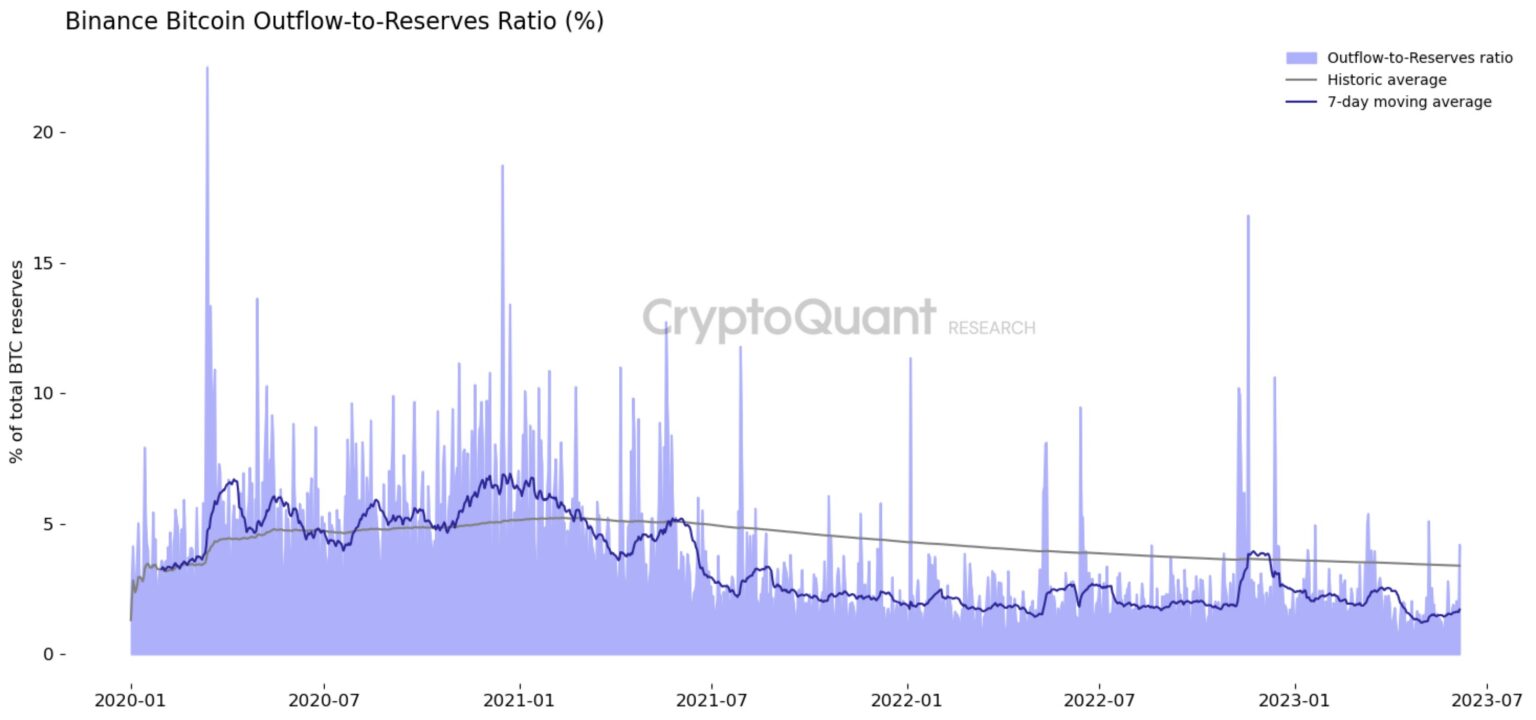

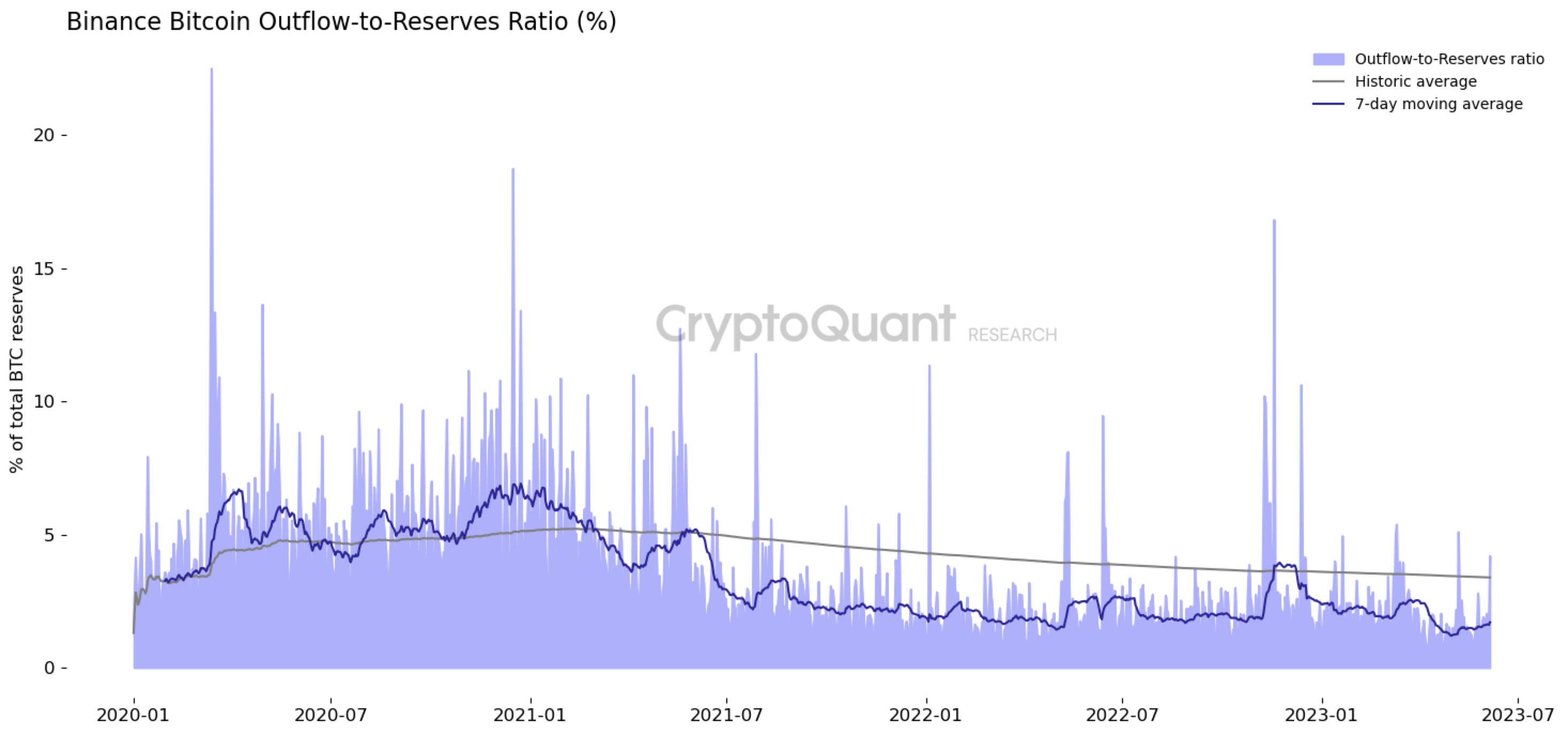

In accordance with knowledge shared by Ki Younger Ju, the CEO says that Binance did endure outflows of 10,000 Bitcoin (BTC), the most important withdrawal complete of 2023.

However that outflow appears much less statistically important when taking a look at a zoomed-out time chart, based on Ki Younger Ju.

The influence of 10k $BTC outflows on Binance.https://t.co/1TXeqp1lnZ

— Ki Younger Ju (@ki_young_ju) June 5, 2023

Julio Moreno, head of analysis at CryptoQuant, additionally notes that Binance’s Bitcoin Outflows-to-Reserves Ratio stays low.

Crypto costs crashed throughout the board on Monday after information broke that the SEC launched a lawsuit towards Binance and its CEO Changpeng Zhao. The regulator alleges the trade violated investor safety and securities legal guidelines.

The grievance additionally zeroes in on BNB, Binance’s native token, and BUSD, the trade’s stablecoin, which was already focused by regulators earlier this yr. In accordance with the SEC, Binance unlawfully engaged in unregistered gives and gross sales of “crypto asset securities.”

The SEC then continued its regulatory crackdown on Tuesday with an announcement that it’s suing high US crypto trade Coinbase. The regulator alleges the corporate operated as an unregistered securities trade, dealer, and clearing company.

Regardless of the second lawsuit, digital asset costs jumped on Tuesday, with the general crypto market cap witnessing a 4.2% enhance previously 24 hours at time of writing.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Generated Picture: Midjourney