The PWN DAO Basis, linked to the peer-to-peer lending protocol PWN, has launched a complete report analyzing user-incurred onchain charges inside main blockchain networks and decentralized functions (dapps) for the previous yr. The 2023 evaluation examines Ethereum, BNB Chain, Bitcoin, and layer two (L2) options, together with widely-used dapps similar to Aave and Uniswap. The report sheds mild on the first developments in charge era and discusses the altering patterns of blockchain utilization and income.

2023’s L1 and L2 Price Technology Stats Revealed

The report revealed by PWN, illustrates a various panorama of onchain charge era, underscoring a 33% general discount in charges throughout the chosen tasks in comparison with the earlier yr. This pattern was notably pronounced in non-fungible token (NFT) marketplaces, which skilled an 87% drop in charge era. In distinction, L2 options exhibited vital development of round 411%, indicating a shift in person preferences and platform utilization.

Screenshot from PWN’s research referred to as the “Crypto Native Economic system Report.”

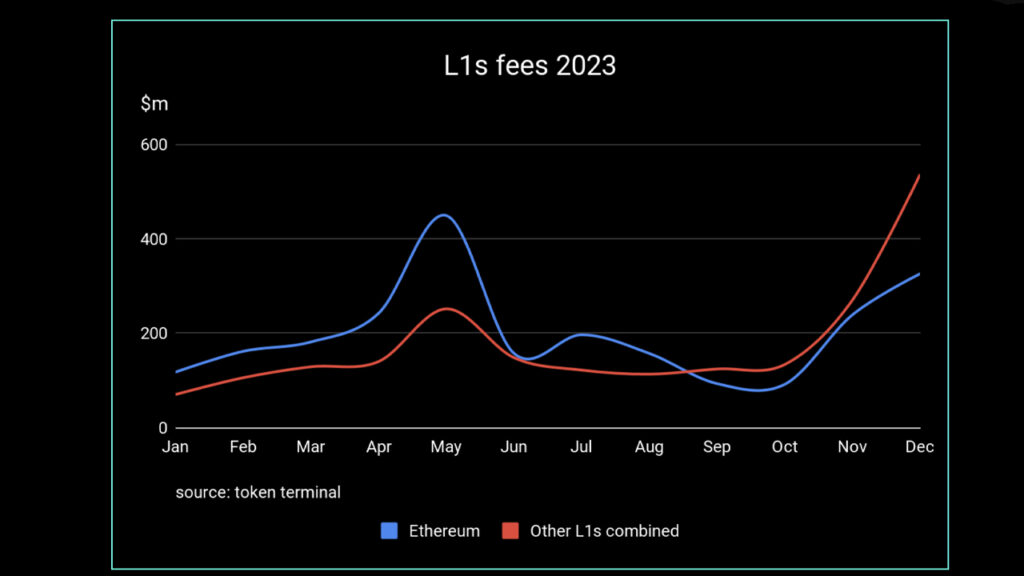

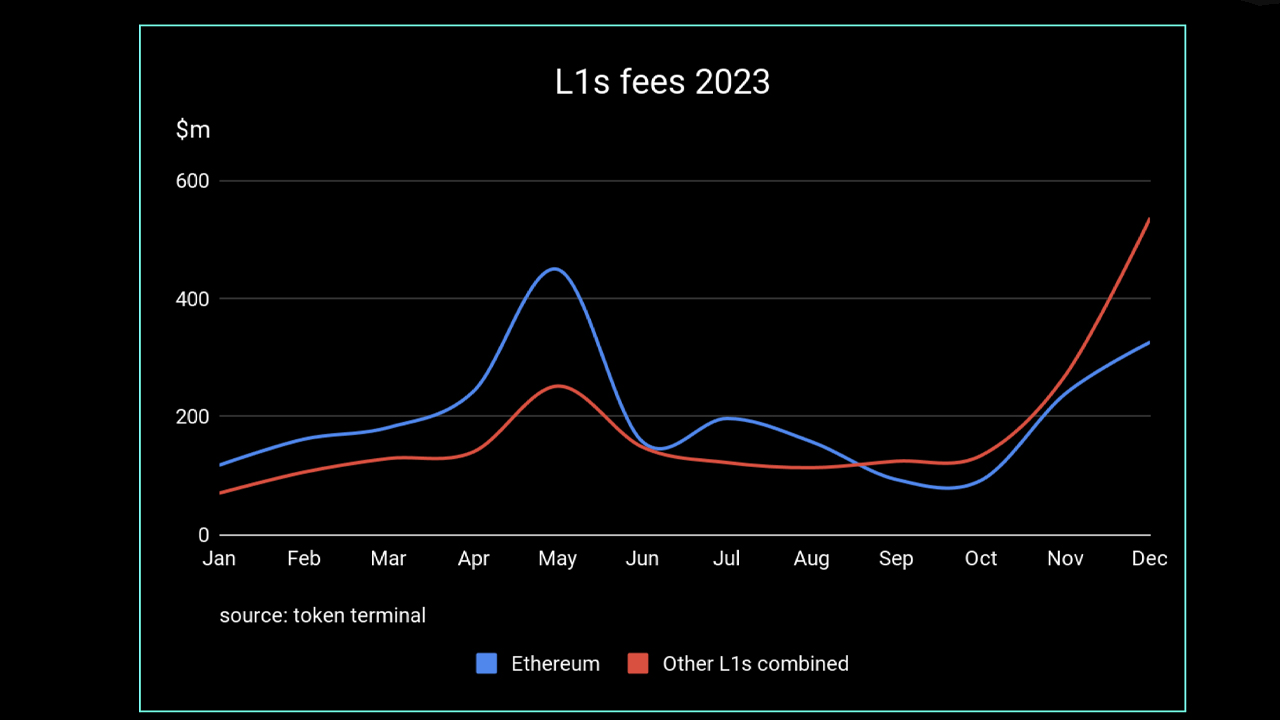

The research exhibits layer one (L1) blockchains, regardless of a slight lower, continued to dominate the charge market, accounting for 59% of all charges, up from 48% in 2022. Ethereum, sustaining its place as a market chief, confirmed a notable 44% decline in charges, partly because of the migration of actions to L2 networks.

“The rising charges generated by [L2s] sign widespread adoption and a major impression on person expertise,” the research’s researchers element.

The report additionally highlights vital adjustments in particular person blockchain platforms. Bitcoin, Tron, and Polkadot noticed probably the most substantial development in charge era, with Bitcoin’s charges surging by 461%. The rise in Bitcoin community charges was attributed to the recognition of Ordinal inscriptions, a novel embedding utility inside the Bitcoin community, marking a notable shift in its utilization dynamics. As of Jan. 29, 2024, the rely of Ordinal inscriptions on the Bitcoin blockchain has impressively surpassed the 58 million mark.

Decentralized exchanges (dexs) witnessed a 51% lower in charge era, with Uniswap rising as a dominant participant, securing 64% of dex-generated charges. The report means that regardless of the decline in charges, the buying and selling quantity on dex platforms remained comparatively secure, pointing to an evolving relationship between buying and selling exercise and charge buildings within the decentralized finance (defi) sector.

The report concludes by discussing liquid staking derivatives (LSDs) which confirmed a major 93% improve in charge era, highlighting the rising curiosity in staking options inside the crypto-native economic system. The report notes that Lido Finance, the LSD chief, collected a good portion of those charges, reflecting the platform’s sturdy place available in the market.

Because the panorama evolves, with person preferences gravitating in the direction of extra environment friendly and revolutionary platforms, it’s clear that the blockchain ecosystem is repeatedly present process a transformative section. This evolution paves the way in which for rising applied sciences and methods, probably redefining the way forward for blockchain utility and financial fashions within the crypto house.

What do you concentrate on PWN’s report surrounding L1s and L2s, dapps and charge era? Tell us what you concentrate on this topic within the feedback part under.