- BTC was up by greater than 15% within the final seven days.

- Shopping for strain on the coin was excessive, however its RSI and CMF urged a pattern reversal.

Over the previous couple of days, Bitcoin [BTC] has come a great distance because it surpassed the $43,000 mark. As reported earlier by AMBCrypto, crossing the $42,500 mark was a activity for the king of cryptos, which it has accomplished efficiently.

Due to this fact, ought to traders now anticipate BTC to rise above $50,000 anytime quickly?

Bitcoin crosses a key degree

As reported by AMBCrypto, BTC’s liquidation elevated close to the $42,500 mark within the latest previous. Due to this, it was essential for the coin to go above that degree to be able to attain a brand new excessive. Fortunately, Bitcoin managed to beat that barrier.

In keeping with CoinMarketCap, BTC was up by greater than 15% within the final seven days.

On the time of writing, it was buying and selling at $43,990.87 with a market capitalization of over $860 billion. The opportunity of BTC reaching $50,000 appears excessive primarily based on its worth pattern.

The truth is, Ali, a preferred crypto analyst, just lately posted a tweet highlighting a bullish indicator. As per his tweet, BTC’s realized worth was surpassing the long-term Holder worth.

Usually, which means that the market is gaining momentum, with newer traders prepared to purchase at increased costs.

Simply in case you want one other bullish affirmation sign!#Bitcoin Realized Worth is now surpassing the Lengthy-Time period Holder Realized Worth, indicating that the #crypto market is gaining momentum, with newer traders prepared to purchase at increased costs.

This may be seen as a… pic.twitter.com/emeUZzkS5l

— Ali (@ali_charts) December 6, 2023

He added that,

“This may be seen as a bullish signal, exhibiting confidence in BTC’s future efficiency. The final thrice this occurred, BTC skyrocketed 12,736%, 4,474%, and 819%, respectively.”

A more in-depth take a look at Bitcoin’s state

AMBCrypto then took a take a look at Bitcoin’s on-chain metrics to find out whether or not the opportunity of BTC touching $50,000 was seemingly.

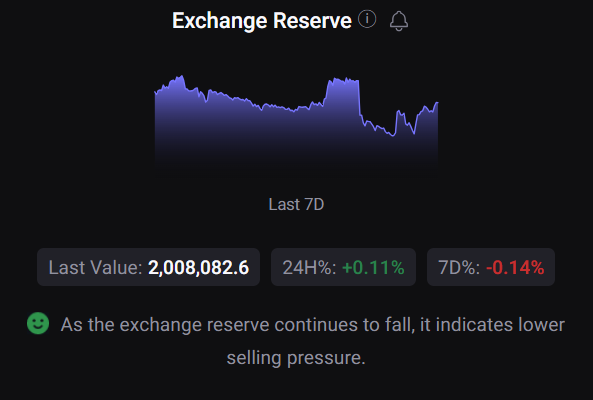

Our evaluation discovered that BTC’s trade reserve was dropping, which means that purchasing strain on the coin was excessive.

Supply: CryptoQuant

Shopping for sentiment amongst US traders was additionally excessive as its Coinbase premium was inexperienced.

Moreover, issues within the derivatives market seemed optimistic as effectively. BTC’s funding fee was excessive, suggesting that futures traders had been actively shopping for BTC at its increased worth.

The truth that shopping for sentiment within the derivatives market was excessive was additionally confirmed by its taker-buy-sell ratio, which was inexperienced.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Although the aforementioned metrics look optimistic, BTC’s day by day chart revealed a unique story. As per AMBCrypto’s evaluation, BTC’s Relative Power Index (RSI) was within the overbought zone, which may improve promoting strain.

Its Chaikin Cash Move (CMF) additionally registered a downtick, growing the probabilities of a worth correction within the days to observe.

Supply: TradingView