- Miner charges accounted for 4.38% of the block subsidies on common in 2023.

- The hashrate dramatically climbed in September after staying muted throughout summer season.

Bitcoin [BTC] mining stays one of many essential foundations on which the edifice of the Bitcoin blockchain stands. Chargeable for bringing new cash into circulation and validating transactions on the community, the method has now advanced right into a full-fledged trade as of this writing.

Analysts and buyers maintain an in depth eye on traits related to the ecosystem, to take a position on the following strikes of not simply the native Bitcoin however the broader crypto market.

Learn BTC’s Value Prediction 2023-24

Community charges decline QoQ

Hashrate Index lately launched its Q3 Bitcoin mining report, offering an summary of modifications that occurred within the final three months. The report additionally said a few of the key efficiency indicators.

The share of transaction charges of all block rewards in Q3 2023 was 2.7%. This represented a pointy decline from 8.17% seen within the final quarter.

Regardless of the quarter-over-quarter dip (QoQ), 2023 has been extra type to miners. So far, miner charges accounted for 4.38% of the block subsidies on common. In distinction, the typical through the crypto winter of 2022 was beneath 1.64%.

Supply: Hashrate Index

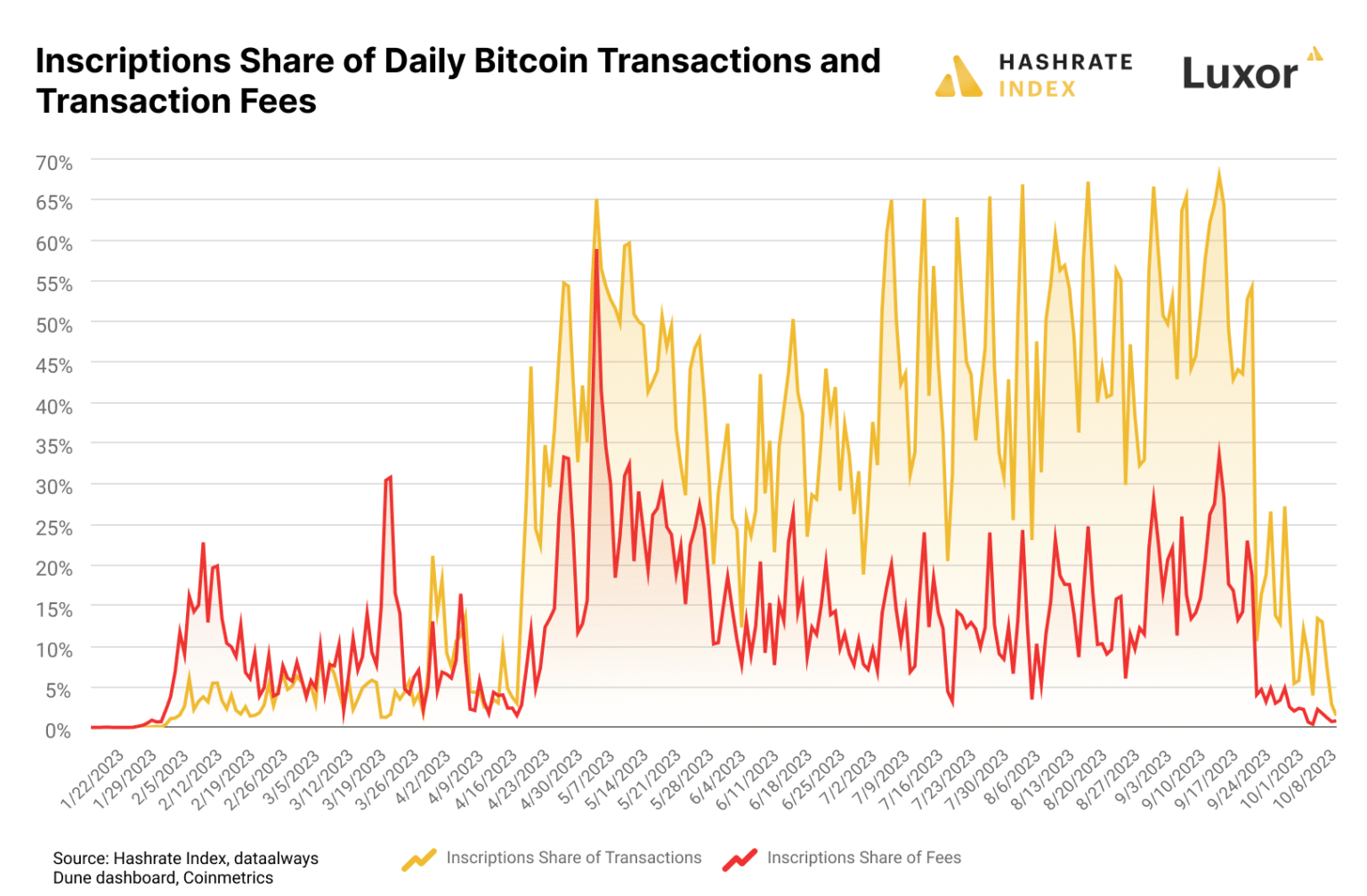

As indicated above, the drop in charges coincided with the regular drop in Ordinals-related transactions. Earnings from final quarter had been boosted by the explosive spike of such transactions in early Could. Nevertheless, there was a marked decline since then. In truth, Ordinals’s share of charges plunged to the bottom ranges since Q1 in October.

Charges paid to miners for validating transactions stay one of many barometers of the mining sector. Miners use block rewards to offset the prices related to mining tools and electrical energy. Whereas one part of it’s mounted, huge fluctuations within the transaction payment half might adversely have an effect on miners’ economics and switch them away from the sector.

Hash Charge jumps after summer season shutdown

The hashrate is a operate of rising community visitors. A rising hashrate implies that miners need to spend money on extra computational energy to validate blocks.

Reportedly, 2023 noticed a repeat of the sooner patterns seen within the hashrate trajectory. For the summer season months of June, July, and August, detrimental progress was noticed. Nevertheless, since September, the hashrate began to climb and maintained the uptrend until Could.

Supply: Hashrate Index

The report linked the drop in summer season months to voluntary curtailment by U.S.-based mining corporations.

The nation’s Bitcoin mining hub, Texas, usually faces excessive warmth throughout these months. This leads to peak demand for electrical energy. As a part of an settlement with the state’s electrical grid operator, mining corporations energy down their rigs throughout this time in order to not overstress the grid. In return, mining corporations obtain vitality credit from ERCOT which may go into hundreds of thousands of {dollars}.

Hash worth traits decrease

Hashprice is a well known mining metric that measures miner income on a per terahash foundation. Put merely, it gauges miners’ profitability. It’s depending on two components — Bitcoin’s market worth and the community hash price. Whereas it’s positively correlated to Bitcoin’s worth, it responds negatively to modifications in hash price.

Based on the report, Bitcoin’s common worth in Q3 was $28,100 as in comparison with the 2023 common of $26,350 so far. The noticeable enhance in market worth countered the detrimental impact of hashrate enhance on hashprice.

Supply: Hashrate Index

Having mentioned that, hashprice trended downwards from August onwards. The common for September plunged to $61.71/PetaHashes/day, harking back to the lows seen through the peak of the crypto winter in late 2022.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

ASIC costs hit lows

It’s common information that specialised {hardware}, like Utility-Particular Built-in Circuits (ASICs), are used to mine Bitcoins as of late. Miners spend money on extra refined ASIC units that suck much less vitality per TeraHash of computing energy.

Nevertheless, because of the decline in hashprice, many mining rigs went into losses, in flip pulling the value of machines down in Q3. Costs for machines within the decrease effectivity class plunged even additional as miners rushed to money in.

Supply: Hashrate Index

On a shiny word, Q3 witnessed the launch of the Antminer S21 by Bitcoin ASIC producer Bitmain. The brand new mannequin is the first-ever Bitcoin mining ASIC to realize an effectivity underneath 20 J/TH.