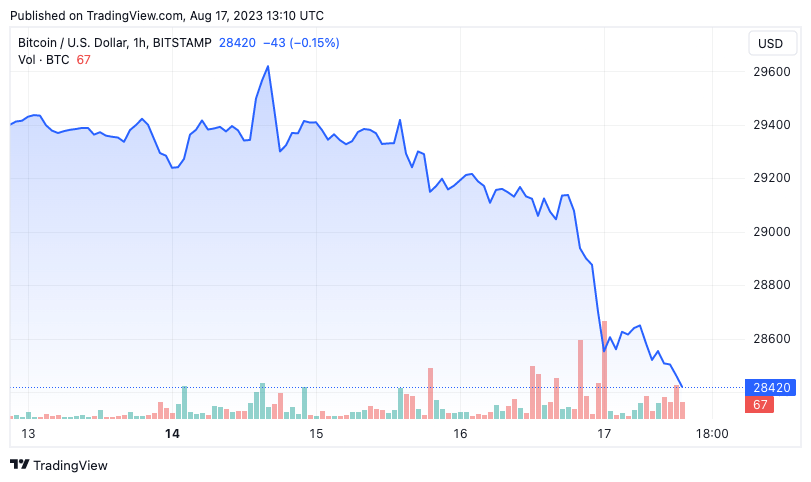

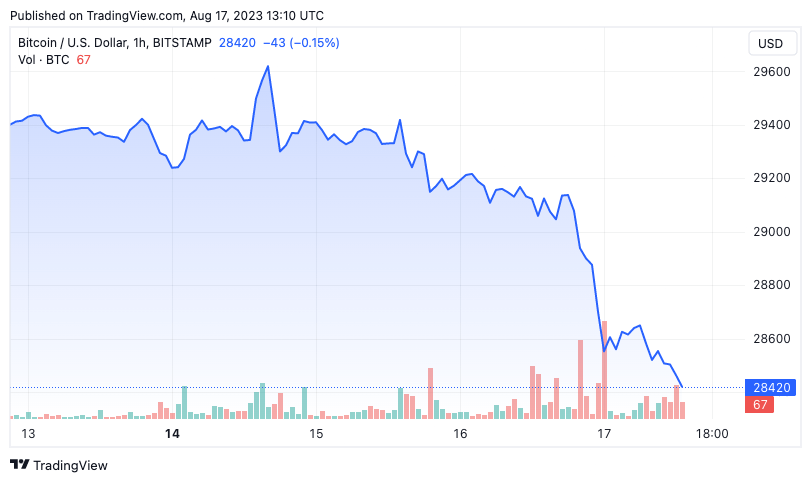

On Aug. 17, Bitcoin’s value dropped under the $29,000 mark, settling round $28,500. Whereas this decline might sound insignificant given Bitcoin’s traditionally unstable nature, the context of its latest buying and selling vary magnifies the significance of this transfer.

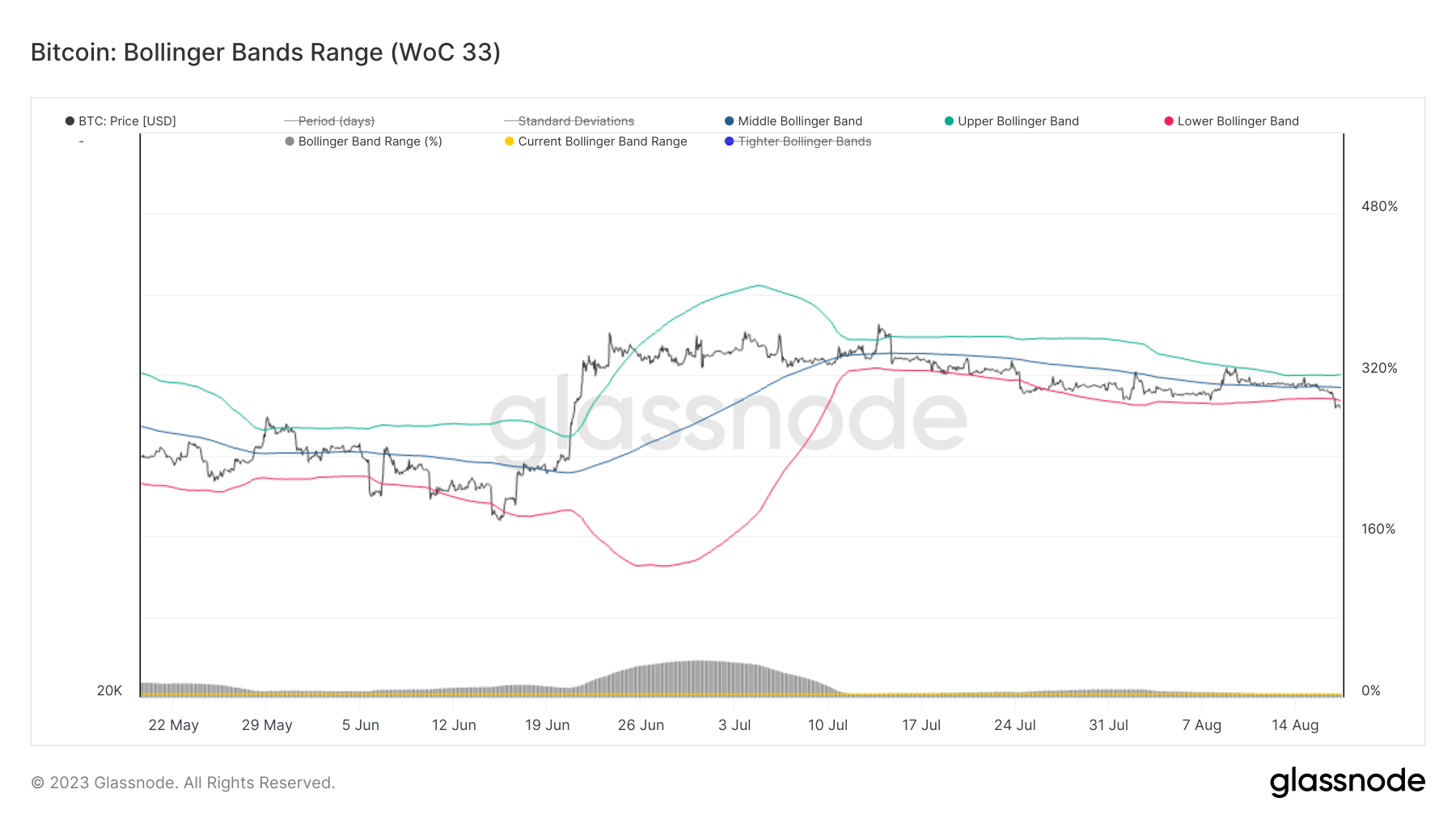

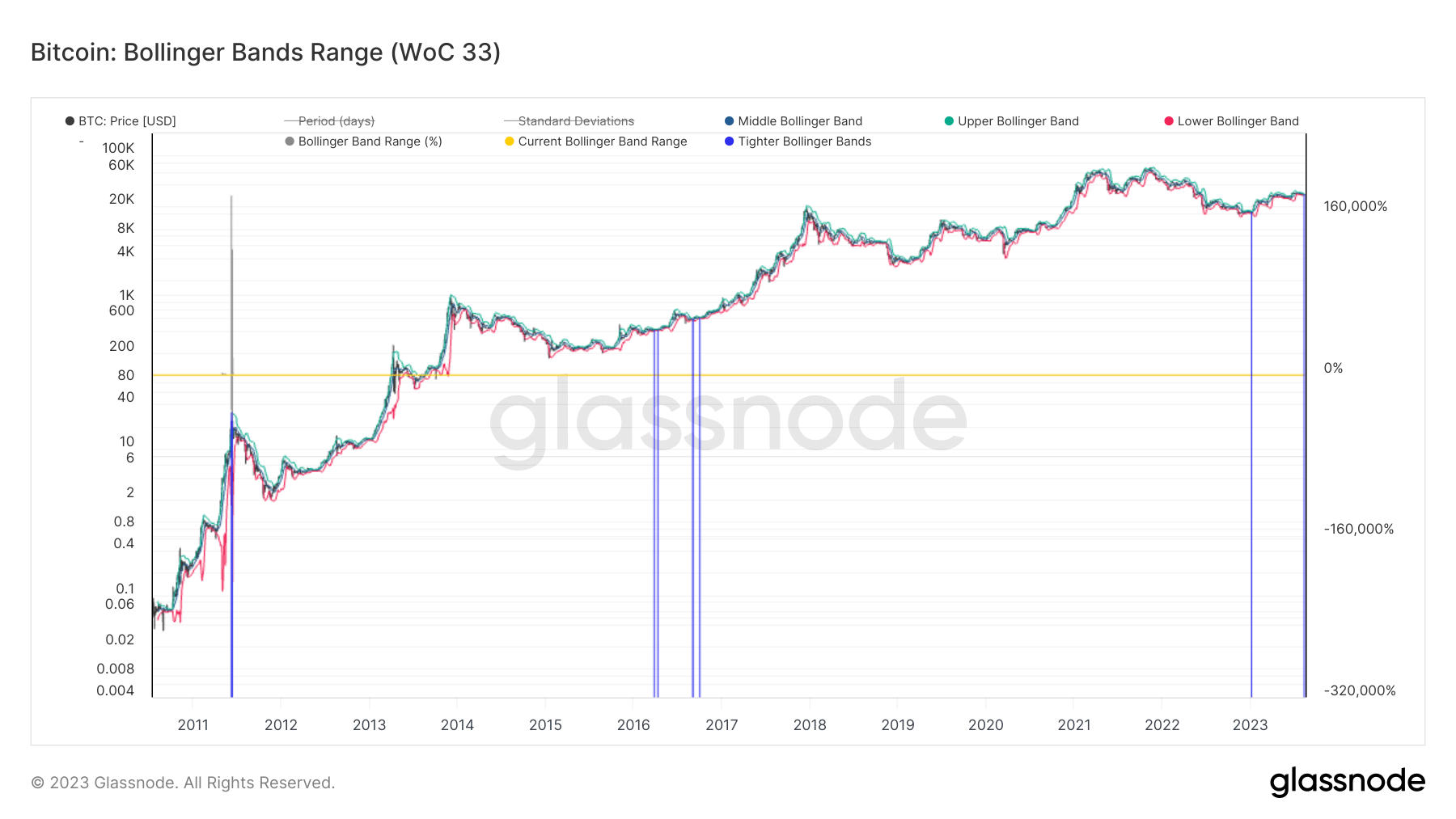

Bollinger Bands are a monetary device used to evaluate the value volatility of varied belongings, together with Bitcoin. The bands comprise three strains — one central line and two outer ones. The central line on the chart represents the easy shifting common (SMA) of the asset’s value, whereas the outer bands are decided by the usual deviation, a measure indicating how unfold out the costs are from the typical.

These bands widen during times of excessive volatility and contract throughout low volatility. These bands are a vital market indicator, serving to merchants establish potential purchase and promote indicators. When an asset’s value strikes exterior these bands, it will possibly point out a major value motion within the breakout route.

August has seen Bitcoin’s value volatility plummet to historic lows. Earlier than right now’s drop to $28,500, the higher and decrease Bollinger Bands had been separated by a mere 2.9%. Such a good unfold has solely been witnessed twice in Bitcoin’s historical past. With the descent to $28,500, Bitcoin’s value breached the decrease Bollinger Band, which stood at $28,794. Consequently, the Bollinger Band vary expanded barely to three.2%.

Historic information means that when Bitcoin’s value breaks under the decrease Bollinger Band, it’s typically adopted by a swift restoration and an upward trajectory. This sample has been noticed a number of occasions, reinforcing the importance of the Bollinger Bands as a predictive device.

Moreover, each occasion of extraordinarily tight Bollinger Bands in Bitcoin’s historical past has preceded a notable value swing. For example, a number of occurrences of equally tight bands had been recorded in 2016. This era was the precursor to the rally that propelled Bitcoin to its all-time excessive in 2018. Extra lately, in January 2023, Bitcoin’s value remained stagnant at round $16,800, with the bands indicating low volatility. Shortly after, Bitcoin surged, almost doubling its worth to $30,000.

So, what do these observations suggest for the market? The present tightness of the Bollinger Bands, mixed with Bitcoin’s value motion under the decrease band, suggests a possible for a major value upswing within the close to future.

The submit Bitcoin at $28.5K: Unpacking the importance of tight Bollinger Bands appeared first on CryptoSlate.