- BTC nudged previous $26,000 following CPI’s information announcement.

- Maximalists reiterated that the normal monetary system couldn’t cease Bitcoin’s development.

Bitcoin [BTC] continued its unprecedented bullish run and climbed above $26,000 as america Bureau of Labor Statistics launched its February Client Value Index (CPI) information. In accordance with the nation’s fact-finding company, the CPI dropped to six% on a 12 months-on-12 months (YoY) foundation.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

The CPI expresses the change within the present costs of products in a given 12 months in comparison with the costs inside a base interval. The metric used to measure inflation rose to six.4% per January’s information. Nevertheless, the 14 March declaration implied that the CPI had dropped for the eighth consecutive month, hitting the bottom since September 2021.

Preparedness, backtracks, and the proceeds of warning

After the announcement, BTC solely took a couple of minutes to achieve the aforementioned value. However at press time, the coin had misplaced its maintain on the area and was buying and selling at $24,967.

Nevertheless, CNBC’s report on the state of affairs talked about that Signature and Silicon Valley Financial institution crashes have now ignited the speculation {that a} hike in Fed charges would stop for some time.

The Fed assembly determines financial coverage and assesses the long-term targets of value stability and financial development. With the subsequent one billed for 22 March, the patron information and enterprise channel identified:

“Banking sector turmoil in latest days has kindled hypothesis that the central financial institution may sign that it quickly will halt the speed hikes.”

Previous to the announcement, BTC and lots of different cryptocurrencies have been pricing at a peak. However earlier than the coin hit its 12 months-To-Date (YTD) excessive, some traders have been bullish on the response. In accordance with Lookonchain, a pseudonymous whale named “Rewkang” elevated his lengthy BTC place hours earlier than the CPI report.

2 hours earlier than the #CPI announcement, the GMX whale(@Rewkang) elevated their lengthy positions of BTC.

At present, his common entry value is $23,608, and the revenue is $2.5M.https://t.co/M7t9jcxzYB pic.twitter.com/oqL5CsZGqS

— Lookonchain (@lookonchain) March 14, 2023

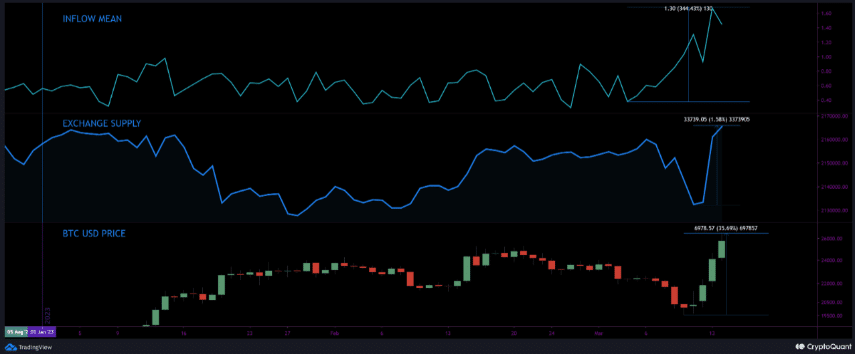

An hour after CPI, CryptoQuant analyst “Papi” took to the platform to warn traders, predicting that there may very well be a brief retracement.

In accordance with him, the $25,000 intraday restoration may set off large profit-taking because of the change move spike. A rise in change move often interprets to intent to promote. Typically, it results in a value decline.

Supply: CryptoQuant

Papi acknowledged that the macroeconomic elements and developments from the banking arm have been different facets to look at.

How a lot are 1,10,100 BTCs price in the present day?

BTC loyalists: By no means to give up

Nevertheless, it appeared that the Bitcoin pattern has assured a lot of its devoted that neither banks nor regulators. Reacting to the worth improve, CEO of Custodia Financial institution and Bitcoin maximalist Caitlin Lengthy famous that the occasions of the previous few days have confirmed why the king coin has a greater working system than the normal banks. She stated:

“The Fed has now damaged precedent, turning all the banking system into “systemically necessary” successfully bailing out ALL banks. The Fed has simply become a Leveraged Lender with a powerful incentive to decrease charges.”

Financial institution regulators: “chancellor getting ready to a second bailout for banks”🤬#Bitcoin: “maintain my beer”🍻 (up >30% since SVB financial institution run Thursday) pic.twitter.com/LaxYqr035l

— Caitlin Lengthy 🔑⚡️🟠 (@CaitlinLong_) March 14, 2023

Amid the banking business crises, fairly a lot of traders look to have turned to Bitcoin for security. It’s shocking that it has repaid the belief inside a brief interval regardless of its long-term underwhelming efficiency. Nevertheless, seasoned dealer Peter Brandt tweeted that he was not shocked that BTC obtained rejected at $26,000.

Not stunned 26,000 rejected advance pic.twitter.com/nUQkNAtI1t

— Peter Brandt (@PeterLBrandt) March 14, 2023

![Bitcoin [BTC] breaks $26k, CPI drops – is the euphoria back](https://cryptosemantic.com/wp-content/uploads/2023/03/Screenshot-2023-03-14-at-17.01.23.png)