- Bitcoin and Ethereum defy destructive market sentiment, witnessing a buying and selling quantity surge to month-high ranges.

- Merchants preserve a constructive outlook on BTC and ETH as flows stay destructive.

Bitcoin and Ethereum, together with the complete cryptocurrency market, responded to the current transfer by the Safety and Alternate Fee (SEC). Nonetheless, there was a notable turnaround following the noticeable decline in buying and selling exercise triggered by the SEC’s newest motion.

Reasonable or not, right here’s ETH’s market cap in BTC phrases

Bitcoin and Ethereum quantity surge to month-high

Following the SEC’s announcement that Binance US and Coinbase have been dealing with authorized motion, main cryptocurrencies, together with Bitcoin and Ethereum, skilled a decline in each value and buying and selling quantity. This decline could possibly be attributed to FUD as market individuals noticed the general market response.

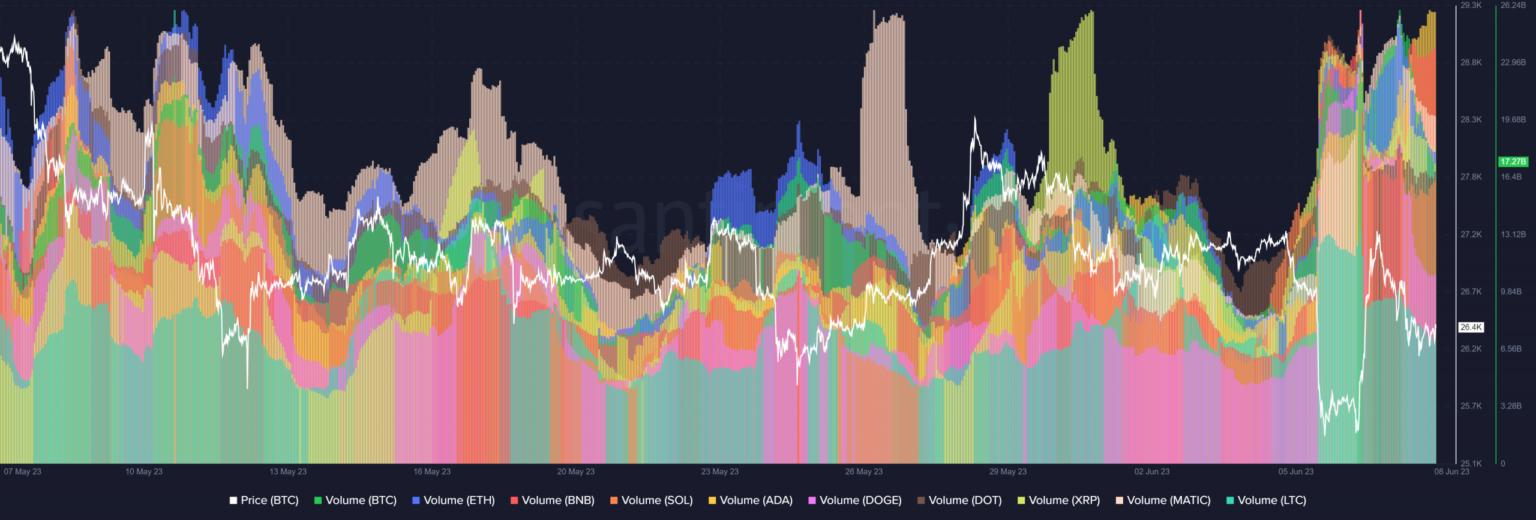

Nevertheless, a big resurgence in buying and selling quantity has been witnessed throughout the market after the preliminary dip on 5 June, igniting renewed curiosity in dip buys and panic sells.

Supply: Santiment

Santiment knowledge revealed that Bitcoin and Ethereum reached their highest month-to-month quantity ranges.

Analyzing the chart, it turned obvious that Bitcoin’s quantity exceeded 20 billion after the decline on June 4. It briefly dropped to round 8 billion on that day however shortly spiked the next day, reaching its peak for the month.

Equally, Ethereum’s quantity dipped to roughly 3 billion on June 4 however surged to round 10 billion within the subsequent days. As of this writing, Ethereum’s quantity has already reached round 7 billion.

This spike in quantity was not restricted to Bitcoin and Ethereum alone however was additionally noticed in different cryptocurrencies like Binance Coin (BNB), Solana, and Cardano.

Bitcoin and Ethereum see a destructive move

Analyzing the Netflow knowledge of Bitcoin and Ethereum on CryptoQuant revealed a constant destructive move over the previous few days. This advised that sellers reasonably than patrons have primarily pushed the current surge in buying and selling quantity.

Particularly, analyzing the Netflow metric of Bitcoin, it spiked to over -10,000 on June 7. It represented the best move recorded within the month. As of this writing, the Netflow remained on the destructive facet, surpassing 1,000.

Supply: CryptoQuant

Ethereum’s Netflow additionally skilled a spike in destructive territory on 5 June, reaching roughly -360,000, marking its highest move for the month thus far. As of this writing, the Netflow for ETH already exceeded 9,000 on the destructive facet.

Supply: CryptoQuant

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Analyzing present market sentiment

Coinglass knowledge indicated that regardless of the prevailing market sentiment, merchants maintained a constructive outlook on Bitcoin and Ethereum. This optimism is mirrored within the funding fee metric, which revealed that merchants positioned their bets on a value improve for these two property. As of this writing, the funding fee remained constructive for BTC and ETH on most exchanges, indicating the prevailing sentiment amongst merchants per Coinglass.