- Month-to-month commerce quantity for each property stayed muted over a lot of Q2 and July to date.

- BTC and ETH deposits to exchanges have been on a downward spiral for weeks.

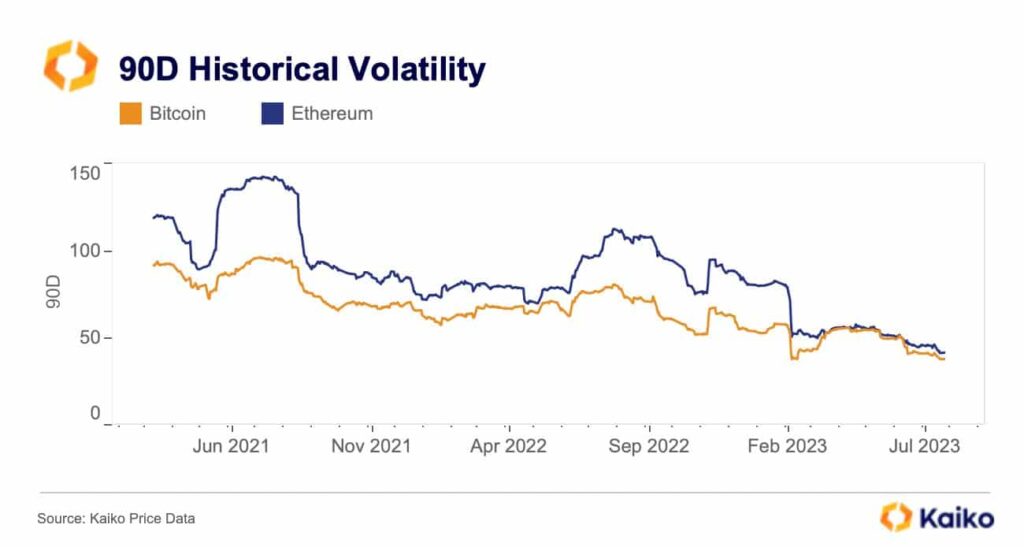

The continuing quiet within the crypto market has put the highlight again on one of many most-talked about matters within the sphere – volatility.

Are your BTC holdings flashing inexperienced? Take a look at the Bitcoin Revenue Calculator

Based on digital property information supplier Kaiko, the 90-day annualized volatility for Bitcoin [BTC] and Ethereum [ETH] plunged to two-year lows, giving a 360-degree flip to the historic debate over cryptos’ excessive volatility.

Supply: Kaiko

Inactivity engulfs crypto markets

The 2 largest cryptos by market cap have held on to their positive factors for greater than a month for the reason that final significant rise in June. Whereas the king coin stagnated within the $29k-$31k vary, Ethereum buyers waited for an enormous breakout from the cussed $1.85k-$1.95k zone, as per CoinMarketCap.

One other testomony to the market’s dwindling volatility was the Bollinger Bands (BB) indicator. For the reason that June rally, the bands have constricted for each property, serving as proof that vertical motion was missing.

Supply: Buying and selling View

Persevering with drop in commerce volumes

What seemed like the start of one other prolonged bull market in June plummeted to a moist squib for a lot of buyers. As evident from Token Terminal, BTC’s month-to-month commerce quantity stayed muted over a lot of Q2 and July to date.

Supply: Token Terminal

On related traces, the frequency at which ETH exchanged palms went down considerably over the previous few months with July exhibiting little indicators of enchancment.

Supply: Token Terminal

The dip in buying and selling exercise could possibly be as a result of shrinking liquid provide i.e, the variety of tokens obtainable for purchasing and promoting within the secondary market.

Based on on-chain analytics agency Glassnode, BTC and ETH deposits to exchanges have been on a downward spiral for weeks, hitting multi-year lows on the time of writing.

Supply: Glassnode

Not a foul signal, is it?

Such giant withdrawals could be defined by both a shift to a long-term holding technique or a willingness to maintain one’s funds in self-custody.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

The concept of utilizing crypto property as a protected haven has began to achieve mainstream consciousness amidst a steeper decline in asset lessons that are thought-about much less dangerous. The current curiosity proven by TradFi giants has additionally helped to strengthen this narrative.

On this backdrop, the declining volatility, although an irritant for lively merchants, had the potential to cement crypto as a respectable asset class for buyers with various levels of threat tolerance.