- Bitcoin’s provide on centralized exchanges has fallen persistently since 2020.

- This meant coin holders have more and more adopted a long-term funding outlook.

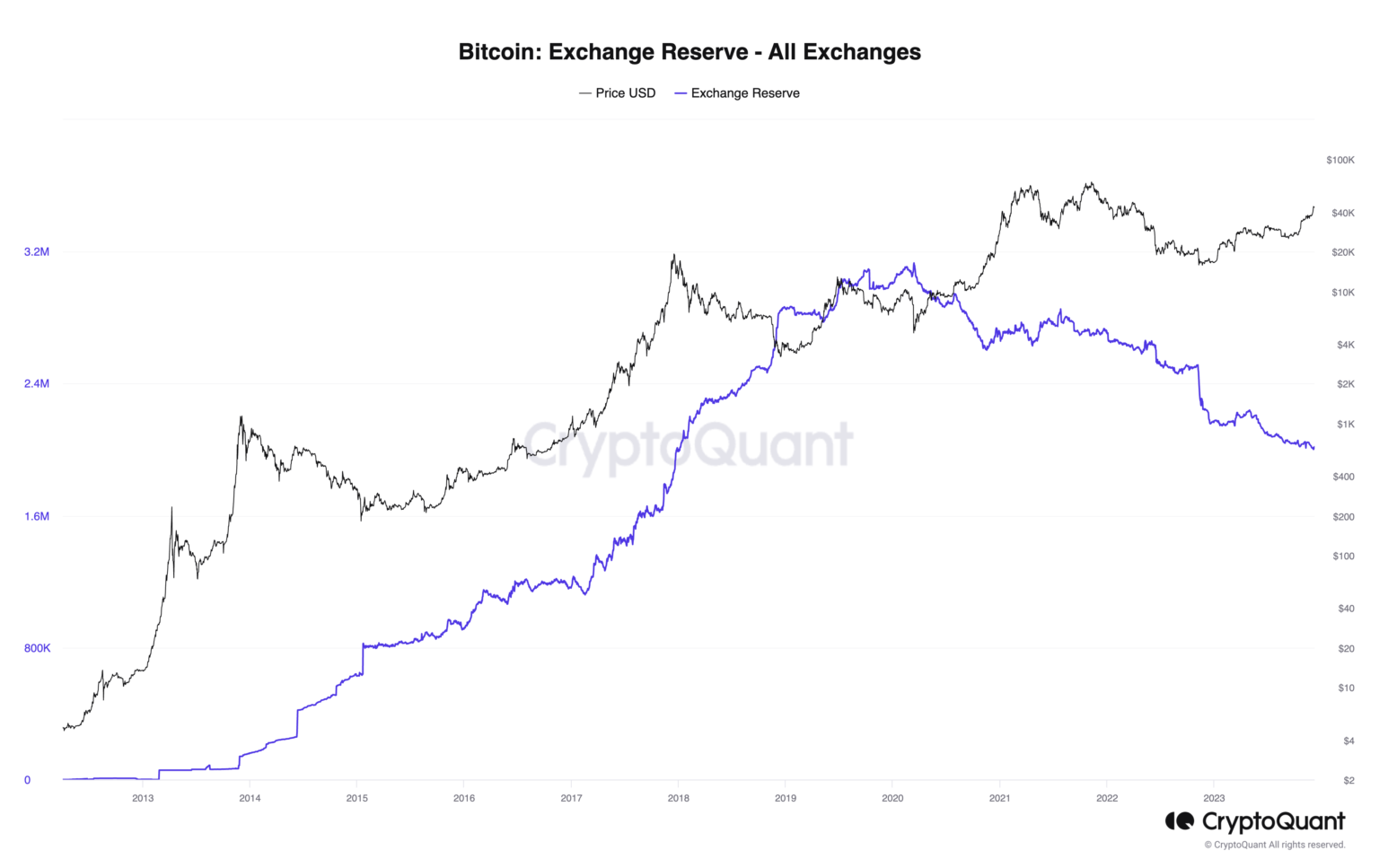

The quantity of Bitcoin [BTC] held on centralized cryptocurrency exchanges has dropped to its lowest degree since December 2017, in response to on-chain knowledge obtained from CryptoQuant.

The main coin’s alternate reserve peaked at 3.08 million on 2nd March 2022, after which it started to say no. As of this writing, 2.01 million BTC stay on exchanges, representing a 34% lower within the final three years.

Supply: CryptoQuant

Why the decline?

The plunge within the quantity of BTC held on centralized exchanges, reaching a six-year low, will be seen as a direct consequence of the FTX collapse and the broader turmoil throughout the crypto business.

Buyers, shaken by the FTX debacle and the elevated scrutiny from regulators just like the SEC, are opting to take management of their property, turning away from centralized platforms and embracing self-custody options.

This development in direction of self-custody signifies a rising sentiment amongst traders that BTC is a long-term asset price holding quite than actively buying and selling.

As of this writing, BTC traded at an 18-month excessive of $43,000. On-chain knowledge revealed that many long-term holders have refused to promote their cash in anticipation of extra earnings.

Nonetheless, a better evaluation of long-term investor buying and selling exercise revealed {that a} subset of this investor class stays underwater. In a current report, pseudonymous CryptoQuant analyst IT Tech discovered:

“The cohort that invested in BTC 2-3 years in the past, for example, continues to be grappling with a mean realized value of $45,000, leading to an ongoing common loss.”

Nonetheless, through the years, market members have more and more seen BTC as a long-term asset that must be held. Therefore the regular decline in its alternate reserve.

Why this is likely to be an issue

Nonetheless, as BTC alternate reserve continues to fall, it will probably considerably impression market liquidity. It is because as fewer traders maintain their BTC on exchanges, there could be much less cash out there for buying and selling.

This might end in a shallower order ebook, the place the variety of purchase and promote orders decreases. This may make it troublesome for big orders to be executed.

Learn Bitcoin (BTC) Value Prediction 2023-24

With fewer orders out there, the distinction between the bid and ask costs would widen. This may end in a rise in the price of buying and selling BTC, as merchants need to pay extra to execute their orders.

Lastly, diminished liquidity can enhance value volatility, as small orders can considerably impression the market value.