- ORDI and BCH have been a part of the few cryptocurrencies that jumped by double digits within the final 24 hours.

- BCH’s uptrend could change into weak, however ORDI has the potential to maintain going.

Cryptocurrencies together with Bitcoin Money [BCH] and Ordi [ORDI] have been two of the largest gainers in a transfer that noticed Bitcoin [BTC] attain a brand new excessive this 12 months. At press time, ORDI had a 24-hour 30% enhance, whereas BCH jumped by greater than 10%.

The transfer will not be shocking to some who’ve monitored Bitcoin’s correlation with these property. For Bitcoin Money, the 2017 Bitcoin exhausting fork appears to be working in its favor.

For context, a tough fork refers to an replace applied to a blockchain which might trigger the cut up into two cryptocurrencies.

Tied up within the motion

BCH was Bitcoin’s exhausting fork, however nonetheless capabilities as a decentralized peer-to-peer community like the highest blockchain. Because of this, when BTC pumps, BCH adopted most instances. This was evident within the sequence of articles AMBCrypto printed earlier this 12 months.

In ORDI’s case, its standing as the best BRC-20 token has favored its sturdy correlation with Bitcoin. BRC-20 is an experimental token commonplace that allows the minting of fungible tokens on the Bitcoin blockchain.

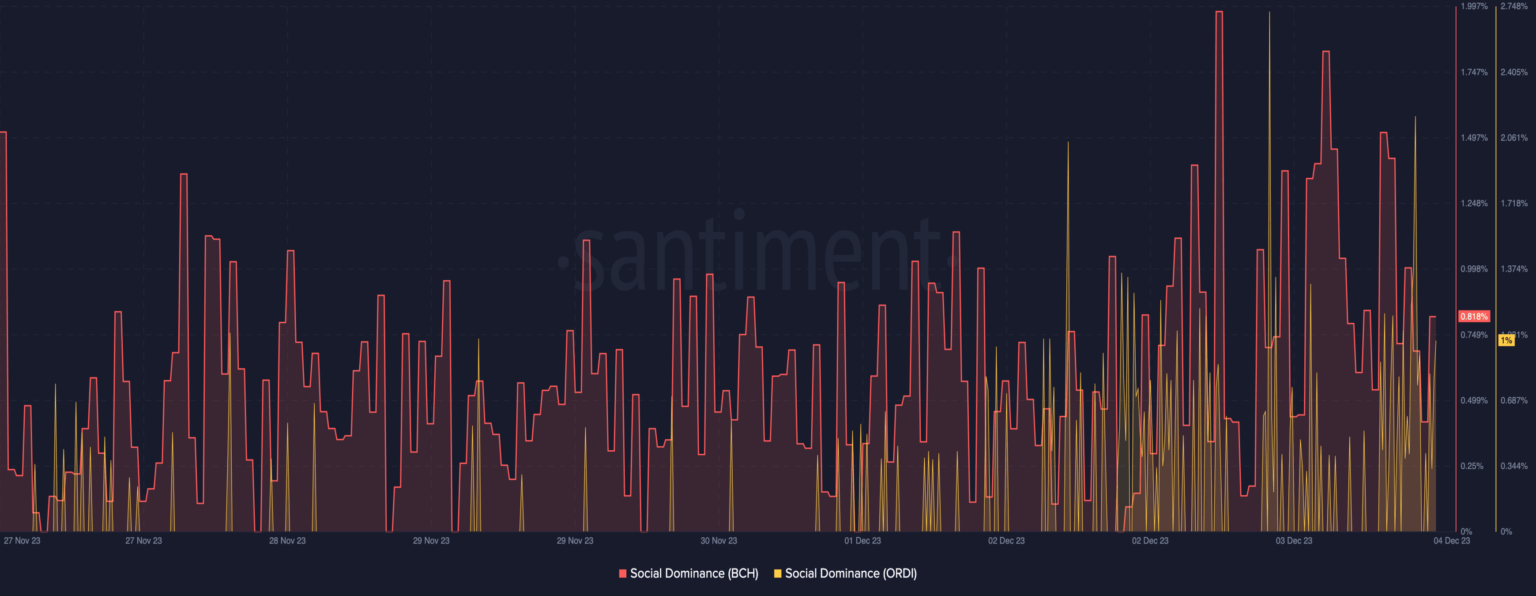

It’s also vital to say that ORDI’s rise to $42.25 means it had reached a brand new All-Time Excessive (ATH). When it comes to social dominance, Santiment knowledge analyzed by AMBCrypto confirmed that ORDI and BCH have been rising.

Supply: Santiment

On the time of writing, Bitcoin Money’s social dominance was 0.81% whereas ORDI had tapped the celebrated 1% dominance. The rise within the metric means that the property are getting extra consideration from the media and market members.

Cautious, not all that glitters is gold

So, it’s possible that merchants try to capitalize on the worth motion whereas monitoring the potential tops and bottoms. An evaluation of the Funding Charge confirmed that the metric was all inexperienced.

Whereas ORDI’s Funding Charge was 0.015%, BCH stood at 0.01%. Funding charges are charges paid between shorts and longs to maintain their contract open. If the Funding Charge is unfavourable, it implies that merchants are bearish and anticipating the worth to fall.

Supply: Santiment

Nevertheless, the funding charges for BCH and ORDI have been optimistic at press time, confirming the bullish bias merchants have concerning particular person worth motion.

Moreover, merchants shouldn’t get too enthusiastic about BCH’s worth motion. That is due to the development proven by the Open Curiosity. Open Curiosity reveals the entire variety of excellent futures contracts left on the finish of a buying and selling interval.

Practical or not, right here’s ORDI’s market cap in BCH’s phrases

At press time, the Open Curiosity round Bitcoin Money was all the way down to $213.74 million. When positioned by the worth motion, the decline within the Open Curiosity signifies that BCH’s upward course may change into weak.

Therefore, there’s a probability that the uptick will come to a cease quickly.

Supply: Coinglass