- Bitcoin has proven elevated decoupling from the primary asset lessons of the standard market.

- BTC’s correlation with gold retracted from its all-time excessive to face at 11% as of 31 Could.

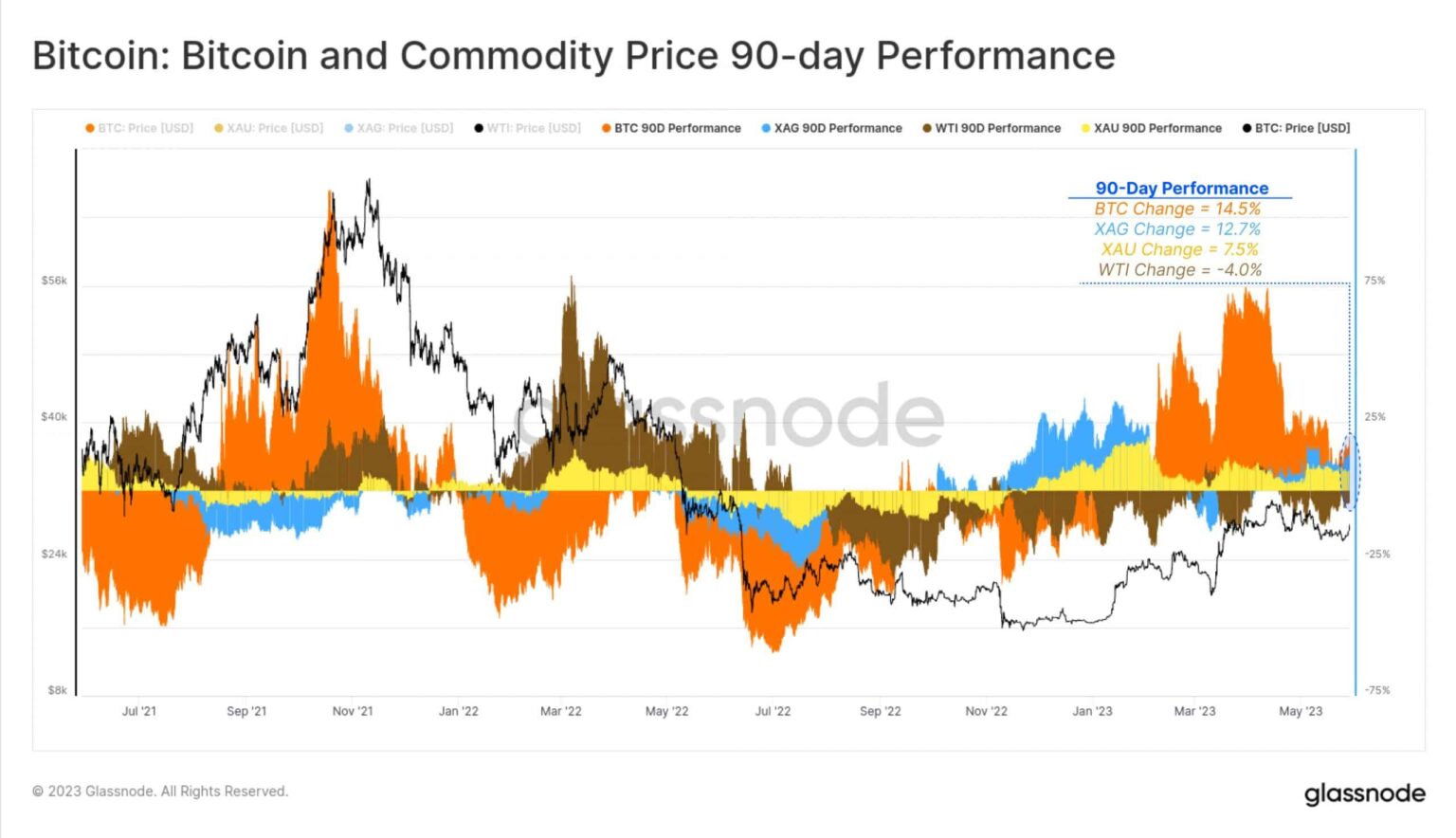

Over the previous couple of months, the world’s largest crypto asset by market cap Bitcoin [BTC] gained an higher hand over different main commodity belongings of the monetary market. As per on-chain analytics agency Glassnode, the king coin outperformed Crude Oil, Gold, and Silver to clock a 14.5% progress charge over the past three months.

Whereas the worth of Crude Oil fell by 4% in the identical interval, there was some excellent news from the bullion market. This was as a result of treasured metals like Gold and Silver grew by 7.5% and 12.7% respectively.

Supply: Glassnode

Bitcoin rising as a safe-haven asset?

The truth that Bitcoin’s progress got here amidst the U.S. banking disaster strengthened BTC’s long-supported narrative of being a safe-haven asset. A secure-haven asset is one whose worth is anticipated to stay secure or improve by way of durations of financial downturns.

The disaster prompted many buyers to dump their financial institution shares and switch their funds into the crypto economic system, extra particularly, Bitcoin.

In current months, Bitcoin has proven elevated decoupling from the primary asset lessons of the standard market. In response to Kaiko, a supply of market statistics for digital belongings, Bitcoin’s correlation with Gold dropped to 11% from a multi-year excessive of fifty% in April.

As well as, because the starting of 2023, the digital forex’s correlation with American shares fell significantly. This indicated that Bitcoin was more and more seen as an unbiased asset class.

#Bitcoin‘s correlation with #gold has retraced from all time highs, and presently sits at 11% pic.twitter.com/QGdJvSX5qz

— Kaiko (@KaikoData) May 30, 2023

These components might be at play

One of many key the reason why Bitcoin can show to be a authentic retailer of worth is its shortage. In lower than a 12 months, Bitcoin will endure yet one more halving occasion that can additional reduce down the rewards paid to miners for producing blocks. This primarily implies that Bitcoin is a deflationary asset. Moreover, the issuance of cash will lower over time, leading to important worth appreciation.

Supply: bitcoinblockhalf.com

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

But it surely was not simply speculative curiosity driving the worth of Bitcoin. It has seen a outstanding improve in its utility because the begin of 2023 with the Ordinals protocol paving the best way for the creation of non-fungible tokens (NFTs), cash, and stablecoins on the community.

This has piqued the curiosity of retail buyers, as evidenced by the rising variety of addresses holding lower than 10 BTC. Nevertheless, the coin’s weighted sentiment remained impartial and didn’t shift in favor of anyone explicit market emotion.

Supply: Santiment