- Bitcoin community exercise rebounded, with the potential to succeed in a million energetic addresses in June.

- There was elevated curiosity in Inscriptions, however cautionary indicators emerged with declining MVRV ratio.

Bitcoin’s [BTC] exercise rebounded following a latest hunch, with Santiment’s knowledge implying that the community’s energetic deal with rely may enhance to 1 million in June 2023.

📈 Might’s concerningly low #Bitcoin deal with exercise is lastly beginning to rebound once more. Growing utility is important for #crypto property to take pleasure in sustained rallies. Keep watch over whether or not $BTC can head into June with 1M or extra each day energetic addresses. https://t.co/LSa2slHWgt pic.twitter.com/zqTH9KGIqc

— Santiment (@santimentfeed) May 27, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Curiosity in Inscriptions rises

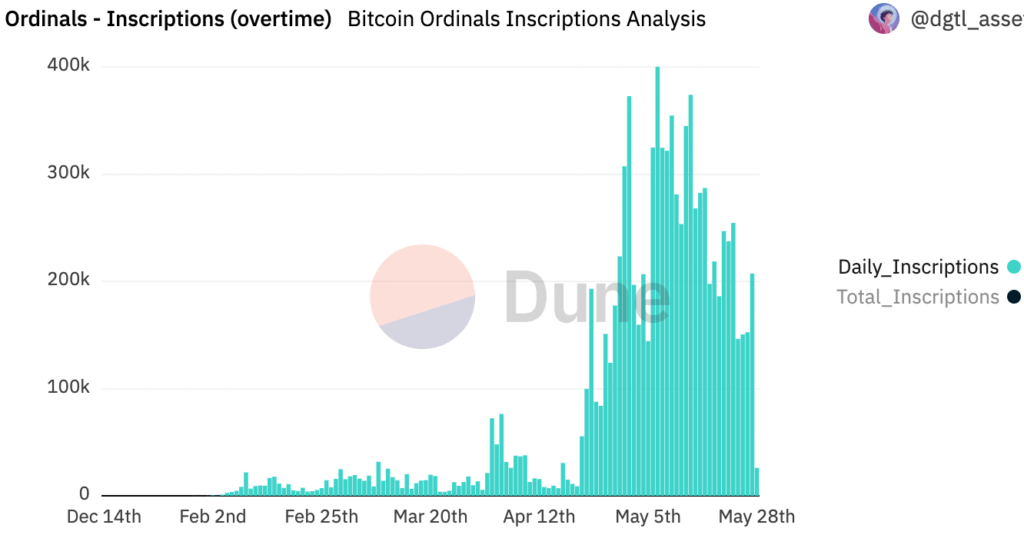

One of many main causes for the excessive exercise on the community is the surge of curiosity in Bitcoin Inscriptions. Dune Analytics’ knowledge revealed that the variety of each day inscriptions skilled a big enhance from 150,000 to 200,000 over the previous couple of days.

Supply: Dune Analytics

Furthermore, an awesome majority of the inscription exercise stems from the demand for text-based inscriptions, which accounts for roughly 90% of the general exercise.

Coupled with the growing curiosity in Inscriptions, there was a notable surge within the curiosity in holding Bitcoin. Glassnode’s knowledge signifies that the variety of non-zero addresses reached an all-time excessive on 28 Might.

📈 #Bitcoin $BTC Variety of Non-Zero Addresses simply reached an ATH of 47,180,069

View metric:https://t.co/VtoChZbLsa pic.twitter.com/124aCwyEd4

— glassnode alerts (@glassnodealerts) May 28, 2023

Moreover, the MVRV ratio of Bitcoin, which measures the common revenue or lack of all holders, declined. This steered that Bitcoin holders have been changing into much less worthwhile. If this pattern continues, it may doubtlessly result in a lower in promoting strain from holders.

Whereas these developments bode effectively for Bitcoin, some cautionary indicators have additionally emerged. The lengthy/quick distinction of BTC has been reducing, indicating that the variety of new addresses have been outnumbering the outdated addresses.

It’s price noting that new addresses usually tend to promote their holdings, doubtlessly inflicting value fluctuations and challenges for Bitcoin’s stability sooner or later.

Supply: Santiment

Bitcoin merchants flip optimistic

Regardless of these potential issues, the general variety of lengthy positions for BTC has witnessed a big enhance in latest days, based on Coinglass. This enhance signifies a rising bullish sentiment amongst traders, presumably pushed by optimistic market indicators and the prospect of future value appreciation.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

One motive for the spike in lengthy positions favoring Bitcoin could possibly be the declining Implied Volatility for the cryptocurrency. Lowering volatility usually encourages traders to take extra favorable positions, anticipating a interval of value stability or upward motion.

Supply: The Block

At press time, Bitcoin was buying and selling at $27,214.77, a 1.89% enhance over the past 24 hours, based on CoinMarketCap.