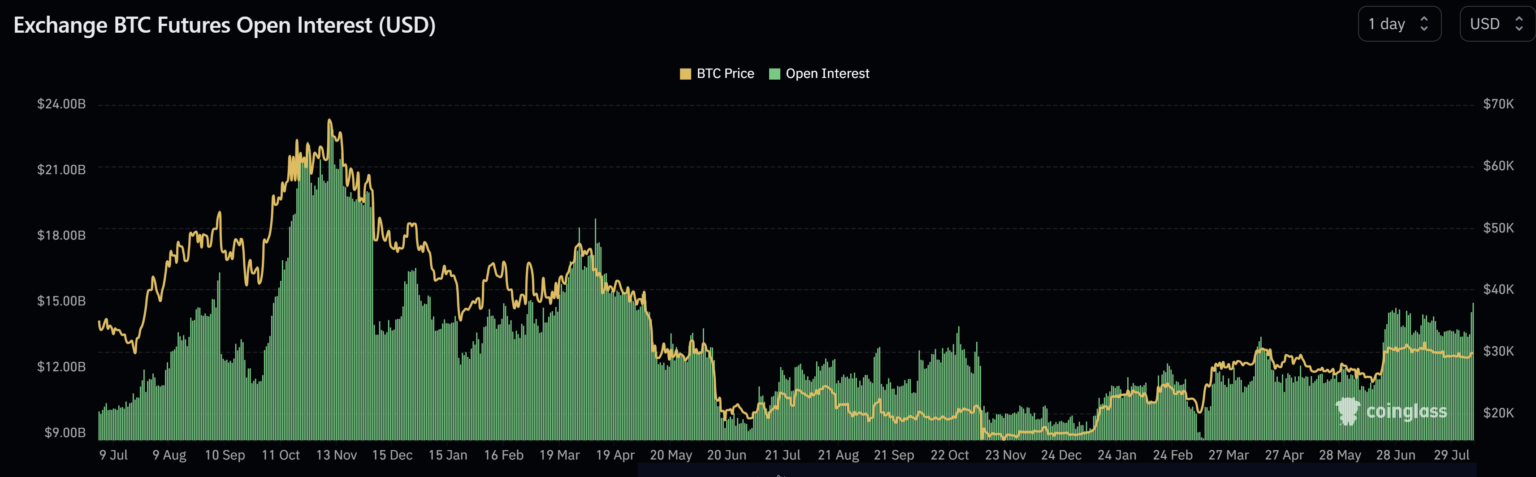

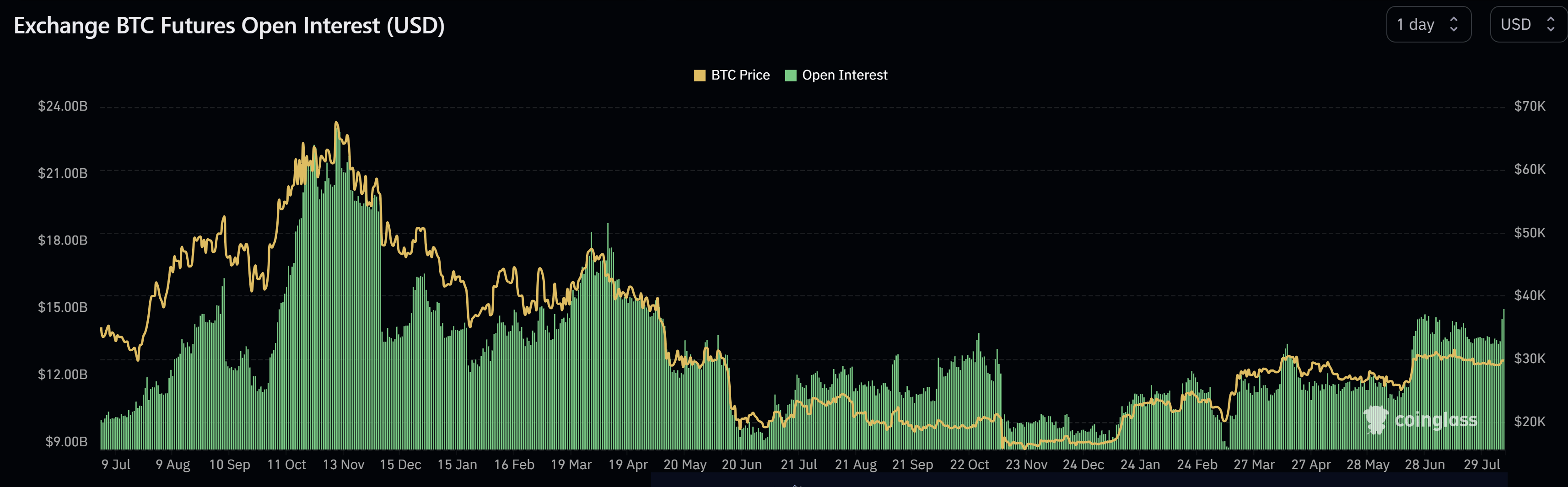

In a market that has been comparatively quiet for weeks, Bitcoin (BTC) has abruptly sprung to life, with its Futures Open Curiosity (OI) reaching ranges not seen for the reason that FTX crash. Open Curiosity, a metric that measures the whole variety of excellent futures that haven’t been settled, offers a glimpse into the buying and selling exercise and potential future worth actions of an asset. A surge in OI can point out heightened buying and selling exercise and curiosity out there.

Beginning early Tuesday, Bitcoin’s worth motion surged by greater than 3.5%, breaking the $30,300 mark for the second time this month. This motion started round 5 am EST, pushing the value to a 16-day-high. The catalyst behind this surge gave the impression to be the rumor that insiders at BlackRock and Invesco have confirmed {that a} Bitcoin spot ETF will not be a query of “if” however “when”, suggesting an approval inside the subsequent 4 to 6 months.

“Bitcoin whales opened giga lengthy positions at $29k,” remarked CryptoQuant CEO Ki Younger Ju. The Head of Analysis at CryptoQuant additional added, “Lots of discuss recently about rising chance of Bitcoin spot ETF approval within the US. Now Coinbase premium sharply up and transferring in the direction of optimistic territory (implies Bitcoin demand within the US is strengthening). GBTC worth low cost has continued to slender.”

Bitcoin Futures Open Curiosity Skyrockets To Yearly Excessive

Combination OI for Bitcoin futures noticed a major leap, rising by over $1 billion from the day past to a staggering $14.95 billion, in keeping with Coinglass knowledge.

This surge marks probably the most substantial improve in over a month. Nevertheless, derivatives exercise on the CME, usually seen as a gauge of institutional buying and selling, remained comparatively unchanged in OI, suggesting that the current transfer is perhaps predominantly retail-driven.

Miles Deutscher commented on Twitter, “Bitcoin open curiosity is now at its highest degree for the reason that FTX collapse. This means elevated BTC buying and selling exercise from market individuals. Appears to be like like a giant transfer is brewing.” Equally, James V. Straten noticed, “Bitcoin open curiosity is now better than 2.25% of the market cap, approaching YTD highs, and appears exceptionally overheated.”

The Kingfisher, a famend knowledge supplier for Bitcoin derivatives, noted, “Coinbase promoting into each different main change shopping for. Appears to be like like Bybit & Bitmex degens are betting on one other $BTC leg up. Whereas Bitfinex appears to be promoting right here.”

On the choices entrance, the analysts added that sellers appear bullish, able to capitalize on each upward and downward actions. Their shopping for exercise is presently stabilizing the value, whereas any important upward trajectory may see them intensifying their shopping for. In the meantime, the BTC liquidation map of The Kingfisher signifies that whereas there are nonetheless “some late high-leverage shorts to liquidate to the upside, however many of the short-term liquidity is down.”

Famend analyst @52kskew offered insights into the BTC whale vs. algo divergence, stating, “Whales require fairly thick liquidity to exit or shut positions & most frequently that is throughout a squeeze occasion. Some corporations will use algos with the intention to get the very best worth when closing out sizeable place (that is the place TWAP algos come into play).”

CPI Launch To Take Out The Warmth?

Notably, the Shopper Value Index (CPI) within the US is scheduled for tomorrow, Thursday, 8:30 am EST. The discharge has the potential to trigger a mass liquidation of the overheated BTC futures market in each instructions. A significant transfer by the BTC worth appears imminent.

Forecasts recommend an increase within the headline CPI from 3% to three.3% year-over-year (YoY) for July, marking a major transition because the optimistic impacts from the prior 12 months begin to wane. Notably, the Cleveland Fed’s Inflation Nowcast mannequin initiatives a 3.42% headline CPI, marginally surpassing normal expectations. Core CPI is anticipated to barely decline from 4.8% to 4.7% YoY.

At press time, the BTC worth was slightly below key resistance at $30,000.

Featured picture from BTCC, chart from TradingView.com