- Roughly 2.6 million Bitcoin have been pushed into revenue.

- BTC’s value was on three days of consecutive decline however maintained the $30,000 value vary.

In an exhilarating flip of occasions, Bitcoin [BTC] shattered a major value barrier and surged previous the $30,000 mark. This paved the best way for quite a few buyers to rejoice of their monetary features. However what does the profitability of those lucky holders indicate for the longer term path of Bitcoin’s pattern?

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Bitcoin short-term holders cruise into revenue

New information from Glassnode revealed that the latest surge in Bitcoin’s value has caused a wave of triumph for short-term holders. The leap from roughly $25,000 to past $30,000 has pushed many of those holders right into a worthwhile place.

To be exact, over 66.4% of short-term holder cash, amounting to a staggering 1.8 million, have now discovered themselves in revenue. This surge has elevated the worthwhile short-term holder provide proportion to 96.9%, equal to roughly 2.6 million BTC.

Moreover, historic patterns indicated that such durations of profitability usually led to cost will increase. Which means we might see the worth of BTC rise extra if extra STH is pushed into revenue.

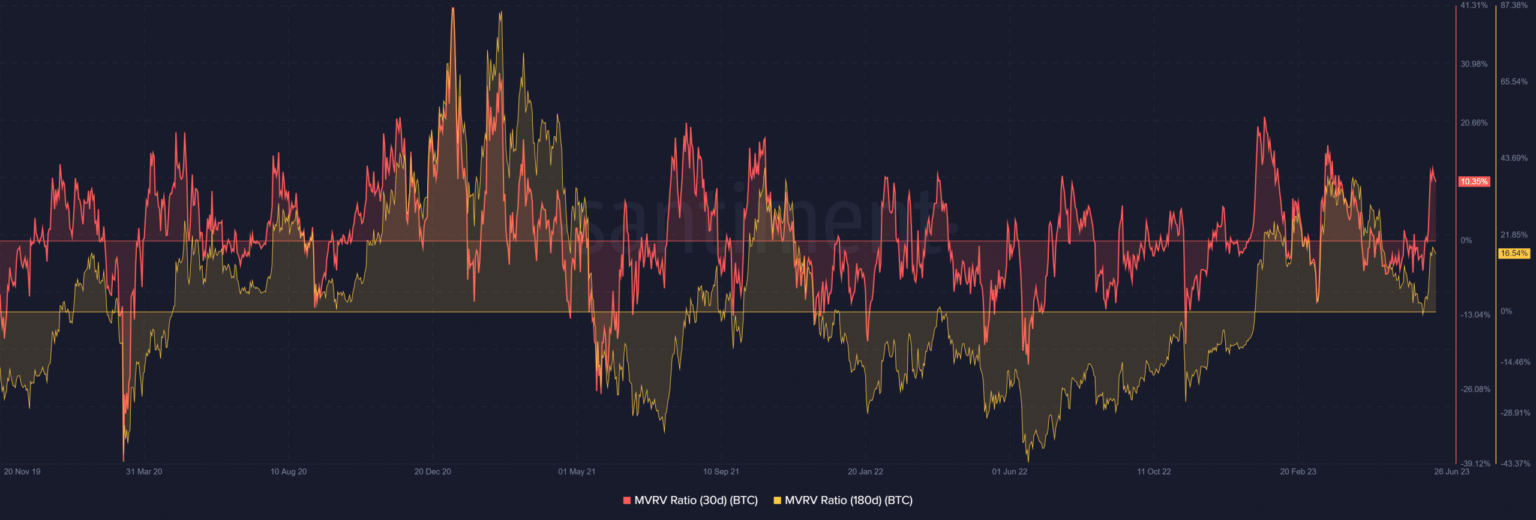

Evaluating 30-day and 180-day Bitcoin MVRV

An examination of the Bitcoin 30-day Market Worth to Realized Worth Ratio (MVRV) on Santiment confirmed the profitability of STH. As of this writing, the 30-day MVRV stood above 0, signaling a good state of profitability for BTC held by STH.

The metric surpassed 10% at press time, although there have been indications of a slight decline.

Supply: Santiment

The comparability between the 30-day MVRV and the 180-day MVRV revealed that it was not solely STH who had been reaping earnings.

Analyzing the 180-day MVRV confirmed that holders inside this timeframe had been holding their BTC at a revenue margin of over 16%. This steered that each short-term and long-term BTC holders from the previous six months have been in a position to search earnings from their holdings.

A better have a look at the 90-day MVRV evaluation confirmed the general profitability pattern, showcasing constructive returns for BTC holders inside this timeframe.

How a lot are 1,10,100 BTCs price at this time?

Which means is BTC shifting?

As of this writing, Bitcoin was buying and selling at roughly $30,300, exhibiting a slight decline on a every day timeframe. Notably, the chart revealed that BTC had skilled a three-day consecutive decline, albeit with minimal variations in worth.

Regardless of these short-term fluctuations, the king coin’s general pattern remained bullish, as indicated by its Shifting Common Convergence Divergence (MACD). The MACD was noticed to be trending above zero as of this writing.

Supply: TradingView