- BTC’s worth jumps by virtually 10% within the final 24 hours.

- That is as a result of determination by U.S. regulators to guard all buyer deposits at failed Silicon Valley Financial institution (SIVB).

Following the determination by the U.S. Division of the Treasury, Federal Reserve, and Federal Deposit Insurance coverage Company (FDIC) to revive all buyer deposits at failed Silicon Valley Financial institution (SVB), Bitcoin’s [BTC] worth rallied by virtually 10% within the final 24 hours.

On 11 March, BTC’s worth suffered a major drop beneath $20,000 following a mass withdrawal of funds by prospects of SVB.

On account of this, the California Division of Monetary Safety and Innovation shut down the financial institution on the identical day. This led to the de-pegging of assorted stablecoins and different related cryptocurrencies.

Learn Bitcoin [BTC] Worth Prediction 2023-24

Improved sentiments, nonetheless, returned to the market as Federal regulators, in a joint assertion on 12 March, introduced the approval of “actions enabling the FDIC to finish actions in a way that absolutely protects all depositors” on the failed financial institution.

Merchants flock to the BTC market

Exchanging fingers at $22,422.56 at press time and with a 9% soar in worth within the final 24 hours, BTC logged a corresponding hike in buying and selling quantity throughout the identical interval.

Per information from CoinMarketCap, the coin’s buying and selling quantity was up by 40%. A soar in an asset’s buying and selling quantity with a worth rally to point out for it’s taken as a bullish signal that signifies improved optimistic sentiment and continuation of the uptrend.

Information from Santiment confirmed the optimistic sentiment that lingered within the BTC market at press time. The coin’s weighted sentiment was a optimistic 7.114% on the time of writing, suggesting that buyers believed within the continued development of the asset’s worth.

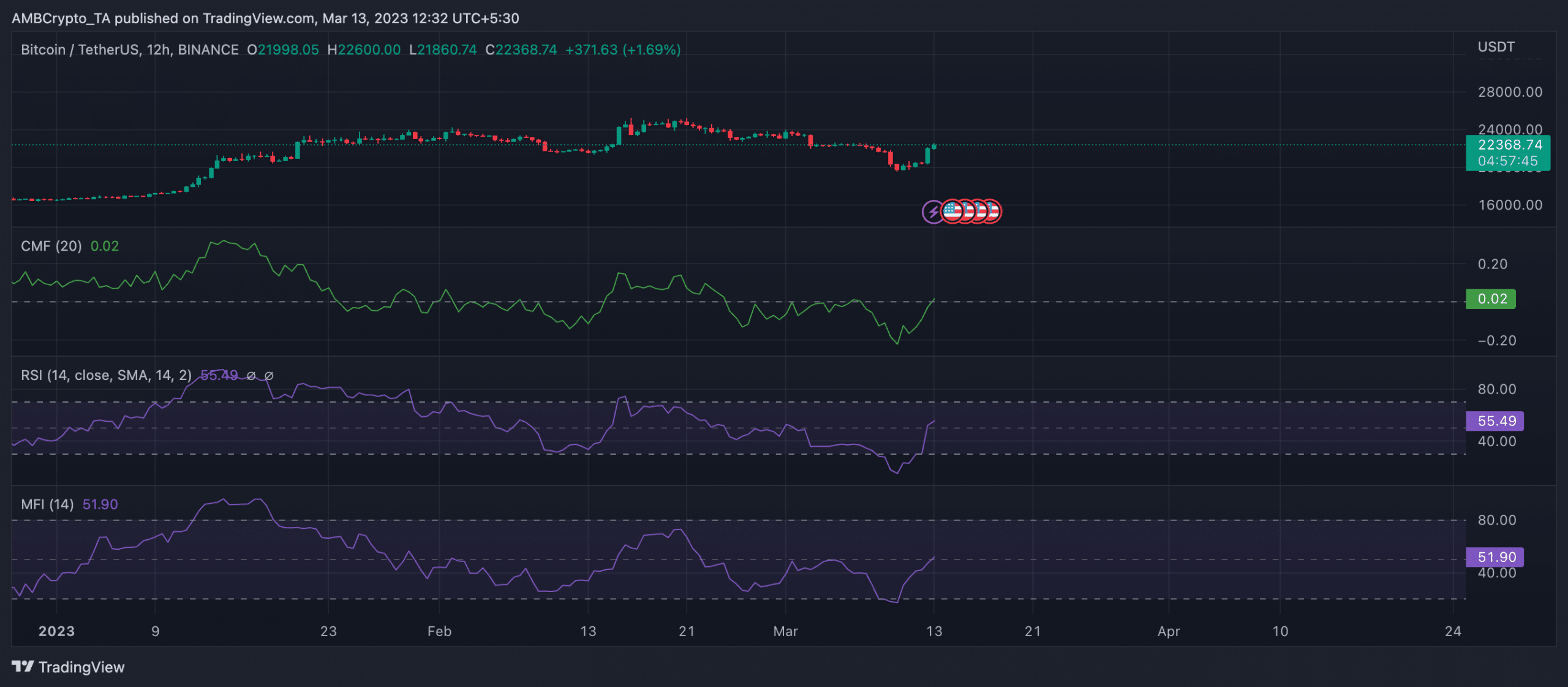

Additional, BTC’s worth motion assessed on a 12-hour chart revealed a sample of rising coin accumulation. Key momentum indicators such because the Relative Energy Index (RSI) and the Cash Stream Index (MFI) rested above their impartial strains in uptrend positions.

This steered that coin accumulation exceeded the distribution at press time. BTC’s RSI was 55.49, whereas its MFI was 51.90.

Likewise, its Chaikin Cash Stream (CMF) reclaimed its spot on the optimistic territory and posted a worth of 0.02 at press time. A optimistic CMF worth is a bullish signal that hints at elevated liquidity wanted to drive up the worth of an asset.

Supply: BTC/USDT on TradingView

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Be at alert

In the meantime, pseudonymous CryptoQuant analyst Crazzy Blockk assessed BTC’s Unrealized Revenue/Loss and located that the metric’s subsequent course would decide whether or not or not the BTC market would undergo one other capitulation.

Relating to the Unrealized Revenue/Loss metric, a worth above zero signifies that the majority buyers are in revenue, whereas a worth beneath zero implies a loss.

Within the present market, “after two heavy capitulation phases within the BTC market, the value is testing degree 0 of this metric,” Crazzy Blockk famous.

Based on the analyst:

“If the bitcoin worth can preserve this degree and the profitability of bitcoins in holders’ pockets start to rise, the restoration section will occur.on this case, the bitcoin worth may rise once more. If the online unrealized Revenue/Loss metric, primarily based on the holders’ actual worth, decreases repeatedly, there can be a risk of a 3rd capitulation section or one other heavy ache out there.”