- Yr-to-date inflows went into digital asset funds reached $13.13 billion.

- Bitcoin, Solana have been excessive on demand, whereas Ethereum noticed outflows.

Digital asset funds have been again to profitable methods final week, spearheaded by robust investments into the newly-launched Bitcoin [BTC] spot ETFs within the U.S.

Robust restoration

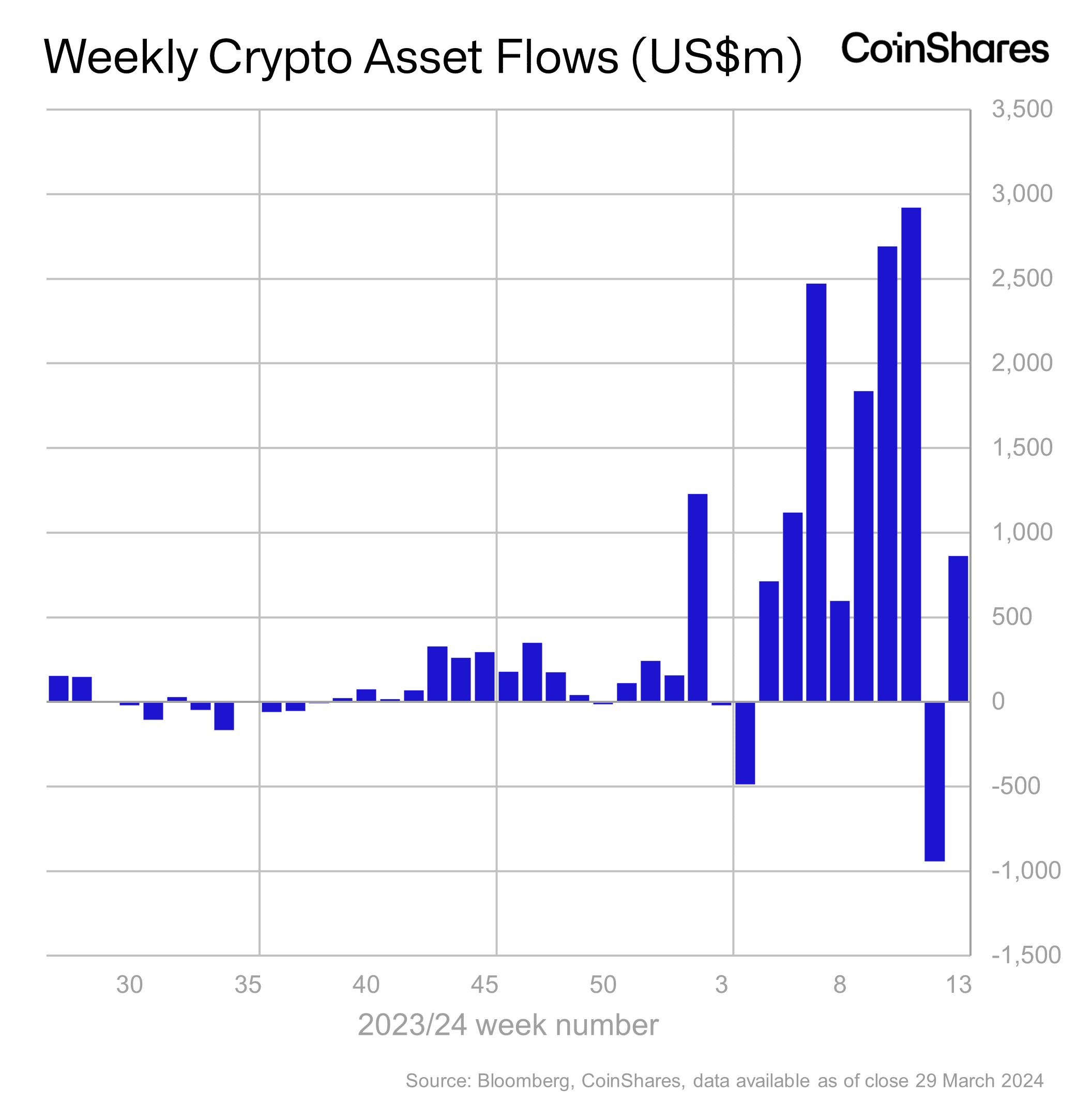

As per knowledge shared by James Butterfill, Head of Analysis at crypto asset administration agency CoinShares, about $862 million in internet inflows was recorded throughout institutional crypto merchandise

This was a pointy rebound from the $942 million in outflows seen every week earlier.

The newest capital infusion propelled year-to-date (YTD) inflows to $13.13 billion. For context, this was almost 25% increased than the entire inflows recorded in 2021 — the yr of the crypto market’s final bull run.

Supply: CoinShares

Throughout the week, the entire belongings underneath administration (AuM) swelled to $98 billion, marking a rise of 11% from the week earlier than.

AUM is a vital efficiency gradient of a fund. The upper the worth of AuM, the extra investments it tends to draw. AUM will depend on the inflows and the market worth of the underlying asset.

Final month, the AUM hit $100 billion for the primary time in historical past, as Bitcoin smashed to its all-time excessive (ATH) of $73,000. Nonetheless, subsequent worth correction precipitated the AUM to drop to present ranges.

Bitcoin stays establishments’ favourite

On anticipated traces, Bitcoin-linked funds led the cost, pocketing $865 million in inflows final week. With this, complete inflows because the starting of the yr rose to a powerful $12.8 billion.

The surge might be attributed to robust demand for U.S.-based spot Bitcoin ETFs, which attracted $860 million in inflows final week.

Strong inflows into new ETFs led by BlackRock’s IBIT helped offset outflows from incumbent issuer Grayscale’s GBTC, which has been bleeding since transitioning to an ETF.

Ethereum loses, Solana positive aspects

Alternatively, funds tied to second-largest cryptocurrency Ethereum [ETH] noticed outflows price $19 million final week. The bearish sentiment doubtless flowed from decrease possibilities of an ETH ETF approval.

Solana-based funding merchandise witnessed inflows of $6 million final week, spurred by spectacular worth efficiency of the native asset SOL.