Knowledge reveals that Bitcoin volatility is presently at traditionally low ranges, one thing that has led to violent worth strikes up to now.

Bitcoin 7-Day Vary Has Compressed To Simply 3.4% Just lately

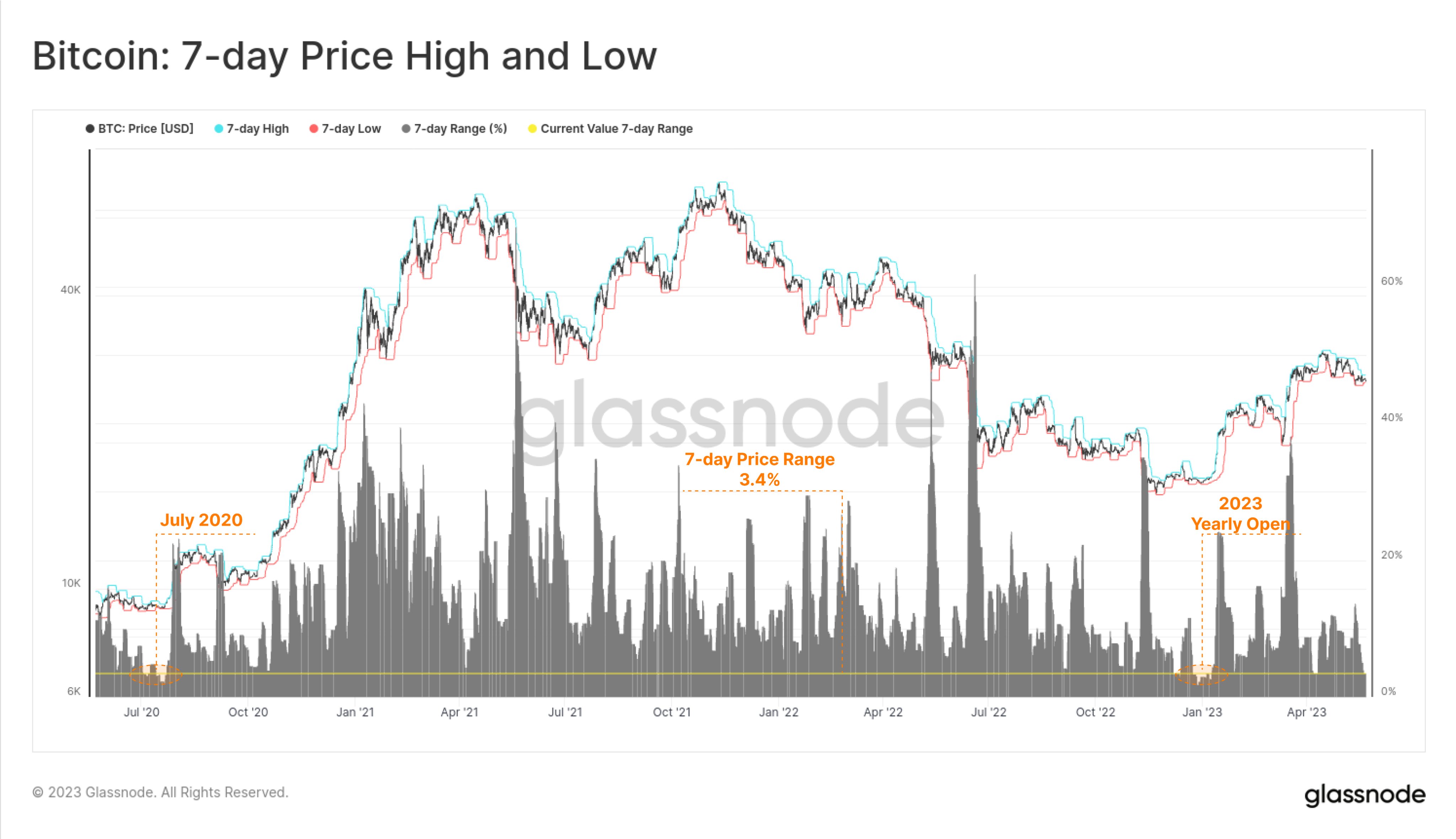

Based on information from the on-chain analytics agency Glassnsode, the present 7-day worth vary is akin to ranges seen again in January of this yr. The “7-day worth vary” of Bitcoin right here refers back to the share distinction between the best and the bottom factors that the asset’s worth has noticed over the past seven days.

This metric can present hints in regards to the current volatility that the cryptocurrency has skilled. When the indicator has a low worth, it means the value motion over the past week has been fairly stale. Naturally, this means that the volatility of the asset is low proper now.

However, excessive values of the 7-day worth vary suggest the coin has seen a excessive diploma of fluctuation inside the previous seven days, and therefore, the volatility has been excessive.

Now, here’s a chart that reveals the development within the Bitcoin 7-day worth vary (in addition to the 7-day excessive and low) over the previous couple of years:

The worth of the metric appears to have been fairly low in current days | Supply: Glassnode on Twitter

As proven within the above graph, the Bitcoin 7-day worth vary had naturally succumbed to fairly low values in the course of the bear market lows that had adopted the FTX crash, because the BTC worth had been caught in a sideways motion.

These low values of the indicator continued into the brand new yr because the coin refused to indicate any vital motion. Quickly after, nevertheless, the metric’s worth had seen an explosion because the rally had begun to happen.

Within the subsequent few months, the 7-day worth vary of the cryptocurrency had assumed comparatively excessive values, however not too long ago, the indicator has noticed one other plummet.

The explanation behind this new plunge has naturally been the slim consolidation vary that the asset has adopted up to now week between the $27,400 and $26,500 ranges.

Due to this low volatility, the 7-day worth vary of Bitcoin has collapsed to solely 3.4%. Within the chart, Glassnode has additionally highlighted the earlier cases the place the cryptocurrency had seen this metric drop so low.

It seems to be just like the indicator dipped to related ranges approach again in July 2020, and the aforementioned lows from the beginning of the yr had additionally noticed the indicator attain such values.

An attention-grabbing factor to notice about each these intervals of low volatility is that the value had gone on to see fast worth motion not too lengthy after they occurred, and the previous low was adopted by the 2021 bull run, whereas the continuing rally succeeded the latter one.

If the present compressed 7-day Bitcoin worth vary will observe the same sample, then some wild worth motion could also be coming for the cryptocurrency within the close to future.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,800, down 2% within the final week.

Seems to be like BTC has been transferring sideways in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com