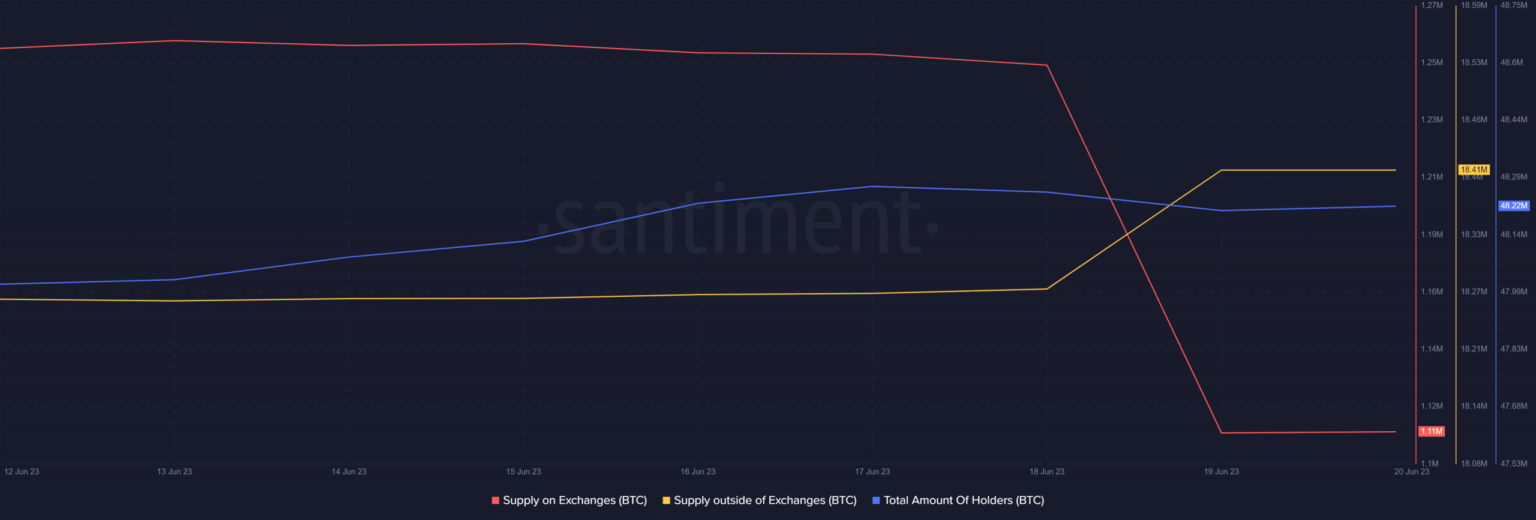

- BTC’s provide on exchanges declined whereas its provide outdoors of exchanges rose.

- Derivatives market metrics additionally appeared bullish for BTC.

Bitcoin [BTC] has been within the accumulation part for a number of weeks now, as its worth stagnated underneath the $28,000 mark. Typically, excessive accumulation occurs when the market doesn’t carry out effectively, which is then adopted by a development reversal. The identical gave the impression to be true this time as effectively, as BTC’s charts have turned inexperienced.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Bitcoin accumulation exhibits results

Santiment’s 20 June tweet revealed that BTC whales have been fairly energetic of late. Notably, wallets holding 1,000 – 10,000 BTC have accrued a mixed $3.5 billion for the reason that first week of April.

🐳 #Bitcoin‘s whales have been busy whereas the gang watched costs dwindle these previous two months. Now again above $27k as soon as once more, it is from coincidence that wallets holding 1K to 10K $BTC have accrued a mixed $3.5B for the reason that first week of April. https://t.co/LUEaQLeXTy pic.twitter.com/z8U5tCa9OQ

— Santiment (@santimentfeed) June 20, 2023

Because of the elevated shopping for energy of the whales, the market could expertise short-term worth will increase. This was evident within the worth charts already, as in accordance with CoinMarketCap, BTC’s worth rose by 2% and 1% within the final seven days and previous 24 hours, respectively.

At press time, the king coin was buying and selling at $26,766.55, with a market capitalization of over $519 billion.

A take a look at BTC’s provide

The buildup development continued into press time, as evident from Santiment’s chart. Bitcoin’s provide on exchanges declined sharply, whereas its provide outdoors of exchanges elevated. This can be a typical bullish sign.

Furthermore, the full variety of BTC holders additionally rose final week. Apart from that, as per a Santiment report, the variety of distinctive tokens has additionally taken off to a few 7-week excessive, which appeared encouraging for the coin’s future.

Supply: Santiment

Will this uptrend translate right into a bull rally?

Bitcoin’s press time worth motion and accumulation development gave hope for higher days forward. A take a look at BTC’s on-chain metrics make clear how the approaching days would possibly look.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

BTC’s change reserve was declining, suggesting that the coin was not underneath promoting stress. The king of crypto’s binary CDD was inexperienced, that means that long-term holders’ actions within the final seven days had been decrease than the typical.

Supply: CryptoQuant

BTC’s funding charge additionally remained excessive, which advised that the value development would possibly proceed for longer. Lastly, Bitcoin’s taker purchase/promote ratio was inexperienced, revealing that purchasing stress was dominant within the derivatives market.

Supply: CryptoQuant