- Utilizing the coinblocks fashions, Cointime Economics can decide BTC’s motion.

- The on-chain metric can even determine the liveliness or inactivity of the community.

After 18 months of intense analysis, a brand new on-chain metric has been added to the Bitcoin [BTC] clan. And the initiators are none apart from on-chain analytic platform Glassnode and world asset administration agency ARK Make investments.

How a lot are 1,10,100 BTCs value in the present day?

As you’re most likely conscious, on-chain metrics play an important function in understanding the dynamics of the Bitcoin community and market sentiment. For ARK Make investments’s analysis affiliate David Puell and Glassnode’s lead analyst James Test, calling this new metric “Cointime Economics” was one of the best tag to present the metric.

Additionally, in case you are aware of the on-chain panorama, you’d notice that Puell, the well-known creator of the Puell A number of, shouldn’t be new to introducing metrics. Test, alternatively, has additionally been acknowledged for his work in contributing to metric growth on the Glassnode platform. So, what precisely is the Cointime Economics?

Coinblocks to the rescue?

In response to the collaborative analysis paper, Cointime Economics would act as a fungible measurement of Bitcoin’s provide and demand. In evaluating the metric, Test and Puell famous that some present metrics must be thought of.

These metrics embody the Market Worth to Realized Worth (MVRV) ratio, the Bitcoin inflation price, and volume-weighted value.

Based mostly on the knowledge from the report, a mixture of the metrics would assist determine Bitcoin’s valuation, exercise, and financial state. This, then, results in the introduction of the coinblocks. The paper defined the time period as:

“Coinblocks are the product of the variety of Bitcoin and the variety of blocks produced through the interval during which these Bitcoin remained unmoved.”

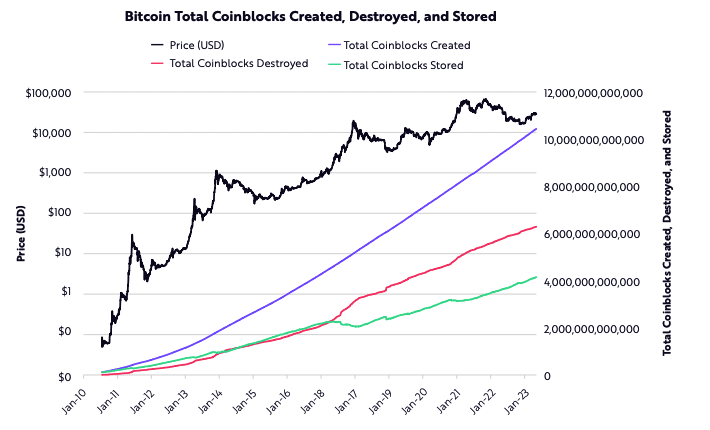

But it surely doesn’t finish there. To evaluate Bitcoin’s financial system, worth, or community exercise, the Coinblocks Created (CBD), Coinblock Destroyed (CBD), and Coinblocks Saved (CBS) would play totally different roles.

The CBD measures the time-weighted turnover of Bitcoin’s quantity, or the variety of Bitcoins moved in a given interval, holding interval, or the time held earlier than shifting.

Destruction equals capitulation

So, when there’s heavy coinblock destruction, it means that long-term holders are promoting. It additionally implies that Bitcoin’s “sensible cash” trades from decrease value bases whereas producing increased income.

Thus, main spikes in coinblocks destroyed have had a excessive correlation with a peak in Bitcoin’s worth.

However, Coinblocks Saved (CBS) represents the overall variety of coinblocks or the distinction between whole coinblocks created and whole coinblocks destroyed.

When CBS is adverse over a interval of seven days, it implies that the variety of coinblocks destroyed has surpassed the quantity created. This means the motion of a considerable variety of previous cash in a brief time period.

When the CBS is constructive, it implies that coinblocks created have surpassed the variety of coinblock destroyed. On this case, it might imply that fewer previous cash have moved inside a brief interval.

Lastly, the Coinblocks Created (CBC) represents the overall cointime created within the Bitcoin community, no matter the coin motion. By combining all of the parameters, Glassnode and ARK Make investments thought of what occurred in 2017 when CBD surpassed CBS.

Supply: ARK Make investments and Glassnode

From the chart above, the analysis paper concluded that Cointime Economics was constructing blocks over time. It talked about that at this level:

“Extra cash had been lively out there versus misplaced or strongly dormant.”

How vigorous is the financial system?

One other mannequin derived from the report to grasp Bitcoin’s financial state was by utilizing liveliness and vaultedness. For context, Bitcoin liveliness is a worth from 0 to 1 which reveals the speed of liquidation from long-term holders.

If liveliness will increase, then long-term holders are liquidating positions. Nonetheless, a lower within the metric means that holders have determined to proceed HODLing. Moreover, Vaultedness measures the inactivity of the community.

In a case the place liveliness will increase to 1, then there can be no Bitcoin holders. And when vaultedness reaches 1, it means miners have by no means bought any of their BTC.

Supply: ARK Make investments and Glassnode

To examine for Bitcoin’s financial place, the Cointime Economics additionally considers the nominal and adjusted inflation price. By definition, the inflation price is the share of recent cash divided by the present provide.

Decrease inflation price for BTC

So, in an effort to clarify this, Puell and Test examined what occurred with the metrics between 2013, and 2017, and on the time of writing. The conclusion was

“Conversely, from 2013 to 2017, cointime inflation reached parity with nominal inflation, then has surpassed it as of the day of this publication.”

Reasonable or not, right here’s BTC’s market cap in ETH phrases

At press time, the nominal and cointime adjusted inflation price urged that inflation was being underestimated. This was due to the sluggish BTC appreciation, which was a lot decrease than in earlier years.

Supply: Ark Make investments and Glassnode

Whereas the Bitcoin Cointime Financial remains to be in its early days, there’s no denying that the metric could provide extra perception into market sentiment. Sensible cash merchants may have to assess different elements alongside the metric to get a full image of what it gives.