- Bitcoin posted losses measuring 14% throughout the previous six days.

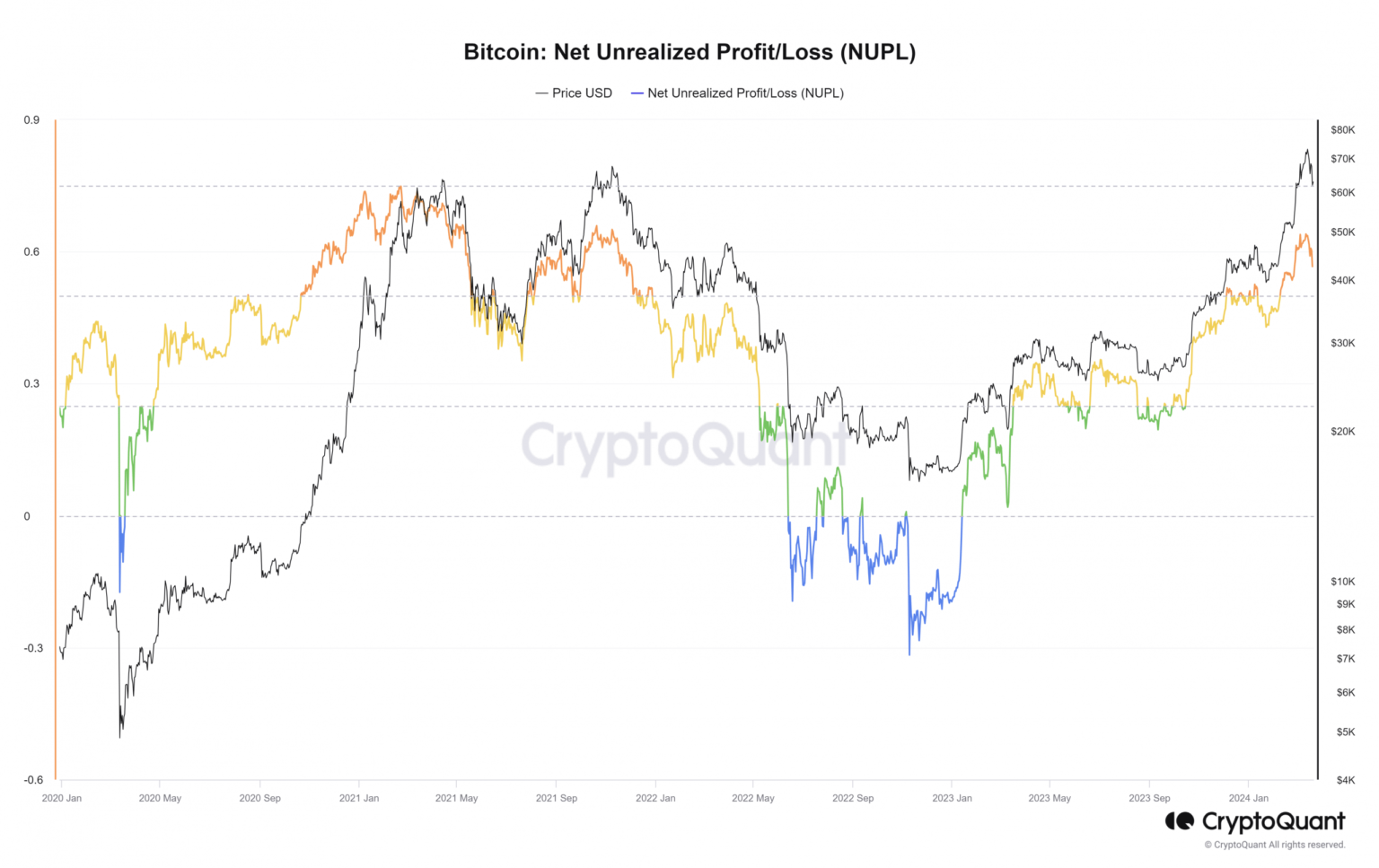

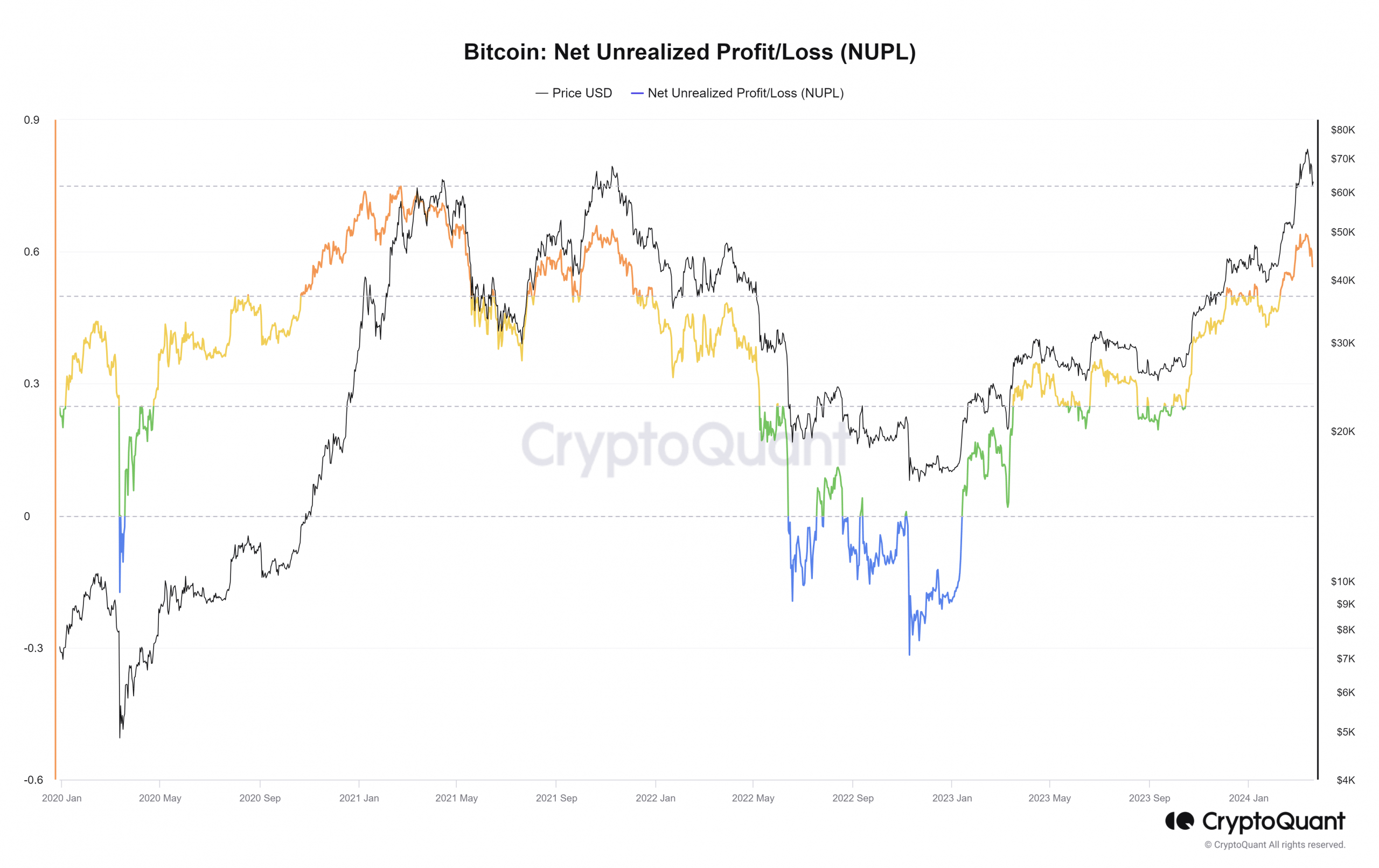

- The NUPL often doesn’t keep above +0.6 for a protracted interval.

Bitcoin [BTC] recorded losses amounting to 7.2% in ten hours earlier than press time. The BTC pullback was dwell, as AMBCrypto reported earlier. Nonetheless, the $64.8k help area didn’t halt the bearish advance.

An analyst posted on CryptoQuant’s Insights web page about how the present Bitcoin uptrend might be nearing its finish. They explored the NUPL metric and what it might imply for BTC traders.

Bull run circumstances even earlier than the halving occasion

Supply: CryptoQuant

The Internet Unrealized Revenue/Loss (NUPL) is a useful gizmo for figuring out when traders are in revenue. Its calculation entails the realized cap of Bitcoin to grasp investor profitability higher.

The analyst famous that the NUPL metric hardly ever stays above the 0.6 mark for lengthy. A +0.6 studying on this metric is often adopted by a pointy value correction, though this pattern will get bucked amid bull runs.

From December 2020 to April 2021, the NUPL was persistently above +0.6 as Bitcoin rallied from $19k to $60k.

On the twenty eighth of February, the NUPL climbed above +0.6 as soon as extra. Bitcoin sailed previous $73k however was unable to carry on. Because the sixteenth of March, the NUPL has fallen under +0.6, and the worth was at $63k at press time.

Supply: CryptoQuant

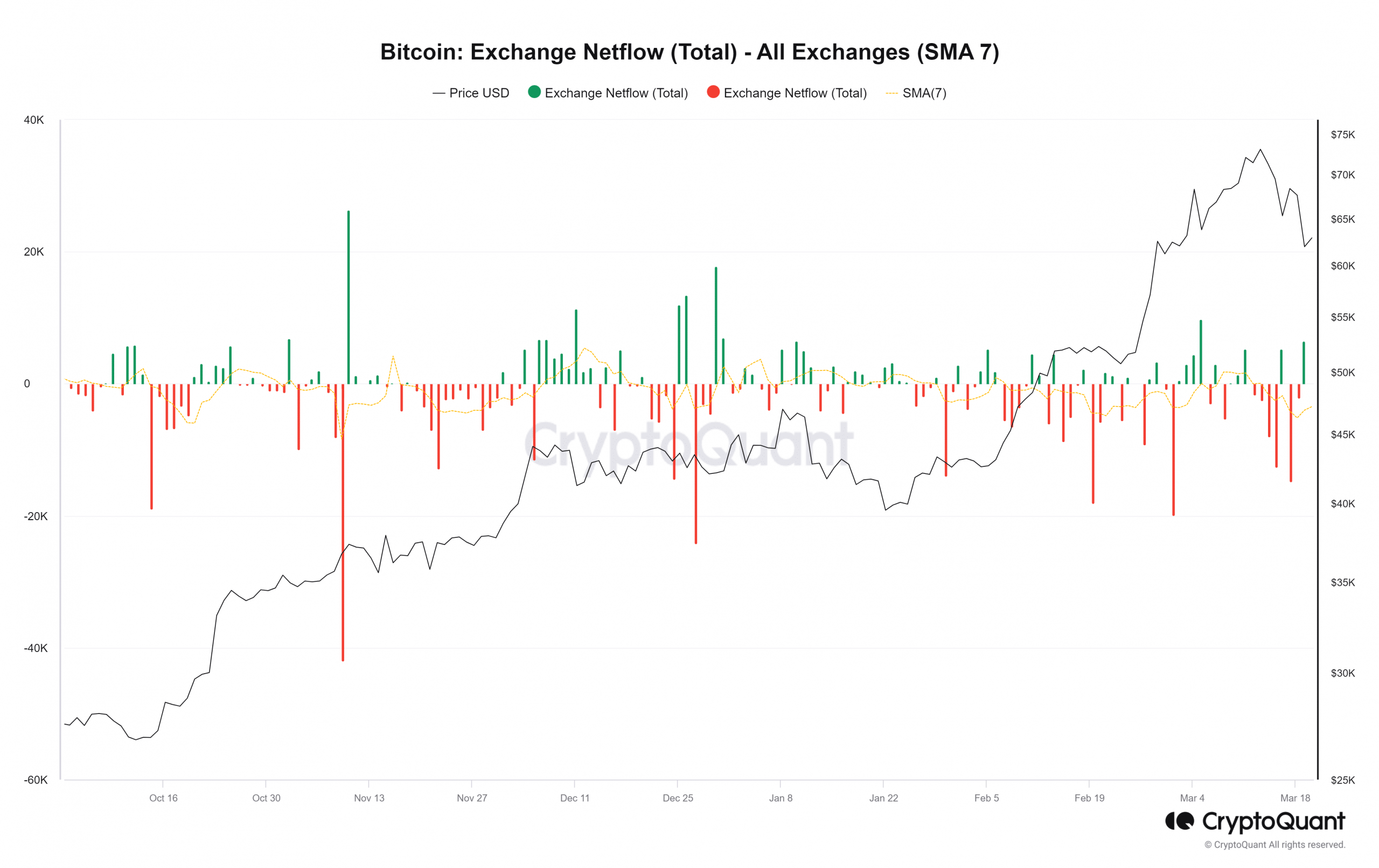

The short-term outlook favored a deeper correction towards $58k. Then again, the previous week noticed Bitcoin proceed to depart exchanges. This was an indication of accumulation.

The BTC netflow chart confirmed extra BTC leaving centralized exchanges than getting into them even when costs started to drag again from the $73k mark.

Lengthy-term holders maintained agency conviction

Supply: CryptoQuant

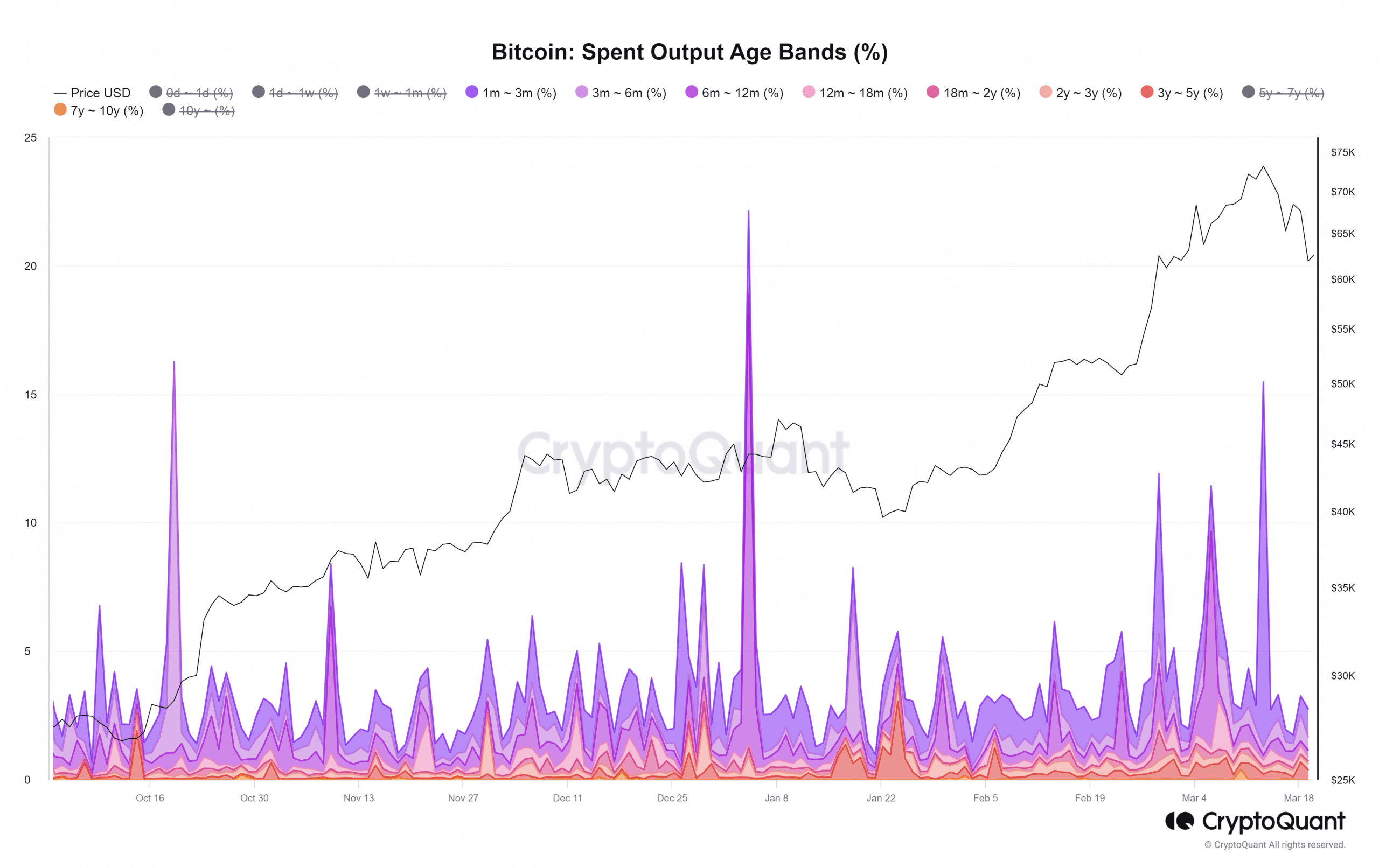

The spent output age bands noticed a big spike within the spent output of holders whose BTC have been aged simply 1-3 months on March thirteenth. This meant short-term holders booked income. Comparable spikes in late February and early March additionally famous holders promoting as costs rose greater.

Nonetheless, just a few of the longer-term holders whose coin age was a yr or longer didn’t relinquish their property as costs fell under the $70k stage just lately. This confirmed religion in Bitcoin.

Is your portfolio inexperienced? Test the BTC Revenue Calculator

But it surely have to be remembered that their habits just isn’t an ideal information to Bitcoin’s trends- generally, the long-term holders panic and promote en masse even when BTC makes a long-term low.

A latest AMBCrypto report explored how the present retracement might play out within the subsequent 4-6 weeks. The Bitcoin halving cycle gave the impression to be repeating itself, however long-term traders needn’t fear concerning the short-term value volatility.