- A number of flash crashes for BTC occurred throughout centralized exchanges.

- Sentiment round BTC declined, however value remained secure.

Bitcoin [BTC] has impressed hope from merchants in the previous couple of days as a result of its current rally.

Nonetheless, the tides may change quickly towards BTC’s favor, primarily as a result of mishaps occurring on Centralized Exchanges (CEXes).

Some sudden crashes

Extra particularly, the sentiment round BTC may very well be impacted negatively as a result of flash crashes occurring on CEXes.

For context, flash crashes seek advice from sudden and excessive drops within the value of an asset or safety, sometimes occurring inside a really quick time frame, typically just some minutes and even seconds.

Throughout a flash crash, costs can plummet dramatically earlier than rapidly rebounding.

These occasions are sometimes triggered by speedy and huge sell-offs, typically exacerbated by automated buying and selling algorithms or liquidity shortages out there.

In the previous couple of weeks, the occurrences of flash crashes of BTC throughout varied exchanges has grown.

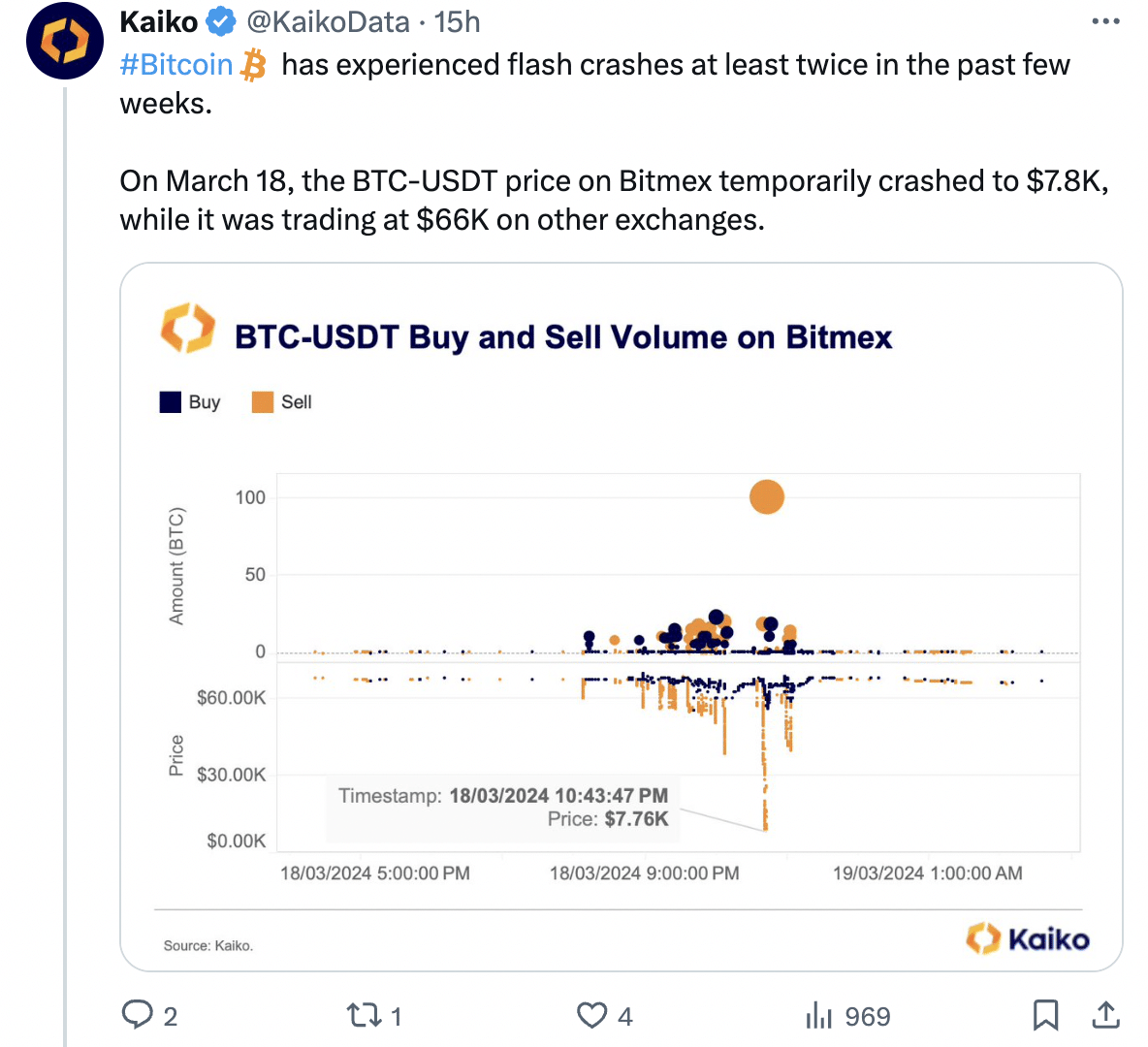

One of many cases of the flash crash occurred on the 18th of March, when the BTC-USDT value on Bitmex skilled a short lived crash to $7,800.

At this cut-off date, it was nonetheless buying and selling at $66,000 on different exchanges.

In a current publish on X (previously Twitter), the alternate attributed the sudden drop in costs to aggressive promoting from just a few accounts.

Quite a few giant promote orders, starting from 10 to twenty BTC, had been executed, together with one exceptionally giant order of 100 BTC, roughly valued at $6.6 million.

One other occasion of this occurred within the European market the place BTC-EUR costs on Coinbase fell from €63,000 to €48,000.

Supply: X

Dangerous optics

These mishaps which have occurred on CEXes could contribute to a adverse perspective round Bitcoin, particularly amidst new market members and retail traders.

Anybody who’s new to the crypto sector could initially begin their journey by shopping for just a few blue chip cash akin to BTC and ETH on their accounts.

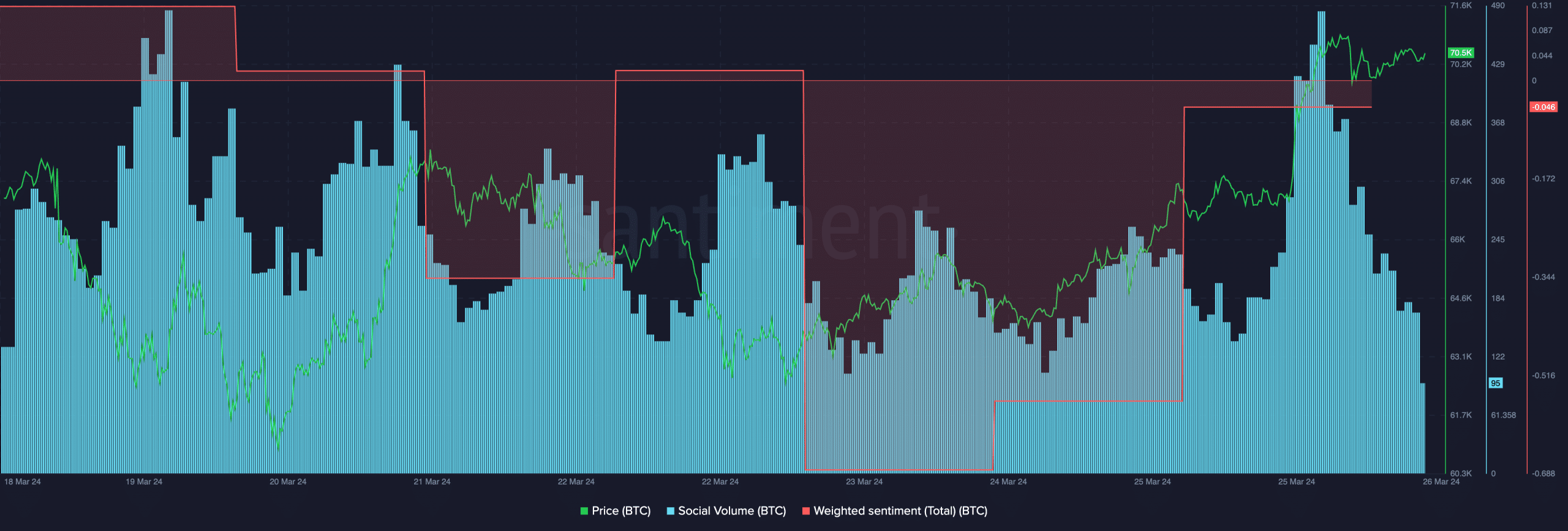

If value crashes happen for these cash, it may erode the belief of latest customers and deter customers from venturing additional into crypto. This adverse perspective was additional showcased by the Weighted Sentiment indicator.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

AMBCrypto’s evaluation of Santiment’s sentiment knowledge indicated that the adverse feedback round BTC had outnumbered the optimistic ones.

These elements may show to be a hurdle to BTC’s rally, going ahead.

Supply: Santiment