- Not too long ago, there was a spike in BTC’s correlation with valuable metals.

- On a each day chart, BTC’s promoting strain outweighed shopping for strain.

Bitcoin’s [BTC] correlation with valuable metals corresponding to gold and silver has skilled a noticeable surge not too long ago, knowledge from IntoTheBlock confirmed.

1/ #Bitcoin and valuable metals have proven a noticeable enhance in correlation not too long ago🪙🧵 pic.twitter.com/PLFro4OVa3

— IntoTheBlock (@intotheblock) May 19, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

This indicated that the value actions of BTC, gold, and silver have been extra intently aligned as traders and merchants alike started to understand the similarities between these asset lessons inflicting them to maneuver in tandem.

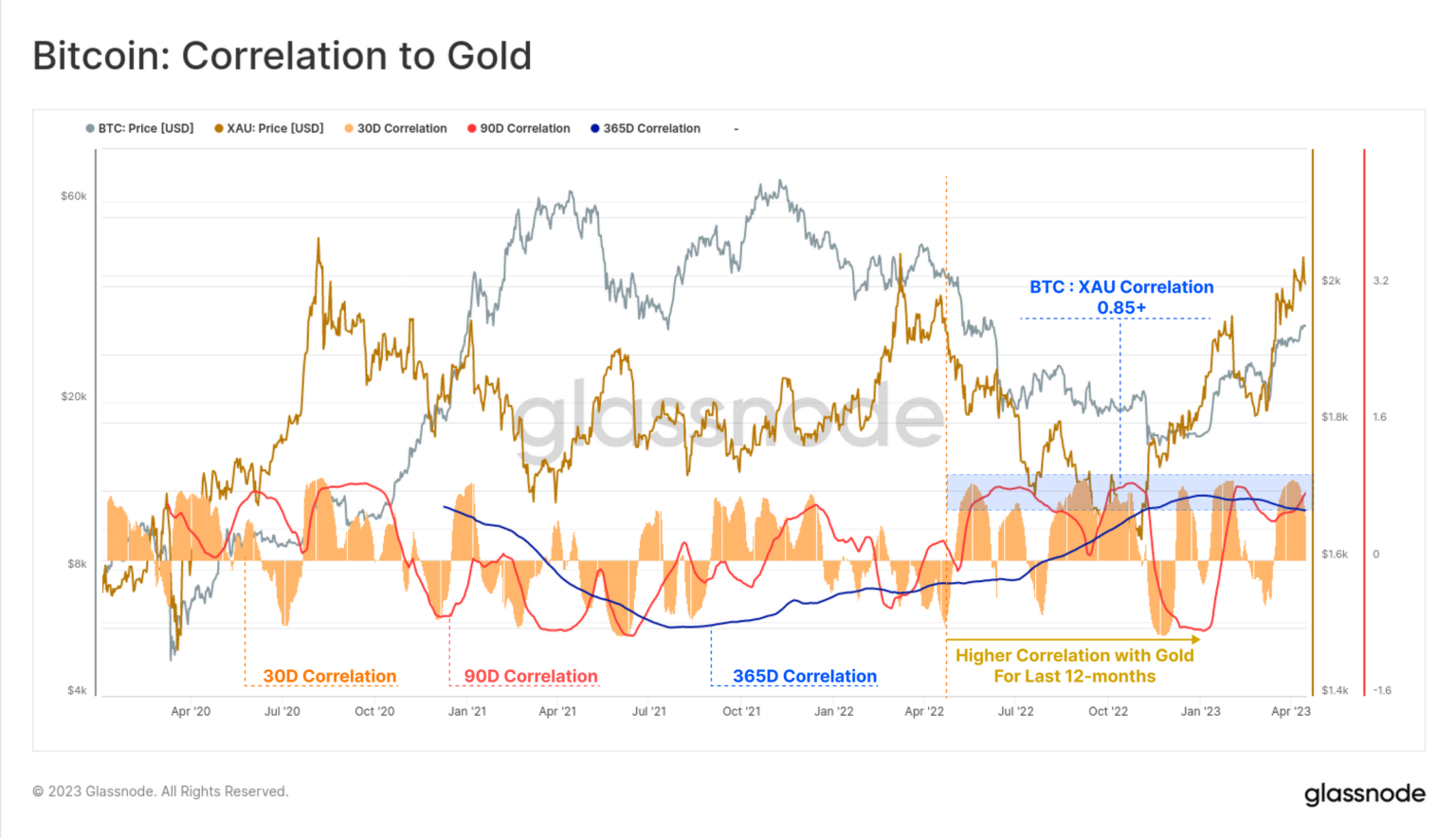

In a report by Glassnode revealed on 17 April, the on-chain knowledge analytics agency famous that over the previous yr, the “correlation between the efficiency of BTC costs, relative to Gold, the normal sound cash secure haven” elevated.

Based on Glassnode, an remark of the constructive correlation on varied time timeframes, corresponding to 30 days, 90 days, and 12 months revealed that the hyperlink remained elevated through the latest banking disaster within the US.

Glassnode famous,

“This does recommend that an appreciation for each sound cash and the realities of counter-party threat are more and more entrance of thoughts for traders.”

Supply: Glassnode

In a 26 April tweet, cryptocurrency market knowledge supplier Kaiko stated that on a 30-day common, BTC’s correlation with gold skilled a surge since March to face at its highest degree in about two years.

Bitcoin 30-day rolling correlation with gold has surged since March and now stands at 57% – its highest degree in nearly 2 years.#BTC #Gold #correlation pic.twitter.com/l7N5eYAgEl

— Kaiko (@KaikoData) April 26, 2023

BTC struggles to entice patrons

Falling to the $26,000 worth mark two days in the past, BTC’s worth has since oscillated inside a slim vary. An evaluation of the coin’s worth motion revealed that the king coin has since traded with $26,800 and $26,900 worth marks.

At press time, it exchanged fingers at $26,862.52, logging a 30% decline in buying and selling quantity up to now 24 hours and a 0.19% fall in worth throughout the identical interval.

With the coin’s weighted sentiment pegged at -0.566 as of this writing, knowledge from Santiment confirmed traders’ lack of curiosity in accumulating BTC.

As indicated by key momentum indicators on the coin’s each day chart, it has brought about promoting strain to outweigh accumulation.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

BTC’s Relative Power Index (RSI) was 40.48 at press time, positioned under its 50-neutral place. Likewise, its Cash Circulate Index (MFI) was positioned in a downtrend, inching nearer to the oversold place at 30.13.

Additional, BTC’s worth approached the decrease band of its Bollinger Bands indicator at press time. This steered that the coin’s worth was nearing a possible assist degree or a interval of consolidation.

Supply: BTC/USDT on TradingView