Blur Founder Pacman has defended his platform towards allegations of it crashing the non-fungible token (NFT) market flooring worth.

Whereas sure blue chip NFTs are close to their yearly lows, the neighborhood has blamed the NFT market Blur’s incentivization mannequin for the autumn out there. Blur founder Pacman took to Twitter to defend his platform.

Blur Founder Pacman Defends The Platform

Pacman quote retweeted a neighborhood member’s tweet who was talking towards the “Blur killing NFTs narrative.” The Blur founder defined that some flooring costs have gone up, whereas others have gone down.

He complained that the neighborhood wouldn’t give credit score when the ground worth elevated with the Blur airdrop, which injected liquidity into the market.

What are the very best upcoming airdrops of 2023? Learn extra by clicking right here.

Lastly, Pacman lashed out:

“When asset costs are up, ppl don’t actually discuss in regards to the root trigger (ie blur injecting liquidity), however when they’re down, the pitchforks come out.”

Blur’s Bid Incentivization Mechanism

The neighborhood members have blamed Blur’s bid incentivization mechanism. A Twitter person Trevor.btc argued:

“Within the present bear atmosphere, the flywheel of Blur’s bid incentive permits mercenary capital to destroy a venture’s flooring with none actual holders promoting, whilst holder counts improve

As a result of farmers ONLY earn factors by having bids lively, they’re not incentivized to truly *purchase* the NFTs they bid on

They NEED to dump as quickly as any bids get accepted, to allow them to get ETH and exchange the bids to earn max factors”

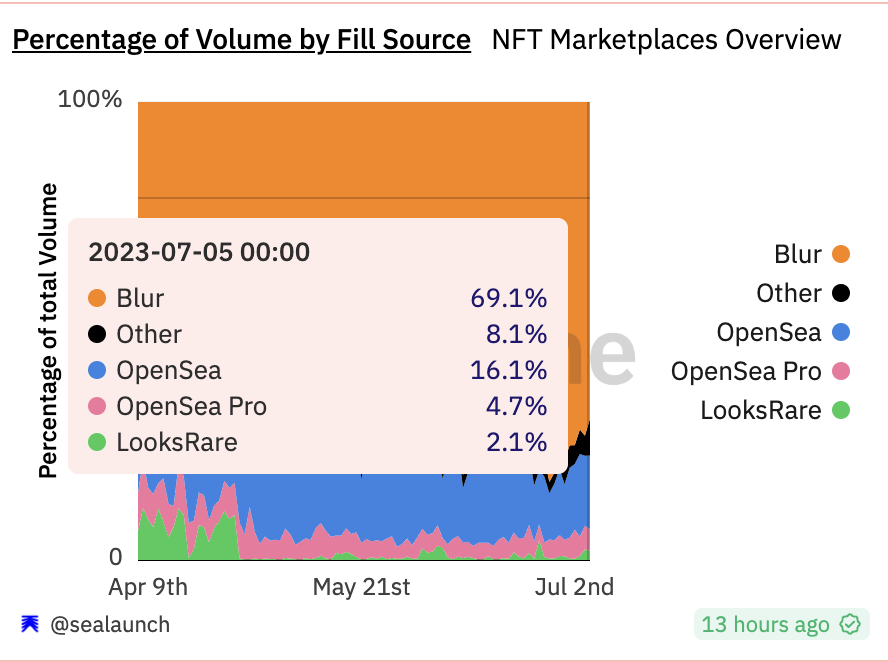

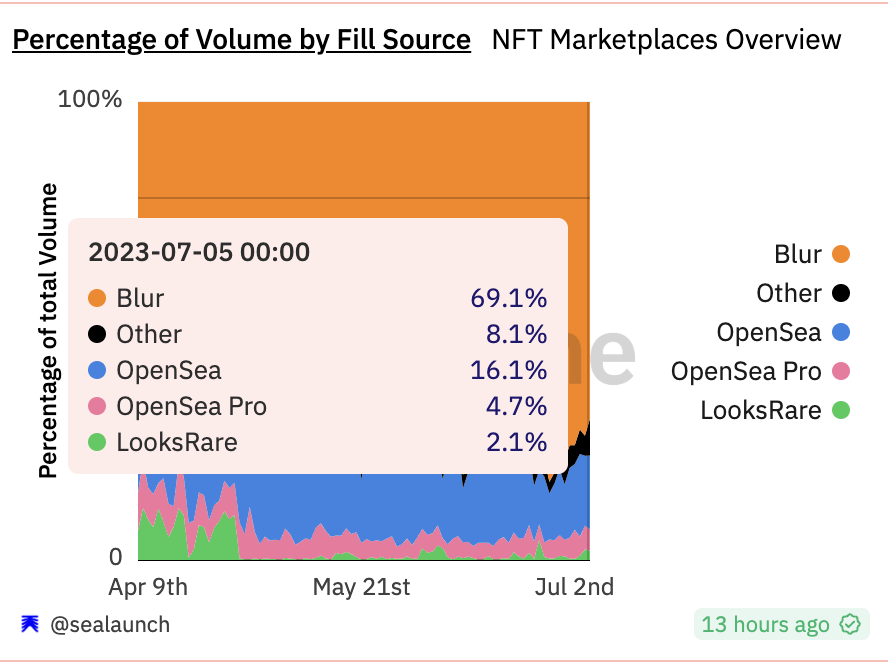

Certainly as a result of massive buying and selling actions, the Blur market dominates the NFT buying and selling quantity. Based on the most recent knowledge from a Dune dashboard, Blur contributes 69.1% to the NFT buying and selling quantity.

Dune dashboard exhibiting quantity dominance of NFT marketplaces

NFT Market Crash

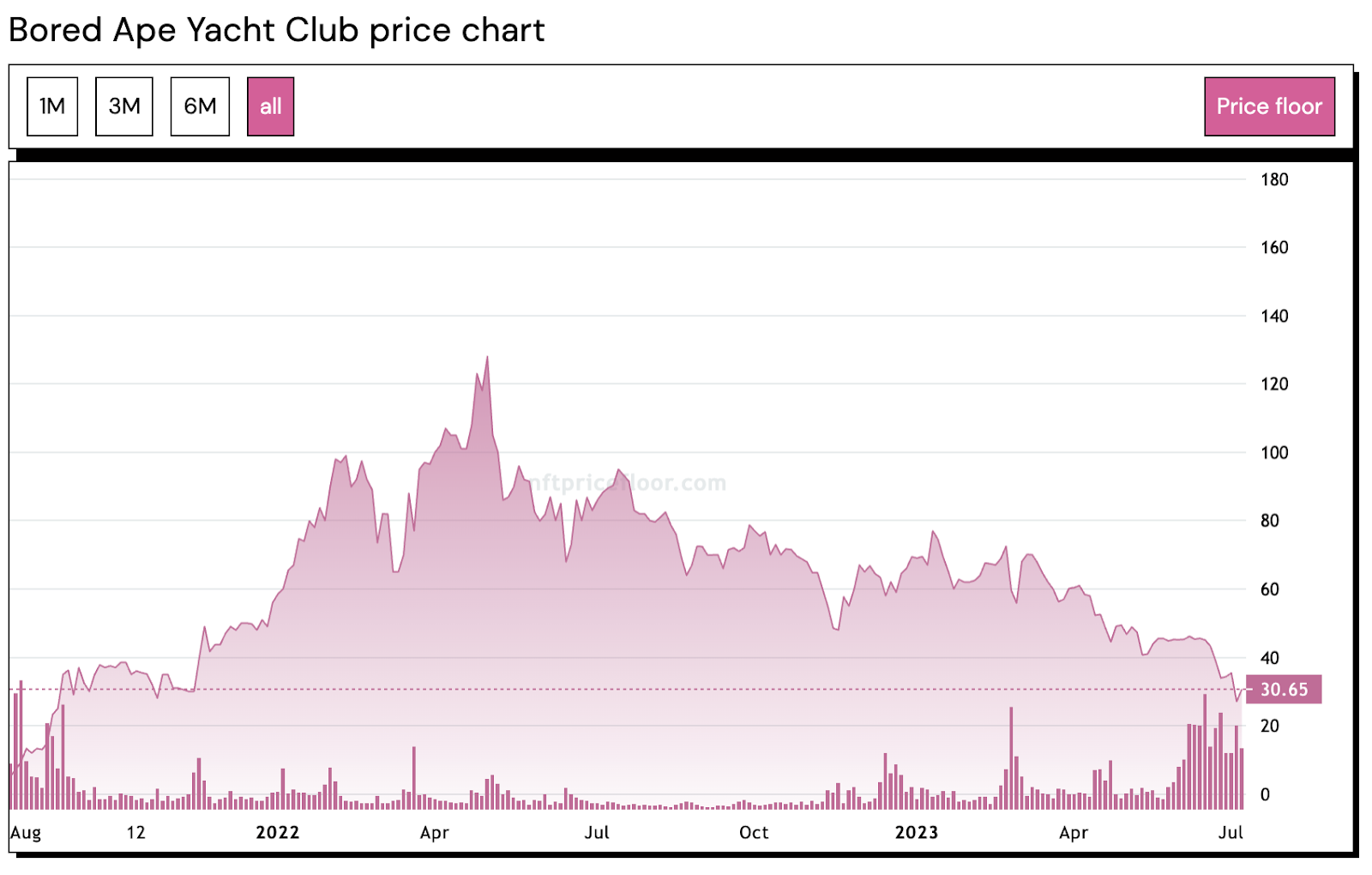

Notably after the controversial launch of the Azuki Elementals, the ground worth of blue chip NFT collections began plummeting. On Sunday, BeInCrypto reported that the ground worth of Yuga Lab’s Bored Ape Yacht Membership (BAYC) fell by over 7% in 24 hours.

As of writing, the ground worth of BAYC is round 30.65 Ethereum (ETH), virtually buying and selling at two-year lows.

BAYC flooring worth chart. Supply: NFTPRICEFLOOR