- BNB turned the best-performing top-10 asset within the final 24 hours.

- If accumulation continues to extend, BNB could head towards $400.

Binance [BNB], the native cryptocurrency of the Binance trade, appears to have gotten a wake-up name to take again its place from Solana [SOL]. On the twenty seventh of December, the BNB worth surged previous the $300 psychological resistance.

Because of the breach, BNB was capable of document a ten.15% rise within the final 24 hours.

At press time, the coin was again within the fourth place with a market cap of $50.92 billion. Just a few days again, AMBCrypto defined how SOL took the place of BNB as a result of unbelievable rise in worth.

Nevertheless, the final 24 hours haven’t been rosy for SOL, whose efficiency all 12 months lengthy has been worthy of emulation.

Binance Coin: Again in fourth place

Throughout the identical interval, as BNB jumped, SOL’s worth decreased by 6.99%. It’s value noting that Binance Coin has had its share of challenges.

On totally different events, the coin had to deal with Worry, Uncertainty, and Doubt (FUD) due to the regulatory troubles of its underlying trade.

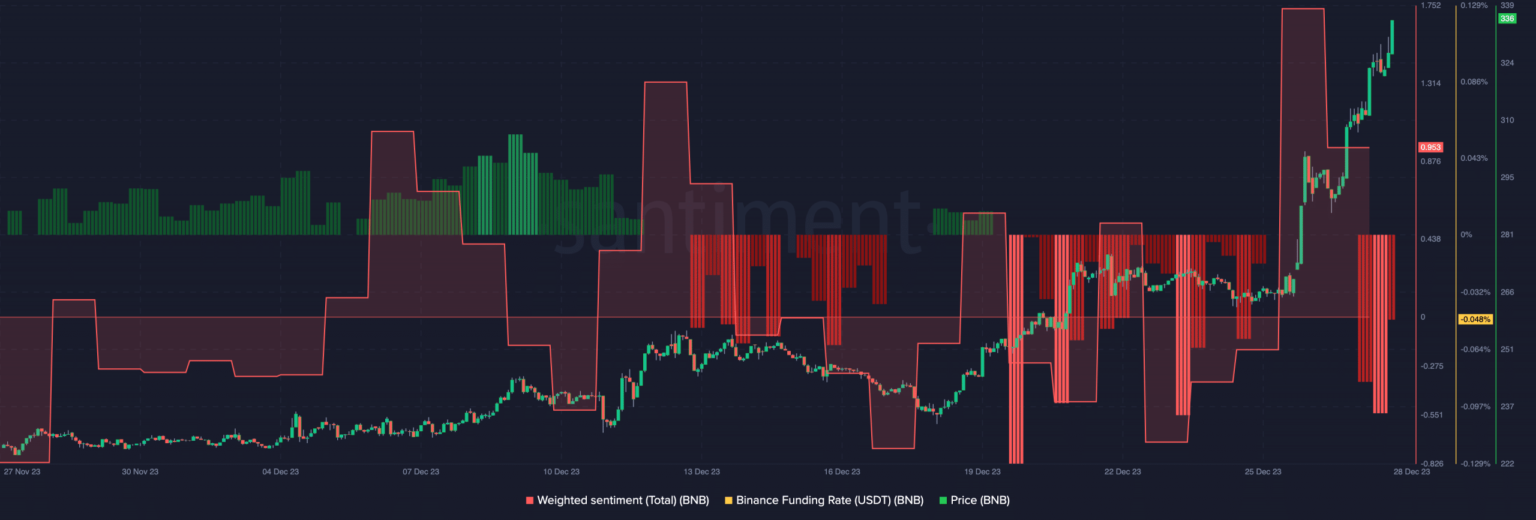

Regardless of the value improve, merchants are bearish on the Binance Coin. In keeping with Santiment’s information, BNB’s Funding Charge was -0.048%. Likewise, its Weighted Sentiment additionally dropped to 0.953.

The decline within the metric was a testomony to the truth that the damaging sentiment round BNB had not but light.

Supply: Santiment

Whereas many would possibly suppose this place implied “doomsday” for BNB, AMBCrypto’s evaluation thought-about the development optimistic for the value.

A take a look at the chart above confirmed that the Weighted Sentiment and Funding Charge had been down within the pink on the 14th of December.

Nevertheless, that place laid the bottom for a worth improve. The identical factor occurred across the twenty third of December. Days later, the BNB worth crossed $300. Ought to the metrics stay in the identical state, then shorts risked being liquidated.

No stopping the breakout?

However additionally it is necessary to say that on-chain information alone may not be sufficient for the BNB prediction. That was why the subsequent part AMBCrypto thought-about was the technical outlook.

From the 4-hour BNB/USD chart, the coin shaped an asymmetrical triangle between the 18th and twenty fifth of December.

Asymmetrical triangles are patterns indicating a possible breakout for a cryptocurrency shortly after a consolidation interval. Between the talked about interval, BNB ranged between $260 and $275.

However the breakout was noticed at $266. This gave rise to the surge that started on the twenty seventh.

Nevertheless, the Relative Power Index (RSI) confirmed that the coin was overbought. So, it’s probably for BNB to expertise a slight reversal.

However alternatively, the Accumulation/Distribution (A/D) studying elevated. This improve is an indication of shopping for stress.

Supply: TradingView

Is your portfolio inexperienced? Try the BNB Revenue Calculator

Thus, if BNB holders don’t resolve to distribute, likelihood is excessive that the coin worth would possibly shut in on the $400 area. If this occurs, a transfer to surpass its All-Time Excessive (ATH) might be validated within the anticipated 2024 bull market.

Nevertheless, that may not occur as early as January.